Wall Street loves a good narrative, and quantum computing stocks have delivered several over the past year. Alphabet demonstrated breakthrough quantum capabilities with its Willow processor in late 2024, triggering a surge of investment into companies promising to solve optimization problems and accelerate drug discovery.

But the surface-level excitement misses the real story: The quantum surge isn't primarily driven by these breakthroughs or potential AI synergies. The true catalyst is an urgent, government-mandated cybersecurity crisis that has transformed quantum computing from a speculative technology into a validated strategic threat. "Q-Day" -- the hypothetical moment when quantum computers can break current encryption -- has moved from academic theory to operational emergency, providing powerful validation for the entire ecosystem.

Image source: Getty Images.

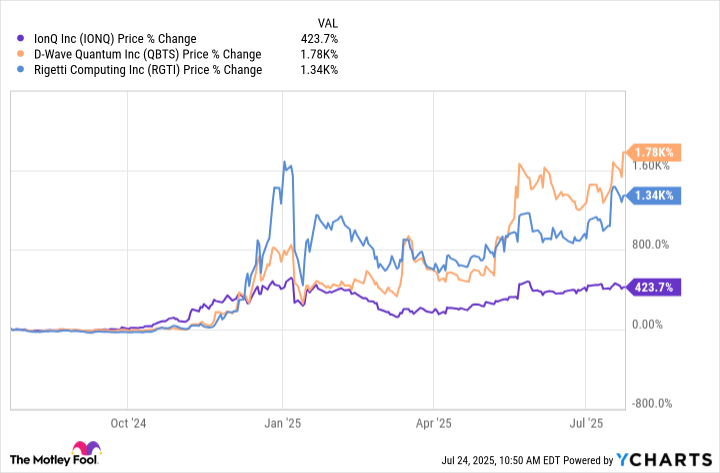

The performance of pure-play quantum stocks tells the story. IonQ (IONQ 4.22%) has gained 423% over the past 12 months, D-Wave Quantum (QBTS 6.54%) has surged over 1,700%, and Rigetti Computing (RGTI 6.05%) has jumped more than 1,300%. These aren't typical tech stock rallies -- instead, they signal the market's definitive recognition that quantum computing has evolved from a laboratory curiosity to a validated national security priority.

The encryption emergency driving quantum validation

The National Institute of Standards and Technology (NIST) released the first three post-quantum cryptography standards in August 2024, including CRYSTALS-Kyber for key establishment and CRYSTALS-Dilithium for digital signatures. Rather than academic exercises, NIST delivered operational blueprints for defending against quantum computer attacks that could render current encryption worthless within a decade.

Government response has moved far beyond research grants. The Office of Management and Budget has issued binding directives requiring all federal agencies to inventory cryptographic systems and develop transition plans. The White House estimates the federal transition alone will cost $7.1 billion between 2025 and 2035, representing massive spending on quantum-resistant cybersecurity solutions that will primarily benefit established cybersecurity firms and cloud providers rather than pure-play quantum companies.

However, this urgent government validation of the quantum threat has created powerful tailwinds for the entire quantum ecosystem. John Young, chief operating officer at Quantum eMotion America, warns that "most businesses remain dangerously unprepared for Q-Day," while government agencies face compliance deadlines. This recognition that quantum computers represent an existential cybersecurity threat has transformed investor perception of quantum hardware companies from speculative science projects to strategic national assets.

Pure-play companies capture the quantum opportunity

IonQ has emerged as the highest-profile beneficiary despite challenging fundamentals. The company reported $7.6 million in first-quarter revenue, essentially flat year over year, while posting a $32.3 million net loss. However, IonQ maintains $697 million in cash and recently completed a $1 billion equity offering, providing substantial runway for continued development and acquisitions across quantum computing and networking.

NYSE: IONQ

Key Data Points

D-Wave Quantum has taken a different commercial approach, focusing on quantum annealing technology for specific optimization problems. First-quarter results demonstrated viability, with revenue reaching $15 million -- a 509% year-over-year increase driven by system sales and cloud access programs. The company's quantum-computing-as-a-service model allows organizations to access quantum capabilities without massive capital investments.

NYSE: QBTS

Key Data Points

Meanwhile, Rigetti Computing represents the highest-risk option, with its full-stack approach combining processor development, system integration, and cloud services. However, recent results show execution challenges: First-quarter revenue declined to $1.5 million from $3.1 million, while operating expenses totaled $22.1 million. The company's 84-qubit Ankaa-3 system represents a technological milestone, but converting achievements into sustainable revenue remains unproven.

NASDAQ: RGTI

Key Data Points

Yes, but speculation risks remain elevated

All three companies trade at extreme valuations that price in flawless execution and rapid market adoption. IonQ trades at approximately 219 times trailing sales, while D-Wave and Rigetti command similarly premium multiples. The quantum computing market remains early stage, with limited commercial applications and uncertain technology winners.

Technical breakthroughs from well-funded competitors, including IBM, Alphabet, and Microsoft, could disrupt smaller players' market positions. Current quantum systems remain error-prone and expensive, limiting commercial viability outside specialized use cases. Investment in pure-play quantum stocks requires tolerance for extreme volatility and extended development timelines.

Capitalizing on quantum's validation moment

The government's urgent preparation for Q-Day has transformed quantum computing from speculative technology to validated strategic necessity. While the $7.1 billion in federal post-quantum cryptography spending will primarily flow to cybersecurity firms and cloud providers implementing defensive solutions, this massive investment validates the quantum threat and elevates pure-play quantum companies from laboratory curiosities to strategic national assets.

Yes, the valuations are extreme, and the fundamentals remain challenging. Quantum computing remains a small, speculative subsector with limited current commercial applications, and predicting which companies will ultimately dominate this emerging technology remains impossible. But the Q-Day validation provides a real catalyst that has shifted investor perception and could accelerate development timelines.

For investors seeking exposure to this validation story, a diversified approach across the quantum landscape offers the best risk-adjusted opportunity. Consider allocating a small speculative portion of growth portfolios across the major pure-play names: IonQ for its comprehensive approach and strong balance sheet, D-Wave for its early commercial traction, and potentially Rigetti for its full-stack development strategy. This approach acknowledges the difficulty of picking winners in an emerging technology while capturing potential upside as the space transitions from government validation to broader commercial adoption.