Although it has been a good year overall for the markets, with the S&P 500 up 7% as of Thursday's market close, shares of electric vehicle maker Tesla (TSLA +0.04%) have been going in the opposite direction and are down about 21%.

The company has been facing a lot of adversity in recent quarters and there's been plenty of negative press surrounding the business and its CEO, Elon Musk, which has undoubtedly weighed on the stock. If things don't improve soon, Tesla could be on track for one of its worst performances in recent years. And unlike in 2022, when the markets were in a tailspin, this time, it's doing badly amid favorable market conditions.

Could this be the start of a troubling trend for Tesla, or can now be a good time to take a chance on this struggling auto stock?

Image source: Getty Images.

Tesla is on track for an unusually bad year

Tesla has normally been a good investment. While it hasn't always outperformed the market, the automotive stock has generated returns of around 1,700% over the past decade, while the S&P is up around 200% over that time frame. Tesla's good years have more than outweighed the bad ones during that stretch.

| Year | S&P 500 | Tesla Stock |

|---|---|---|

| 2024 | 23.3% | 62.5% |

| 2023 | 24.2% | 101.7% |

| 2022 | (19.4%) | (65%) |

| 2021 | 26.9% | 49.8% |

| 2020 | 16.3% | 743.4% |

| 2019 | 28.9% | 25.7% |

| 2018 | (6.2%) | 6.9% |

| 2017 | 19.4% | 45.7% |

| 2016 | 9.5% | (11%) |

| 2015 | (0.7%) | 7.9% |

Source: YCharts. Table by author.

What's notable, however, is that only once during that stretch has the stock been down more than 20% in a single year -- that was back in 2022. As interest rates were on the rise and inflation was a big concern, that led to a disastrous performance for Tesla stock.

This year's losses may not be nearly as deep, but without a significant recovery, the stock may be on track for a decline of more than 20% for just the second time in 10 years.

Can Tesla turn things around this year?

There's been a lot of bad press involving Tesla this year due to its CEO -- Elon Musk -- leading Donald Trump's Department of Government Efficiency initiative and its cutbacks in government spending. While Musk has stepped away from that role, which many investors see as a positive development for Tesla's business, that hasn't been enough of a catalyst to undo the stock's losses this year.

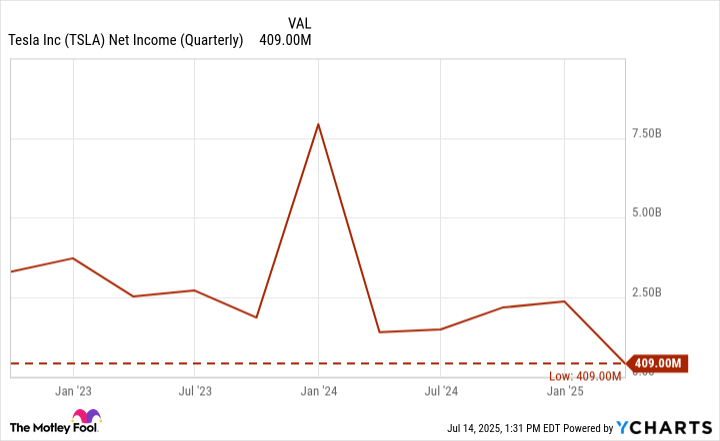

The company's quarterly profits are the lowest they've been in years, as not only has discretionary spending come under pressure due to challenging economic conditions, but a rise in competition is also squeezing Tesla's gross margins.

TSLA Net Income (Quarterly) data by YCharts

For Tesla's stock to turn things around, the business needs to show improvement on its bottom line, which may not be easy. The stock trades at around 180 times its trailing earnings, with its market cap still fairly high at around $1 trillion.

NASDAQ: TSLA

Key Data Points

Should you invest in Tesla right now?

Tesla has historically been a good growth investment, but it's not going to be easy for it to generate strong gains with its market cap as high as it is right now. At such a high price tag, expectations are also high, and Tesla simply hasn't been producing the results necessary to justify its steep premium. In the first three months of this year, the company's automotive revenue was down 20% year over year.

Although it's a leading electric vehicle company, its high valuation means a lot of future growth is already priced in. Tesla's track record may look impressive over the past 10 years, but that doesn't mean it's likely to continue generating strong returns for investors in the future.

I don't expect the stock to recover this year, and I'd hold off on buying shares of Tesla until it can show that it can get back to growing its business while also growing its bottom line.