With the stock market being notorious for its volatility and uncertainty, it's nice to have a reliable income stream you can count on. That's where dividends come into the picture. Dividends provide stable income, regardless of stock price movements.

Dividend stocks aren't immune to volatility or uncertainty, but the guaranteed income offsets some of the risk of stock investing. For an added layer of security, consider investing in dividend-focused exchange-traded funds (ETFs). Many offer yields as high as single stocks and are more stable because it's many companies doing the lifting.

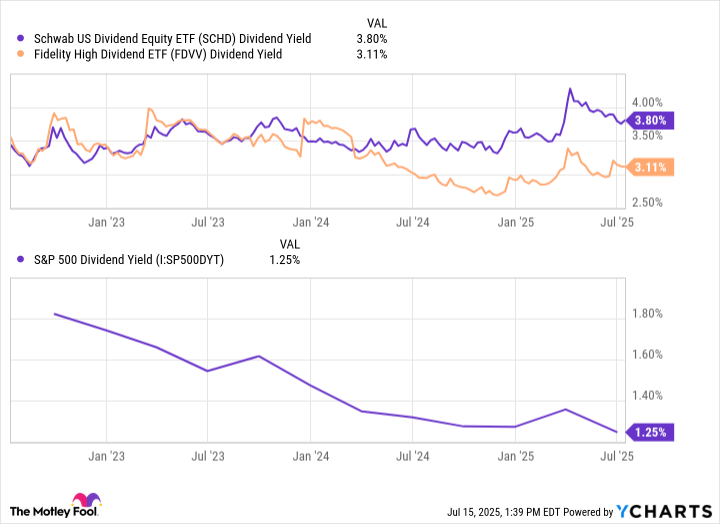

If you're looking for steady income for years to come, the Schwab U.S. Dividend Equity ETF (SCHD +1.53%) and Fidelity High Dividend Yield ETF (FDVV +0.02%) are great options. They both offer dividend yields more than double the S&P 500 average and are led by companies that make me confident it can be a go-to for quite some time.

SCHD Dividend Yield data by YCharts

1. Schwab U.S. Dividend Equity ETF

This ETF tracks the Dow Jones U.S. Dividend Index, which focuses on companies with a history of consistent dividend payments and strong financial performance. It's one of the most popular dividend ETFs on the stock market and is known for holding blue chip dividend stocks like Coca-Cola, Altria, and AbbVie -- all of which are Dividend Kings.

The criteria to be included in Schwab ETF mean it's filled with well-established companies that have stood the test of time. That's what you want when you're investing for the long haul, because there are many instances of companies having to cut or suspend their dividend to help fix their finances during a rough patch.

NYSEMKT: SCHD

Key Data Points

Dividend payouts from ETFs fluctuate because different companies pay on different schedules, but the Schwab fund has maintained a dividend yield of at least 3.1% over the past three years. Its last four payouts were $0.2602, $0.2488, $0.2645, and $0.7545, averaging out to a yield of over 5.6% yield at its $26.90 price at the time of this writing.

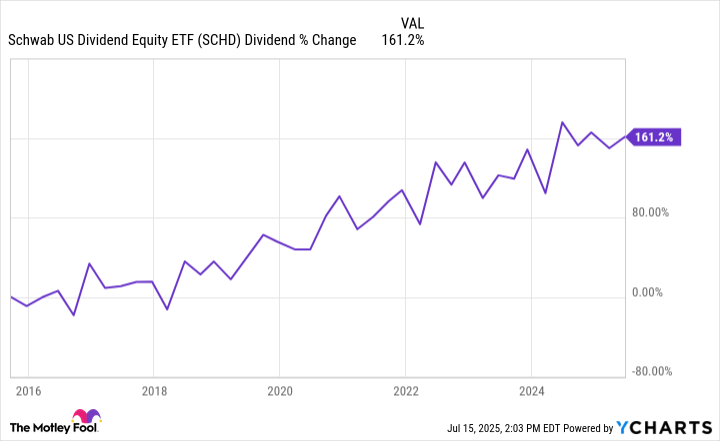

Arguably more important -- especially for long-term investors -- is the rate at which Schwab U.S. Dividend Equity ETF has been able to increase its dividend. In the past 10 years, it has increased by more than 160%.

SCHD Dividend data by YCharts

2. Fidelity High Dividend Yield ETF

Whereas the Schwab ETF emphasizes value-leaning companies, the Fidelity ETF contains a mix of companies that offer both consistent income and growth opportunities. Its top three holdings are Nvidia, Microsoft, and Apple, accounting for over 16% of the fund as of June 30. The tech sector represents over a quarter of the fund (vs. just 7% for the Schwab fund).

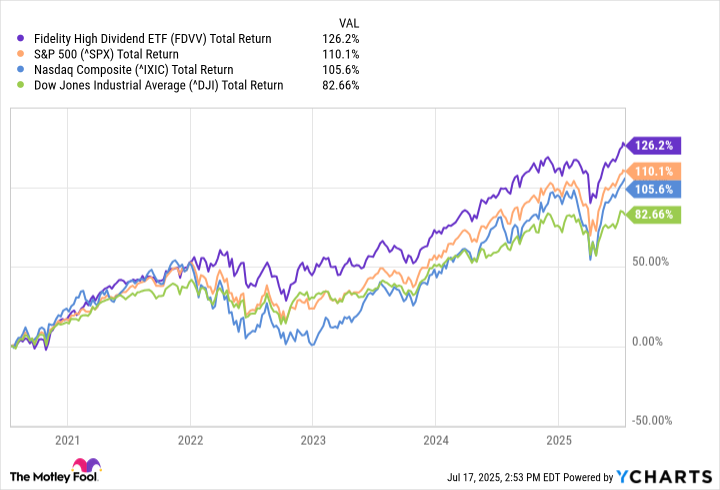

The Fidelity ETF's dividend yield isn't eye-popping (although above 3% is impressive for a broad ETF), but it works out to be a true 2-for-1 when you consider its stock price appreciation. Over the past five years, the Fidelity ETF has outperformed all three of the stock market's major indexes.

FDVV Total Return Level data by YCharts

A high concentration of tech stocks isn't typical for a dividend ETF, as many of these companies prioritize reinvesting profits for growth rather than paying dividends. However, it works out in the Fidelity High Dividend Yield ETF's case because its top holdings are mature tech companies with a strong cash flow and the ability to do both.

You don't have to pick one ETF or the other

If you're interested in both ETFs, the good news is that they cover a good amount of ground without too much overlap. It's common for similarly themed ETFs to hold many of the same stocks, but that's not the case with these two funds. Only 19 stocks are in both ETFs out of more than 100 holdings in each fund.

NYSEMKT: FDVV

Key Data Points

Investing in both could allow you to benefit from Schwab U.S. Dividend Equity ETF's reliability and low cost, and Fidelity High Dividend Yield ETF's mix of growth and income.