Inflation has come down quite a bit since 2022, when it reached 9.1%. The 12-month U.S. inflation rate sits at 2.7% as of June. During the two-decade period from January 2005 to June 2025, inflation was 2.6%, so the current rate is in line with the long-term average.

But those rates are more than the Fed's target of 2%. And inflation, while normal in a healthy economy, cuts into your wealth unless you put your money in assets that generate a return.

Cryptocurrency has become a popular hedge against inflation, and especially market leader Bitcoin (BTC 3.10%). The price of Bitcoin makes it a daunting investment, though -- it costs about $119,000 at the time of this writing (July 22). If you're looking for an inflation hedge that costs well under six figures, Cardano (ADA 6.14%) fits the bill, with a price of less than $1. It also has an important similarity to Bitcoin.

Image source: Getty Images.

Cardano's economic structure makes it a potential hedge against inflation

Cryptocurrencies are either inflationary or deflationary depending on their tokenomics. An inflationary coin has a supply that increases over time, diluting the value. A deflationary coin has a fixed maximum supply. Because there's a firm limit on the number of coins, deflationary coins have a built-in scarcity that can increase their value over time.

Bitcoin is the most famous example of a deflationary coin. It has a maximum supply of 21 million, and once all those coins are mined, there won't be any more released. Cardano is also deflationary, with a maximum supply of 45 billion ADA tokens. Even though it has a much larger supply, there's still a firm cap on how many tokens will ever be in circulation.

CRYPTO: ADA

Key Data Points

Cardano currently has a market cap of about $30 billion, putting it in the top 10 cryptocurrencies by size. It's successful, with the potential for explosive growth. Now, let's look at whether that's likely to happen.

A breath of fresh air -- in 2021

Cardano is a blockchain with smart contracts, and it originally stood out for using a proof-of-stake system to validate transactions. Bitcoin uses a proof-of-work system, and so did Cardano's main competitor, Ethereum (ETH 4.86%), at the time. Proof of stake is much more energy efficient and allows investors to earn rewards by staking their Cardano tokens.

Cardano also uses peer-reviewed research as part of its development process. While many cryptocurrencies lean toward a hyper-fast development approach, Cardano's team opted for a more methodical style.

Those differences from other cryptocurrencies made Cardano an exciting investment in 2021, when it gained a reputation as a "green cryptocurrency" for its energy efficiency. By Sept. 2, 2021, it was up 1,520% on the year and had hit an all-time high of $3.10.

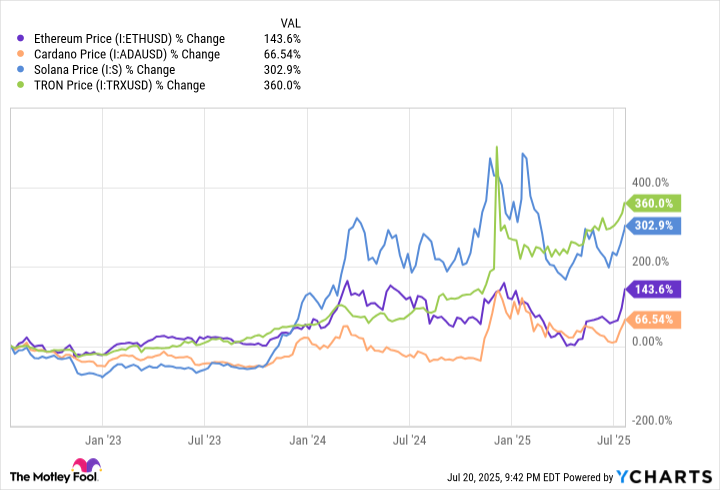

But Cardano quickly became one of many proof-of-stake cryptocurrencies, so that no was longer a competitive advantage. Ethereum switched to proof of stake, and now Solana, BNB, Tron, and plenty of other coins use this validation method. And as you can see in the chart below, those other major proof-of-stake coins have soundly outperformed Cardano during the past three years.

Ethereum Price data by YCharts

The peer-review process has turned out to be a disadvantage, as other blockchains have been able to build more and attract larger user bases than Cardano. The total value locked (TVL) on Cardano smart contracts is $388 million, according to DeFiLlama, which doesn't even place it in the top 20. Ethereum leads with $98 billion, and Solana is also well ahead of Cardano with $10 billion in TVL.

Should you invest in Cardano right now?

It's not all bad news for Cardano. The blockchain launched its Voltaire upgrade last September, introducing a voting system for network participants to help speed up the development process. Its Layer-2 scaling solution, Hydra, improves Cardano's performance by processing transactions off-chain. This November, Cardano plans to launch a side chain, Midnight, that's designed to protect commercial and personal data.

There are still signs of life for Cardano. The fact that it's deflationary gives it some built-in scarcity that many of its competitors don't have (Ethereum and Solana have no maximum supply, although Tron does). And during the past year, Cardano is up 96%.

That said, I consider Cardano a hold at the moment. (That's the approach I'm taking, as it's part of my crypto portfolio.) I think it still has some potential, but I wouldn't recommend buying until it can string together more positive developments and attract more users to its ecosystem.