A common misconception about creating wealth is that you need to be an expert stock picker. While investing in individual companies can indeed generate significant savings, there are many other ways an investor can benefit from the appreciation of the stock market.

One such way is through exchange-traded funds (ETFs). ETFs represent a basket of stocks and provide investors with passive exposure to specific industries or themes.

Below, I'll detail two Vanguard ETFs that can help investors become millionaires while barely lifting a finger.

1. Vanguard S&P 500 ETF

While Warren Buffett is primarily known for his successful stock picking abilities, the famous investor often expresses that most investors should simply buy into the S&P 500 index. While this sounds nice in theory, how can you actually do that?

Well, the Vanguard S&P 500 ETF (VOO +1.16%) has you covered. This fund provides investors with passive exposure to the companies that comprise the S&P 500. Not only does this help investors achieve a high degree of diversification, but it also mitigates downside risk as industries respond to news and economic shifts in different ways.

One thing that makes this Vanguard ETF different than other S&P 500-themed funds is that it is weighted by market cap. This means that the companies with the largest market caps -- such as Nvidia, Microsoft, Apple, Berkshire Hathaway, or Eli Lilly -- have more of an influence on the fund's price movements relative to smaller companies.

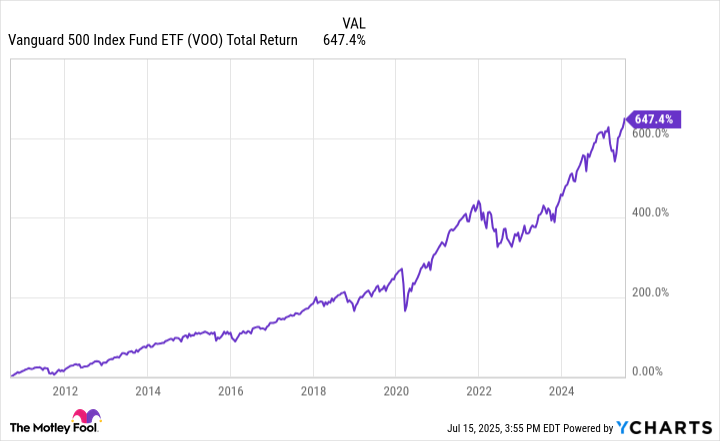

VOO Total Return Level data by YCharts

Per the graph above, the Vanguard S&P 500 ETF has generated a total return of 647% since its inception in 2010. This equates to 14.5% annually.

Assuming these returns keep up, a $200 monthly investment can grow significantly over the course of a long-term time horizon.

| Timeline | Long-Term Savings |

|---|---|

| 10 Years | $53,400 |

| 20 Years | $279,078 |

| 30 Years | $1,232,848 |

Calculations by author via Investor.gov.

2. Vanguard Dividend Appreciation ETF

The Vanguard Dividend Appreciation ETF (VIG +0.91%) is made up of companies that have increased their dividend payments over 10 years or more. This is important to understand, as inclusion in the index isn't guaranteed simply by offering a juicy dividend yield. Instead, members of the VIG index are companies that have proven to sustain their dividend payments while having the financial flexibility to increase them over time.

I see this fund as a great complement to VOO since it offers a unique mix of growth and value stocks that serve as reliable sources of dividend income such as Visa, Broadcom, and Walmart.

NYSEMKT: VIG

Key Data Points

The fund's annual return since inception hovers right around 10%, which is slightly better than the long-run average return of the S&P 500 index.

Assuming these returns keep up, a $200 monthly contribution can grow to roughly $450,000 over the course of 30 years.

Image source: Getty Images.

Keep these ideas in mind

An important factor to consider when choosing an ETF is the expense ratio. With expense ratios of 0.03% and 0.05% for VOO and VIG, respectively, investors are paying less than $1 per $1,000 invested.

While VOO and VIG can help make you a millionaire, it's important that investors consistently contribute to their positions on a frequent basis. Moreover, it's equally important to remember that building a seven-figure savings can take decades.

The more important idea explored in this piece is that building wealth takes time, discipline, and patience. All told, I see both of these Vanguard funds as low-cost and low-effort ways to generate significant wealth.