Wall Street is always on the lookout for the next big thing, and quantum computing is one of this year's hottest topics. Look no further than IonQ (IONQ 1.48%), which has surged roughly 500% over the past 12 months.

The company is developing and building quantum computers, and its CEO hopes its technology will enable the company to become the Nvidia in its field.

Can IonQ meet such high hopes? Let's scan the quantum computing landscape to determine where the company fits in and whether the stock can still be a game-changer for your portfolio.

Image source: Getty Images.

Quantum computing stocks: The potential and a caveat

Quantum computing represents a new frontier of technological innovation by using quantum mechanics to process highly complex calculations far faster than even today's most powerful supercomputers.

The main holdup is that the technology is still primarily at the research stage. At least a dozen companies, including IonQ, are developing quantum computers. But they still have very little practical use outside of academic applications because current quantum computers are unstable and prone to errors.

Once the kinks are worked out, the technology could be a leap forward for society. Estimates from McKinsey suggest that the market opportunity could reach $100 billion by 2035.

The caveat is that most of this growth will likely occur in the latter half of the next decade. Many experts, including the CEOs of companies developing quantum computers, agree that the widespread utility of the technology is still several years away, at least.

Examining IonQ's place in the quantum landscape

IonQ is developing trapped-ion quantum computers for deployment in data centers. What's important is that its technology is widely compatible across vendors. For instance, the company's hardware is available on all of the major cloud platforms and supports all notable quantum computing programming languages and software development kits.

And it has acquired several companies to expand its technology footprint. Most recently, IonQ announced that it will purchase Oxford Ionics for $1.075 billion (primarily funded with stock), which will give it ownership of Oxford's trapped-ion quantum processors.

The idea is that the company wants to lay the groundwork for its quantum computers to integrate into real-world uses as seamlessly as possible.

IonQ is also starting to generate revenue. Recently, it announced that it was working in conjunction with Amazon (through its Amazon Web Services) and Nvidia to help pharmaceutical company AstraZeneca use quantum computing for accelerated drug development. It has also won multiple contracts from the U.S. Air Force Research Lab, totaling about $94.4 million in value.

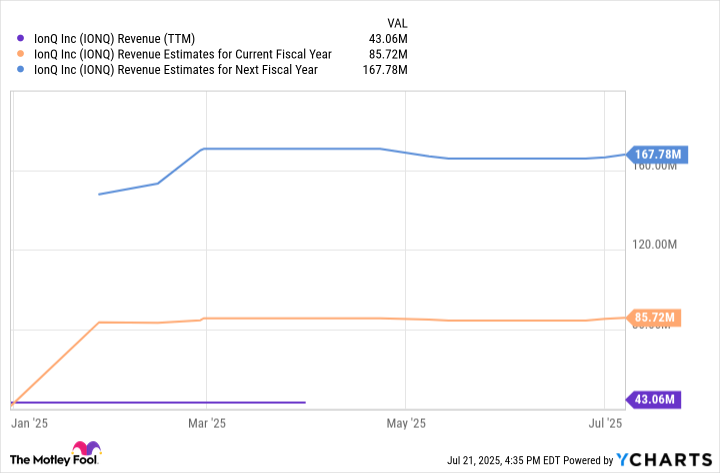

The combination of organic revenue and bolt-on sales from acquisitions has IonQ poised for strong growth over the next two years.

IONQ Revenue (TTM) data by YCharts; TTM = trailing 12 months.

Is the stock a buy now?

To be clear, this remains a very risky stock. For starters, the company's aggressive acquisition strategy can easily backfire if it drastically overpays for companies or fails to integrate them effectively into its broader business. Growth could also slow if organic revenue fails to keep pace with the growth added from these acquisitions.

NYSE: IONQ

Key Data Points

Beyond that, the landscape is crowded, with deep-pocketed competitors, including IBM, Amazon, Microsoft, and Alphabet, all developing quantum computers, as well as a handful of upstart companies, such as IonQ.

Lastly, IonQ now has a market capitalization of $12 billion. That's a price-to-sales ratio of 71 using next year's revenue estimates. It's probably safe to say the share price already reflects much of the company's near-term growth and success.

On the flip side, that may also mean that the stock has priced in little to no room for downside if things go wrong -- and things could very easily go wrong here. IonQ is an unproven company with limited revenue in an immature and speculative industry. A high valuation means a stock has further to fall if it loses favor with investors.

Such a one-sided risk-to-reward dynamic can easily backfire, potentially sticking investors with severe losses if things break the wrong way. Therefore, it's probably best to avoid IonQ stock for the time being.