It's been a tough past few months for Krispy Kreme (DNUT 0.59%) shareholders. Although the stock's perked up this month after becoming one of the market's favorite meme stocks, this gain still doesn't come close to unwinding the ticker's 66% setback from its September peak. Shares are now down 77% from their 2022 high, despite the recent bounce from the record low made in June.

Veteran investors know that the best time to buy a great stock is "on sale." Krispy Kreme shares are most definitely trading at a discount. However, a stock isn't necessarily great simply because it dipped.

Here's some food for thought if this ticker has made its way back onto your radar.

Krispy Kreme, up close and personal

Krispy Kreme is one of the U.S.'s favorite doughnut brands, selling its goods through thousands of grocers and convenience stores all over the world, but also operating over 1,400 of its own stores where consumers can enjoy a freshly made treat. The company did over $1.66 billion worth of business last year, leveraging the sheer deliciousness of its doughnuts.

There's no denying the drama undermining the stock's price, however.

NASDAQ: DNUT

Key Data Points

Case in point: After looking like it was going to turn into a fruitful partnership when it first materialized in late 2022, in May of this year, fast food giant McDonald's discontinued its sales of Krispy Kreme's doughnuts. Although it was never disclosed exactly how much business this arrangement was generating for Krispy Kreme, in light of the sheer reach of McDonald's, it arguably wasn't insignificant.

Image source: Getty Images.

The recent decision to cut its dividend payments doesn't exactly bolster the bullish argument, either.

Krispy Kreme's woes began well before the dividend cut and the end of its relationship with McDonald's. The divestiture of its stake in Insomnia Cookies beginning late last year pared back reported revenue as well. People are just eating healthier, too, looking to lose some of the bad eating habits -- and some of the pounds -- added during the COVID-19 pandemic.

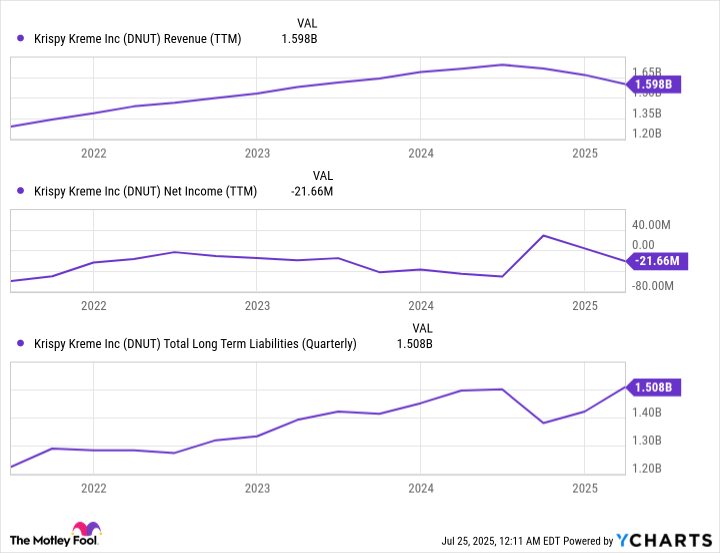

Krispy Kreme picked up weight as well during this time, in the form of debt. As of the end of the first quarter of 2025, the doughnut powerhouse was nursing a little over $1.5 billion worth of long-term liabilities. That doesn't seem like much, but it's a lot for a $1.76 billion outfit that's barely breaking even. It's also a lot for an organization that was sitting on only a little over $1 billion in long-term debt four years ago, at the peak of the coronavirus contagion that was proving complicated for all businesses.

DNUT Revenue (TTM) data by YCharts.

Now the company wants to become bigger, but it recognizes that to do so, it will first need to become better. That means de-leveraging its balance sheet by paying down at least some of the debt that's ultimately eating into profits. That's not easy to do if you're running the business you want to evolve and expand while you're also shrinking some aspects of the operation.

But there's always a chance that things will go as hoped.

Enough reasons not to bite

The question remains, however... is Krispy Kreme stock a buy following what's turned into a prolonged, sizable sell-off?

From a valuation perspective, not really. Analysts expect the company to remain in the red this year -- and next -- as it suffers the fallout from a couple of flopped partnerships and the new cost of paying down debt. It's also shifting from in-house to outsourced logistics that may end up costing it more in the long run. After all, a third-party delivery service will be pricing in at least a little profit for itself, which Krispy Kreme didn't have to pay while it was handling its own transportation duties.

Meanwhile, although it didn't explain exactly what it meant or how much it will cost, Krispy Kreme's plans to "strengthen [its] performance-based culture" ultimately sound like an expense. At the same time, while "deploying capital to only the highest returning investments" makes enough superficial sense, the implication is that at least some semi-important initiatives could go underfunded, if not entirely unfunded.

In other words, all its plans are easier said than done, and all of them come at a cost of one sort or another.

Data source: StockAnalysis.com. Chart by author.

Then there's the not-so-small matter of suddenly becoming a meme stock.

A meme stock is a stock that's attracted the attention of an individual or group of traders specifically because they can influence that ticker's price. Sometimes they're talking it up because they own it. Other times, they're talking it down because they've shorted it, which is a bet that the stock's price will sink. All these groups or individuals will primarily exert this influence online, using clever digital imagery with a short message that's usually shared online using social media. You know these images as memes.

Sometimes it works -- and sometimes it doesn't. Given that the targeted stocks tend to be small-caps or low-float issues, these efforts usually work at least a little, but only for a little while. The bullish memes have certainly lifted Krispy Kreme shares out of the funk they were in through June.

You want nothing to do with any ticker being targeted by anyone only looking to cash in on a short-term move they're creating. See, it works... but only right up until the point it doesn't. Once it doesn't work anymore, it all unravels in a hurry. And you never really know when that reversal is coming.

Not now, but maybe later

Don't misunderstand. Whether or not Krispy Kreme was one of the market's most active meme stocks at this time, there's still not enough of a bullish argument to justify the risk you'd be taking by buying it.

Face it. This company's struggling to remain profitable in the midst of a complicated overhaul. It might all work out in the end. However, there could be plenty of misery in the meantime. Being a meme stock only adds to the near-term uncertainty. There are far better risk-versus-reward scenarios to choose from right now.

Still, you have to respect the willingness to at least try to fix what's broken. Plenty of companies would be too fearful of making any major changes or doing anything differently than what they were already doing. It might be fun to check back in on Krispy Kreme two to three years down the road, which is when analysts collectively believe it's going to be fully out of the red and back in the black.