From the outside looking in, investing in stocks can seem complicated. Some people think you need to spend hours researching companies or industries, but that's far from the case. Being an effective investor can be as easy as investing in a broad exchange-traded fund (ETF) and letting hundreds of companies do the heavy lifting.

One ETF in particular that's a great option is the Vanguard S&P 500 ETF (VOO 0.02%). It mirrors the S&P 500 -- an index that tracks 500 of the largest American companies on the stock market -- and has shown it's an effective one-stop shop for investors.

It doesn't require a lot of money to benefit from investing in VOO, either. A relatively small investment today could pay off huge in the future.

NYSEMKT: VOO

Key Data Points

Some of America's top companies are leading the way

The S&P 500 is arguably the most important index in the stock market, mainly due to the companies it tracks. When you invest in an S&P 500 ETF, you know you're getting exposure to some of the world's best companies from across many industries.

It includes tech giants like Apple, Microsoft, and Nvidia; finance giants like JP Morgan Chase, Visa, and Bank of America; consumer staples like Coca-Cola, Procter & Gamble, and PepsiCo; energy giants like Chevron, ExxonMobil, and ConocoPhillips; and hundreds of others.

VOO is weighted by market cap, so larger companies account for more of the ETF and its performance than smaller companies. This has made it more tech-heavy than usual, but it still contains companies from all 11 major sectors:

- Information technology: 33.1%

- Financials: 13.9%

- Consumer discretionary: 10.4%

- Communication services: 9.8%

- Health care: 9.3%

- Industrials: 8.6%

- Consumer staples: 5.5%

- Utilities: 2.4%

- Real estate: 2.1%

- Energy: 3%

- Materials: 1.9%

Given the number of companies, their diversification, and their influence, an investment in VOO can be viewed as banking on the growth of the U.S. economy. They aren't directly correlated, but they tend to move in the same direction over time.

VOO has a history of proven results

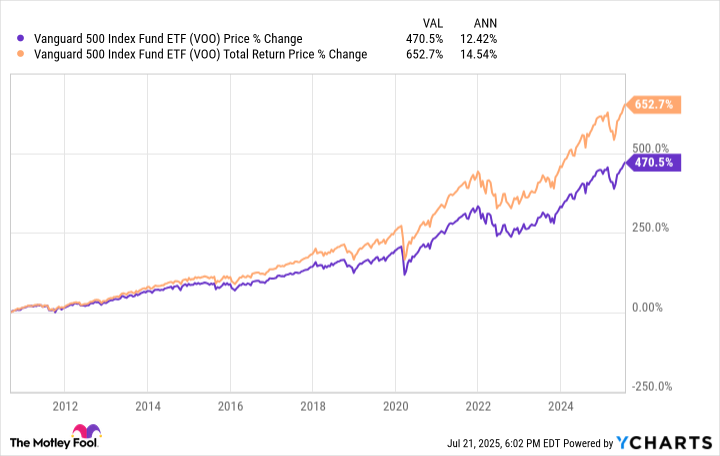

The S&P 500 has historically averaged around 10% annual returns. VOO was created in September 2010, and since then, it (and the S&P 500) has exceeded this average and had very impressive returns.

By no means does VOO's historical track record guarantee its future performance. However, for the sake of showing how effective a $1,000 investment in VOO can be, let's assume you're invested for 20 years. Below is how a one-time $1,000 investment would roughly shape up at different annual average returns:

| Average Annual Returns | Investment Total After 20 Years |

|---|---|

| 10% | $6,690 |

| 12% | $9,594 |

| 14% | $13,671 |

Calculations by author. Investment amounts are rounded down to the nearest dollar and take into account VOO's 0.03% expense ratio.

The real power comes from continuing to add to your investment after the initial $1,000, but even the one-time investment can grow into a meaningful amount.

VOO allows you to keep more of your gains to yourself

Several ETFs mirror the S&P 500; VOO is just one of them.

However, it's my personal go-to because of its low 0.03% expense ratio, which works out to a $0.30 annual fee per $1,000 invested. This is one of the lowest expense ratios available in the stock market, regardless of ETF type. ETF expense ratios can often be overlooked, but even the smallest differences can amount to hundreds or thousands of dollars over the long run.

Investing has one main objective: to make money. Investing in a low-cost ETF like VOO ensures that you keep more of your gains for yourself.