Buy low and sell high is a valid investment strategy, but many investors only understand it to mean buying a stock at a low price and then selling it when the price rises.

An alternative view might argue that you should buy when the valuation is low and sell when it's high, or in this example, even buy when the business fundamentals are low and then sell when they are peaking.

Let's dive into an example with Apple (AAPL 0.96%).

Image source: Getty Images

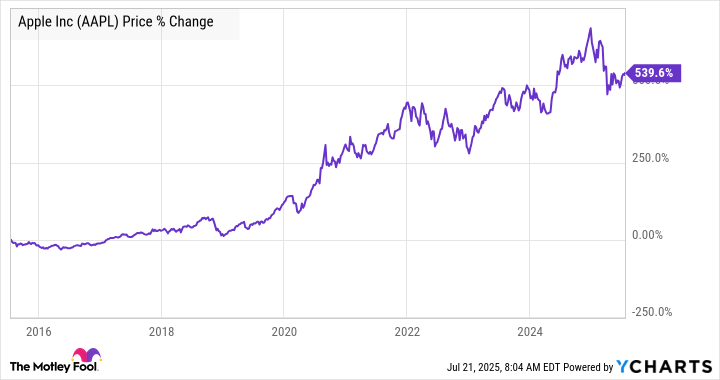

Apple stock price

As the chart below shows, there are numerous instances when an investor might have decided to "sell high" after "buying low" a decade ago. And more often than not, it would have been the wrong decision.

There's nothing wrong with taking a profit or reducing a position size to balance a portfolio. Still, anyone who looks at Apple's price chart and concludes they were buying "high" would miss two key metrics that indicate Apple's earnings growth could continue for a long time into the future.

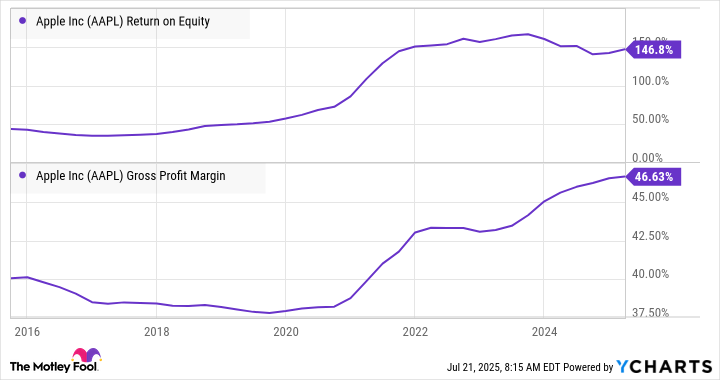

Its return on equity (profitability relative to equity invested by shareholders) and its profit margins have both improved significantly over the last decade.

AAPL Return on Equity data by YCharts

Part of the reason for the improvement stems from the ongoing growth of Apple's higher-margin service ecosystem offerings, which are sold into a massive installed base of Apple hardware devices.

It's a trend that has legs, and despite the substantial rise in the share price over the last decade, Apple's stock seems to have room to run.