Netflix (NFLX +0.37%) was founded in 1997 to disrupt the video rental industry. Its business model introduced convenience by mailing DVDs to customers so they no longer had to visit a physical store. Blockbuster, which operated America's largest movie rental chain at the time, didn't see the value in Netflix's idea, because it turned down an opportunity to acquire the budding start-up for just $50 million in 2000.

Netflix shifted its focus to streaming in 2007, which eliminated the need for discs and other hardware altogether. This created an existential crisis for rental chains like Blockbuster, which are now a distant memory for most consumers. Investors who bought Netflix stock at the time of its initial public offering (IPO) and kept the faith are now sitting on a whopping 112,700% return.

The company's valuation now stands at over half a trillion dollars -- talk about a missed opportunity for Blockbuster. But can the streaming giant still deliver upside for investors who buy it today?

Image source: Netflix.

Advertising and live events are key to Netflix's future growth

Netflix has over 300 million paying subscribers, which is far more than Amazon Prime's estimated 200 million subscribers, and more than double the 126 million subscribers using Disney's Disney+. The larger Netflix becomes, the harder it is to generate growth, so the company is taking full advantage of its incredible scale to outspend its competitors in an effort to remain the most attractive platform in the industry.

The company is on track to invest $18 billion to create and license content this year alone, and live events are becoming more of a focus because they are big draw cards for new members. Netflix exclusively showed both Christmas Day NFL games last year, which each attracted more than 30 million viewers. This made them the most streamed matches in the sport's history, so they'll be back again in 2025.

Moreover, following the success of the Mike Tyson vs. Jake Paul boxing match last November, Netflix doubled down on the sport this year. The platform livestreamed the Katie Taylor vs. Amanda Serrano bout on July 11, and it will show the Canelo Alvarez vs. Terence Crawford matchup in September.

In addition to attracting new members, live events also attract advertisers. Netflix now offers three subscription tiers: Premium ($24.99 per month), Standard ($17.99 per month), and Standard with ads ($7.99 per month). Ad-tier subscribers become more valuable over time because in addition to paying a monthly subscription fee, Netflix monetizes them through ads. The larger this user base becomes, the more money Netflix can charge businesses for ad slots.

Netflix's advertising revenue doubled in 2024, and management expects it to double again in 2025. As of the last update (in the fourth quarter of 2024), the ad-supported tier accounted for 55% of all new sign-ups in countries where it's available, so it's creating a huge opportunity for Netflix to bring advertisers to the platform.

NASDAQ: NFLX

Key Data Points

Netflix's revenue growth is reaccelerating

Netflix generated a record $11.1 billion in total revenue during the second quarter of 2025 (ended June 30). It represented a 15.9% increase from the year-ago period, which was an acceleration from the company's first-quarter growth of 12.5%. According to management's guidance, revenue growth is likely to accelerate yet again to 17.3% in the upcoming third quarter (which ends on Sept. 30). This trend highlights the company's momentum, thanks in part to its booming advertising business.

Netflix also delivered a record $3.1 billion in net income during the second quarter, which marked a whopping 45% jump from the year-ago period. It translated to $7.19 in earnings per share (EPS), comfortably above Wall Street's consensus estimate of $7.08.

Netflix is one of the few profitable pure-play streaming providers, which is key because this cash flow fuels its content spending, which in turn attracts more members and keeps the flywheel spinning. Without its billions of dollars in quarterly net income, the company would have to rein in its formidable content engine, which could result in a loss of market share.

Netflix stock isn't cheap right now, but long-term investors can still do well

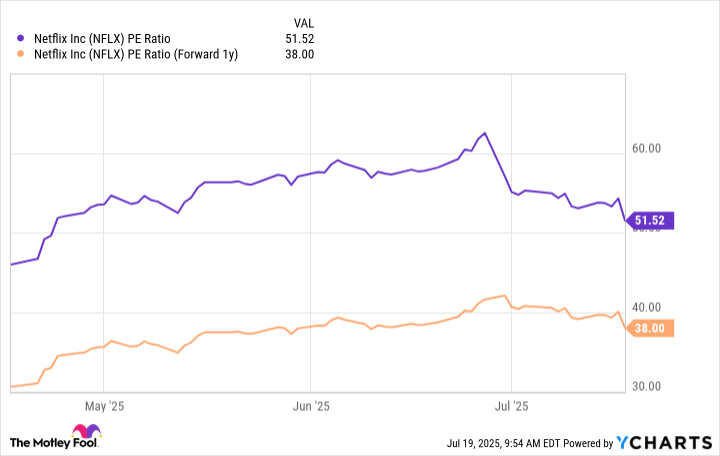

Since Netflix stock is up by a staggering 112,700% since its IPO, are you late to the party if you don't already own it? It certainly isn't cheap at the moment -- it's trading at a price-to-earnings (P/E) ratio of 51.5, which is twice what you'd pay for the S&P 500 right now (24.7). In other words, Netflix is far more expensive than the broader market.

The stock looks a little more reasonable if we value it based on its future potential earnings. Wall Street's consensus estimate (provided by Yahoo! Finance) suggests Netflix will generate $30.87 in EPS in 2026, placing its stock at a forward P/E ratio of around 38.

NFLX PE Ratio data by YCharts

No matter which way we look at it, investors who want to buy Netflix stock right now have to get comfortable paying a premium. Whether significant returns will follow might depend on an investor's time horizon. For example, an investor who is looking for big gains in the next 12 months might be left disappointed because of Netflix's valuation, but an investor willing to hold on to it for the next five years could do extremely well if the company's earnings continue to grow.

A five-year time horizon will give Netflix's advertising business time to flourish, which could be a major tailwind for its stock price. In fact, according to an internal forecast, the company plans to double its total 2024 revenue of $39 billion by 2030, with $9 billion set to come from selling ads. If those targets are met, the next five years will probably be very rewarding for shareholders.