To say that Warren Buffett has made a name for himself in the investing world would be a huge understatement. Buffett, who's 94 years old and plans to retire at the end of the year, has turned Berkshire Hathaway into a trillion-dollar company and amassed a personal 12-figure net worth.

Buffett and Berkshire Hathaway's continuous success is why many investors closely follow their moves, hoping to gain some inspiration. Although the average investor and a trillion-dollar corporation may not share the same goals or risk tolerance, there are still benefits to be gained by keeping an eye on the company's portfolio.

Image source: The Motley Fool.

Two stocks in Berkshire Hathaway's portfolio that can make great investments are Amazon (AMZN +0.49%) and Coca-Cola (KO 0.06%). If you have $1,000 available to invest, consider putting $500 into each. This will provide you with opportunities for growth and reliable dividend income.

From books to a full conglomerate

Amazon was a stock that Buffett was admittedly reluctant to invest in -- and one he wishes Berkshire Hathaway had invested in sooner. Amazon has been a poster child for growth stocks, up 11,750% in the past 20 years, while the S&P 500 is up around 420%.

NASDAQ: AMZN

Key Data Points

Amazon has a tight grip on the e-commerce industry, but its business expanded far beyond delivering items to you in less than two days. It's grown to be one of the more prominent conglomerates in the tech world.

Its main growth driver for the foreseeable future is its cloud platform, Amazon Web Services (AWS). It's one of the pioneers of cloud computing and has been the global leader since its release. It has a 30% market share, leading Microsoft Azure and Alphabet's Google Cloud, which stand at 21% and 12%, respectively.

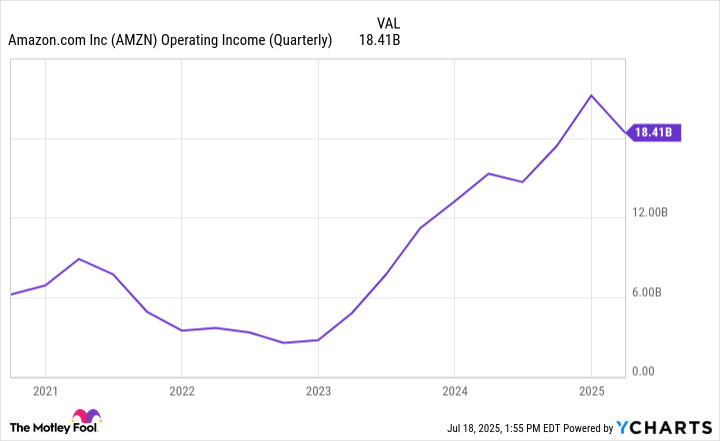

E-commerce generates revenue for Amazon, while AWS generates profits. AWS' operating income (profit from core operations) was around $3.08 billion in the first quarter (Q1) of 2020. At the end of Q1 this year, it was $11.5 billion -- a 273% increase. This has helped Amazon's overall operating income increase by almost 200% in that span.

AMZN Operating Income (Quarterly) data by YCharts.

Amazon has been diligent about expanding its business and diversifying its revenue streams, positioning it better for long-term growth. Aside from e-commerce and cloud computing, it has its hands in advertising, entertainment, healthcare, logistics, and a few other industries that could scale in time.

A $500 investment in Amazon today could go a long way as it continues to expand.

When in doubt, lean on the dividend

Coca-Cola is one of Berkshire Hathaway's oldest and largest holdings. It comes down to two reasons -- its competitive moat and reliable dividend.

NYSE: KO

Key Data Points

The company's competitive moat stems from its brand and reach. Few, if any, brands are as recognizable worldwide as Coca-Cola. That's why it has been able to sustain its dominance and success for decades.

Even with the ultra success of its flagship soda, Coca-Cola has been diligent about expanding its offerings and adapting to changing consumer preferences. It's added various waters, teas, plant-based drinks, and even ready-to-drink alcoholic beverages to its portfolio, further strengthening its position in the beverage industry.

Coca-Cola's products sell regardless of economic conditions. It doesn't matter if it's a boom, a recession, or somewhere in between -- people will find a way to buy their favorite Coca-Cola product. This has given the company pricing power, which has helped its financials remain healthy and cash flowing in.

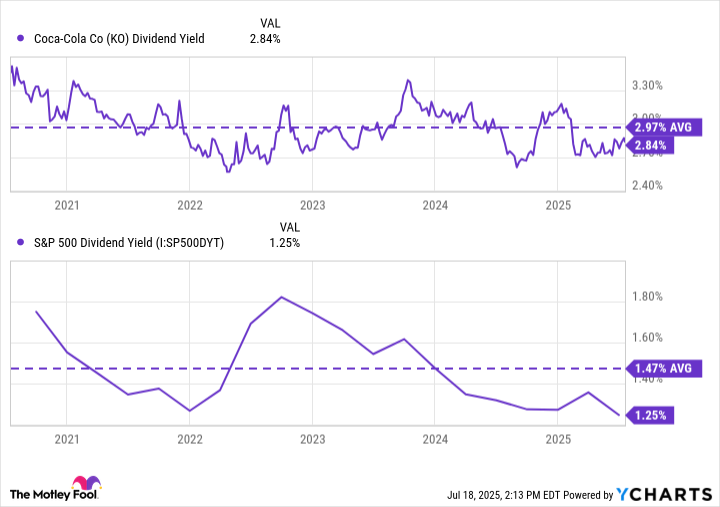

You shouldn't invest in Coca-Cola expecting Amazon-like stock price appreciation, but you can expect consistent and reliable dividend income. Coca-Cola's dividend yield is routinely double that of the S&P 500's average, and the company increased the annual payout for 63 consecutive years.

KO Dividend Yield data by YCharts.

There's a reason Berkshire Hathaway never trimmed its Coca-Cola stake -- the dividend income is too valuable. With 400 million shares, Berkshire Hathaway will receive well over $800 million in dividends from Coca-Cola this year.

Of course, you won't have that many shares, but with $500 invested today, you could begin building a decent stake in Coca-Cola that will pay off in the long run. This is especially true if you're reinvesting your dividends to accumulate more shares.

Coca-Cola is a stock that I plan to hold onto for decades to come.