For the better part of the last decade, growth stocks have been the hot topic in the market. Investors have seen valuations skyrocket, new industries hit the mainstream, and shareholders making a lot of money along the way.

Typically, growth stocks come with a trade-off: Investors often take on more risks for the potential of higher gains. However, not all growth stocks are young, high-risk companies that have recently had their initial public offering. Some are large corporations that meet the growth stock criteria.

One that fits the latter description is Amazon (AMZN +0.26%). It has long been one of the premier growth stocks on the market, and although it sits in the $2 trillion club (as of July 22), its potential remains strong.

If I had to invest $1,000 in a growth stock right now, Amazon would be my go-to. I wouldn't invest expecting it to continue averaging 25% annual returns like it has over the past decade, but it still has a lot of potential.

The undisputed e-commerce king

Let's start with what has made Amazon the juggernaut it is today: e-commerce. It's the business' bread and butter, accounting for more than 80% of revenue in the first quarter.

E-commerce isn't a high-margin business because of the high costs for labor, warehousing, logistics, and the like. However, it remains a cash cow that consistently generates 12-figure revenue. In the first quarter, sales in its North America and international segments (which also includes advertising and subscriptions) was $126.4 billion, up around 7% year over year.

With management recently deploying its one millionth robot to help streamline operations, I anticipate that e-commerce margins will increase meaningfully. Even then, at its current scale, it likely won't be a huge growth driver. Still, the revenue it brings in is essential to fund and invest in Amazon's higher-margin businesses like Amazon Web Services (AWS).

Amazon's growth will come from AWS

While e-commerce is the cash cow, AWS is Amazon's true profit maker, accounting for 63% of its operating income in the first quarter.

As of the end of 2024, AWS held a 30% market share in cloud computing, leading Microsoft Azure (21%) and Alphabet's Google Cloud (12%). That's the good news. The could-be-better news is that AWS has been slowly losing market share.

NASDAQ: AMZN

Key Data Points

Amazon is well aware of the gains the competition has been making in the cloud space, so it has ramped up its investments to build out its technology infrastructure to support AWS growth. Last year, it had $83 billion in capital expenditures (capex), and this year, it will likely spend more than $100 billion.

AMZN Capital Expenditures (Annual) data by YCharts.

The company is trying to make AWS a one-stop platform that companies and developers can use to create their own artificial intelligence (AI) tools. It has Bedrock for building generative AI tools, SageMarker for creating machine-learning models, and its Trainium2 AI chip.

As AWS expands and overall cloud adoption continues, it should keep driving much of Amazon's overall growth.

Prepare to pay a premium for the stock

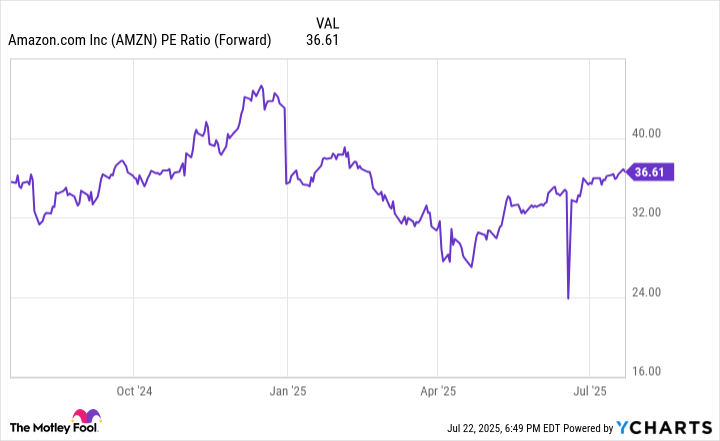

Amazon's stock is far from cheap, trading at 36 times its forward earnings. However, you would expect to pay a premium price for a premium business as popular as Amazon.

AMZN PE Ratio (Forward) data by YCharts; PE = price to earnings.

There will inevitably be volatility along the way, but if you're investing for the long term, you should be encouraged by Amazon's effective efforts to diversify its business and introduce new revenue streams. The company is more than just e-commerce and cloud computing -- it's becoming a full-fledged conglomerate.

Looking back a decade from now, I'm confident that you won't regret investing $1,000 in Amazon stock today.