Quantum computing stocks have gone from virtually unknown on Wall Street to all the rage in just a few months. Last December, Alphabet said that its Willow quantum chip had achieved a milestone in quantum computing, solving complex problems in minutes that would take traditional supercomputers 10 septillion years. The news sparked a frenzy for quantum computing stocks, which had gained momentum following the election.

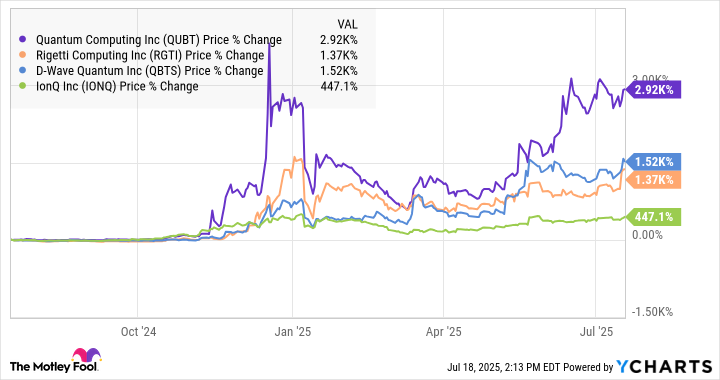

Among the winners was Quantum Computing Inc. (QUBT +2.78%), also known as QCI, and its stock has soared since Alphabet's announcement. As the chart below shows, Quantum Computing and peers like Rigetti Computing, IonQ, and D-Wave Quantum have all skyrocketed over the last year, following the same trend.

Quantum Computing stock won't win the title of most creative name in its sector, but it's the best performing of the four quantum computing stocks over the past year. Some investors believe it could be the next Nvidia, a stock that has jumped 100x over the last decade, recently reaching a market cap of $4 trillion.

Are they right? Let's see if Quantum Computing's super surge can continue.

Image source: Getty Images.

Where Quantum Computing stands today

Part of the reason Quantum Computing has been the best performing of the four stocks above is that it's the smallest one, so it benefited from the same trend as the three others but jumped off the lowest base. It still has the lowest market cap of the group at $3 billion, and its revenue is negligible at this point. In the first quarter, the company brought in just $39,000 in revenue and posted an operating loss of $8.3 million.

The company is pursuing a different goal in quantum computing than its peers above. It's focused on photonic quantum computing, rather than the supercomputing technologies that companies like IonQ, Rigetti, and Alphabet are researching. QCI achieved an important milestone in the first quarter, completing construction on its Quantum Photonic Chip Foundry in Arizona, which sets it up to meet growing demand for thin film lithium niobate (TFLN) photonic chips.

Management expects revenue to begin to ramp up next year once it begins production at that foundry. At this point, Quantum Computing is still clearly a high-risk stock, though it has enough liquidity to last several years, based on current operations. At the end of the first quarter, the company had $166.4 million in cash and no debt.

NASDAQ: QUBT

Key Data Points

Can QCI become the next Nvidia?

Comparing a company like Quantum Computing, which has run-rate revenue of less than $1 million, to Nvidia is a stretch, even if the stock is behaving like it. QCI has essentially no revenue, and there's no proof of concept that the business can work or sufficient or sustainable demand for its product. Still, most breakthrough technologies begin that way, and it took time for Nvidia to get to where it is today.

Nvidia introduced the graphics processing unit (GPU) in 1999, and its defining innovation has iterated, expanded, and evolved many times over since then. However, even back in 1999, Nvidia was much bigger than QCI is today. In the fiscal year ended Jan. 30, 2000, Nvidia reported $374.5 million in revenue in the fiscal year that ended Jan. 30, 2000.

Whether or not QCI can continue to deliver for investors depends on whether quantum computing is truly the next breakthrough technology. Given the surge in the stock above, investors are treating it like it is, though it's too early to tell.

Keep an eye on how QCI's new photonic chips do next year when the company intends to ramp up production and how smoothly its production efforts go. If there's a similar response to what we've seen to AI chips, QCI could take one small step toward being the next Nvidia.