Even though its stock price has more than doubled so far in 2025, Palantir Technologies' (PLTR 3.40%) bull run shows no signs of stopping. The controversial big data analytics company is benefiting from a surge in public- and private-sector clients adopting its artificial intelligence (AI)-enabled software.

But is the market getting ahead of itself? Below, I'll dig deeper into Palantir's fundamentals to see what's really behind this rally and decide if shares can continue beating the market over the next five years and beyond.

Image source: Getty Images.

The intersection of two hype cycles

Palantir's meteoric rise seems to be related to two different hype cycles -- the rise of generative AI and the election of President Donald Trump. The first one is the most clear-cut. Since the launch of OpenAI's ChatGPT in late 2022, investors have been desperate to find software companies that can pioneer real-world use cases for the technology.

Palantir is a natural fit. Its core data analytics business was already designed to help clients uncover trends and actionable insights in vast volumes of data, and the incorporation of its Artificial Intelligence Platform (AIP) can make this process easier.

NASDAQ: PLTR

Key Data Points

For example, instead of using complex commands to sort through data, an analyst can simply enter a text prompt and let the large language model (LLM) do the heavy lifting. It also allows the user to create AI agents (trained on the enterprise's data) that can work semi-autonomously.

The speed and flexibility of LLMs make them ideal for fast-paced field work, like law enforcement and military operations. Palantir already boasts high-profile clients, like the U.S. Army, the North Atlantic Treaty Organization (NATO), and the armed forces of Ukraine and Israel.

Recent legislation also promises to boost defense spending by $156.2 billion for fiscal 2026, with much of that extra money going to next-generation war-fighting capabilities.

Palantir's co-founder Peter Thiel is also a close ally of the Trump administration (Vice President JD Vance worked with him at Mithril Capital). This relationship may add to the hype surrounding Palantir, even though the fundamental benefits are unclear.

Is Palantir's business growing fast enough?

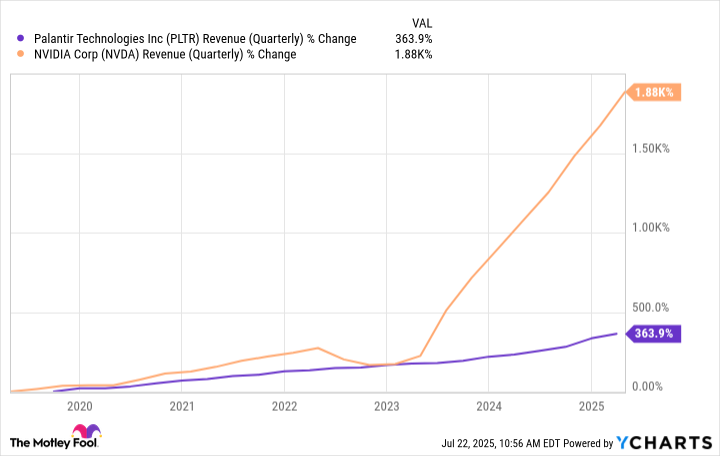

Palantir's first-quarter revenue increased by 39% year over year to $883.9 billion, while net income rose 24% to $214 million. Although this is a decent rate of expansion, it's far from earth-shattering. Other AI-related companies, like the semiconductor giant Nvidia, have frequently posted significantly higher top-line growth rates.

PLTR Revenue (Quarterly) data by YCharts.

Nvidia's revenue growth is absolutely trouncing Palantir's -- it isn't even close. What's worse, however, is that Palantir's stock price has dramatically outperformed its relatively modest fundamentals.

When a company's stock price grows significantly faster than its actual business prospects, it becomes overvalued. With a price-to-sales ratio (P/S) of 122, Palantir's stock is considerably more expensive than alternatives like Nvidia, which has a P/S of 29, and the S&P 500, which trades for an average of approximately 3.2. Furthermore, analysts currently don't expect significant acceleration in Palantir's top-line growth rate, with the consensus estimate of just 26% year over year for 2026.

Where will Palantir stock be in 5 years?

A good company doesn't always make a good investment. Challenges like overvaluation can make the risks of holding a stock outweigh any potential upside.

With a P/S ratio of 122, calling Palantir priced for perfection seems an understatement. It's really priced to disappoint because it doesn't seem capable of justifying its price tag. Over the next five years, expect shares to underperform the market.