Back in late 2020, C3.ai (AI 3.62%) made its debut on the public markets with a lot of hype, trading at a market cap of $15 billion. It worked to be an artificial intelligence (AI)-themed stock before the AI revolution took hold a couple of years later. Since the IPO, however, the stock's price has fallen 84% from all-time highs, putting in a disappointing performance for shareholders. If you had invested $1,000 in C3.ai at all-time highs, you would only have about $160 today.

What went wrong with C3.ai? Does its hefty drawdown mean you should buy the dip on this potential AI winner? Let's take a further look at C3.ai's history and business and see whether this is a good stock to buy for your portfolio today.

Image source: Getty Images.

Bringing AI to enterprises, competing with Palantir

C3.ai builds AI-centric software customized to meet the various needs of enterprises, ranging from oil and gas to transportation to defense. It has large partnerships with cloud providers such as Amazon Web Services (AWS) and consulting firms like McKinsey to drive sales of its analytics and management software. With agentic AI, applications, and even a no-code AI it calls ex Machina, C3.ai wants to be the full analytics layer where large businesses can manage their data.

This is a compelling narrative, with a long runway to convince companies to outsource their internal software development needs to an expert third party. The problem is, the results have so far lagged behind the competition. Palantir Technologies also sells AI-centric software applications to large enterprises and is much larger than C3.ai (and growing faster). Palantir generated $884 million in revenue last quarter, up 39% year over year compared to $108.7 million for C3.ai, up 26% year over year.

There are other companies taking C3.ai's potential clients as well. Databricks, a private company, does $3.7 billion in revenue and sells a similar data intelligence platform. C3.ai remains a minnow in the large software analytics and AI pond.

NYSE: AI

Key Data Points

A history of hyped-up narratives

What gets more concerning is when you dive deeper into researching C3.ai's business and history. It was originally founded as C3 with a goal of operating in the carbon market, developing software to manage climate change. Then, in 2016, it changed its name to C3 IOT as the Internet of Things was just going through a huge hype cycle. After that, it went through a brief phase where it changed its name to C3 Energy to focus on that sector. Finally, it changed to C3.ai just before the huge hype cycle began in the sector. This suggests that C3.ai might be more about chasing the hottest trend in financial markets at the moment, rather than building products customers want over the long term.

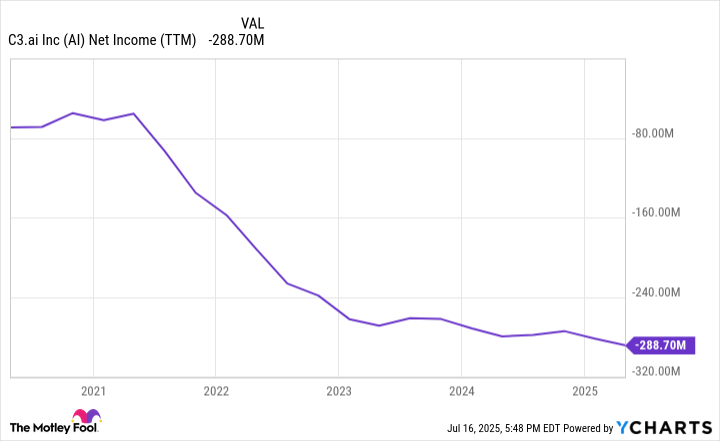

This apparent lack of focus shows up in the company's income statement. C3.ai reported a net loss of $289 million while generating $389 million in total revenue last fiscal year. The company is burning through huge amounts of marketing and research spending, with zero operating leverage at large revenue levels. Its net loss has only gotten worse since going public, which is not a good sign for the prospects of this business.

Data by YCharts.

Should you buy the dip on C3.ai stock?

As already noted, we are in the midst of a hype cycle for anything AI, and as a result, many AI stocks look overvalued right now after seeing their stock prices soar. Palantir stock, for example, is sporting an insane price-to-sales (P/S) ratio topping 100.

Given this runup for other AI stocks, C3.ai may look cheaper by comparison with a P/S ratio of 9 and decent revenue growth. However, this specific comparative valuation shouldn't be used on its own to justify buying the stock. There is a lot more to making a buy decision than just comparing a P/S ratio.

With huge net losses that show no signs of turning around, C3.ai does not look like a good business to buy at the moment, especially if it is losing ground to competitors in an AI bull market. What happens if AI spending slows down? This would have a detrimental impact on C3.ai's business, most likely.

Stay far away from C3.ai stock. This is an unprofitable business that will continue to disappoint shareholders.