AppLovin (APP +1.55%) is an advertising-technology (adtech) stock that's up nearly 1,200% over just the last two years, as of this writing. These incredible gains were fueled by stunning revenue growth and an extraordinary surge in investor confidence in the underlying business.

AppLovin's revenue has increased by more than 250% over the last five years, which is a strong compound annual growth rate (CAGR) of more than 20%.

As for investor confidence, consider the valuation for AppLovin stock. Five years ago, it traded at about 10 times its sales. Now it trades at more than 20 times sales. This higher valuation suggests that investors view the business more favorably than they used to and are consequently willing to pay a higher price to be a part-owner.

Image source: Getty Images.

In 2025, AppLovin stock is up another 10% year to date. And investors may be wondering what to think about this business now. Well, here's the one thing that investors should be watching as the rest of the year plays out.

But first, here's what AppLovin does

AppLovin's Axon software helps apps find users and generate revenue. Some apps monetize users by displaying ads and others find users by buying ad slots. The platform is powered by artificial intelligence (AI) and, if revenue growth is any indication, it's been quite effective.

NASDAQ: APP

Key Data Points

AppLovin's growth has been fueled by its AI software business. And this high-margin platform has helped its profits considerably. In the first quarter of 2025, for example, the company's revenue jumped 40% year over year to $1.5 billion. But its Q1 gross margin jumped to 82% from 72% in the prior-year period -- that's massive.

Moreover, AppLovin's Q1 operating expenses dropped in various areas. For starters, sales and marketing expenses were down 19% from the first quarter of 2024. Likewise, research and development spending went down by 21%. Granted, many investors would like to see a technology company spend money on research to stay in front of competition, which may be a valid concern. But the point is that AppLovin's profits are soaring as it grows because of management's fiscal discipline.

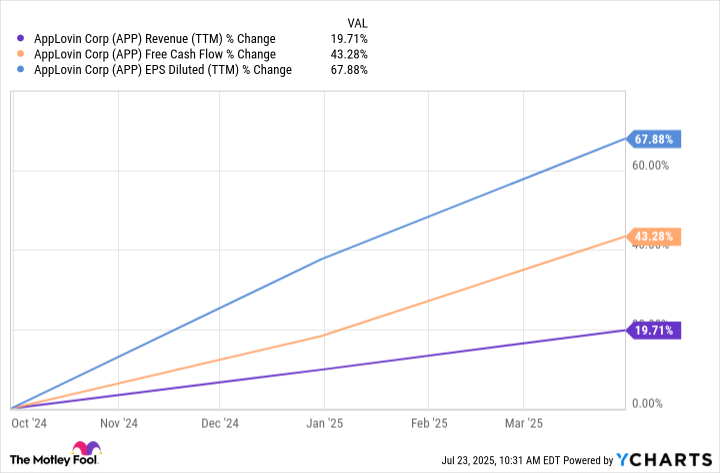

The chart below shows just how much profit metrics such as free cash flow and earnings per share (EPS) outpaced revenue growth over the past year.

APP Revenue (TTM) data by YCharts

What to watch with AppLovin

Based on all the above, I believe it's fair to say that AppLovin has been tremendously successful at what it does. And here's the thing: AppLovin has really only been addressing one part of the advertising market, which is mobile video games. But that's now changing.

In 2025, AppLovin is greatly expanding its market and this is what investors need to be watching for the remainder of the year.

AppLovin is expanding beyond the world of mobile apps and into web-based advertising. And the company is expanding beyond video games into other areas such as connected TV and e-commerce. The point is, AppLovin has succeeded with its first opportunity and now it's setting its sights on a much bigger prize.

Should it succeed with this larger opportunity, AppLovin could certainly be a market-beating business from here. Stocks that outperform the S&P 500 often have strong growth rates and profitability. AppLovin could feasibly deliver on both over the long term if it can make the jump from mobile gaming.

If AppLovin struggles, things could be more challenging for shareholders. As mentioned, the stock trades at more than 20 times sales, which assumes a measure of strong growth in coming years. If its software only works with the niche market of mobile gaming, it may not sustain the level of growth that investors expect, which could cause the stock to underperform.

For what it's worth, I believe that AppLovin deserves the benefit of the doubt as it expands. Many doubted the company could do what it did in mobile gaming. It proved the doubters wrong once and I wouldn't be surprised if it did it again. That said, I don't have a crystal ball so investors will want to watch for signs that AppLovin's expanded strategy is working as 2025 plays out.

AppLovin is expected to report financial results for the second quarter of 2025 on Aug. 6.