The S&P 500 (^GSPC +0.50%) continues to roar higher as we approach the end of July. Not only is the index at an all-time high, but it's also up more than 27% from its April low.

The "V-Shaped" recovery may have some investors hesitant to smash the buy button, even on top stocks. Folks in that boat may want to consider diversified exchange-traded funds (ETFs) that focus on generating passive income. That way, the return isn't solely dependent on stock prices going up.

A trio of Motley Fool contributors think the Global X MLP ETF (MLPA +0.38%), Schwab US Dividend Equity ETF (SCHD +0.14%), and the JP Morgan Nasdaq Equity Premium Income ETF (JEPQ +0.41%) stand out as top ETFs to buy now.

Image source: Getty Images.

Invest in America's energy infrastructure with this high-yield ETF

Lee Samaha (Global X MLP ETF): This ETF invests primarily in midstream master limited partnerships (MLPs) that own natural gas pipelines and storage assets. MLPs trade publicly but are treated as limited partnerships for tax purposes, which gives them advantages when making distributions to investors. As such, this ETF, which currently holds 20 infrastructure investments, offers investors significant distributions -- its current trailing-12-month distribution yield is 7.5%.

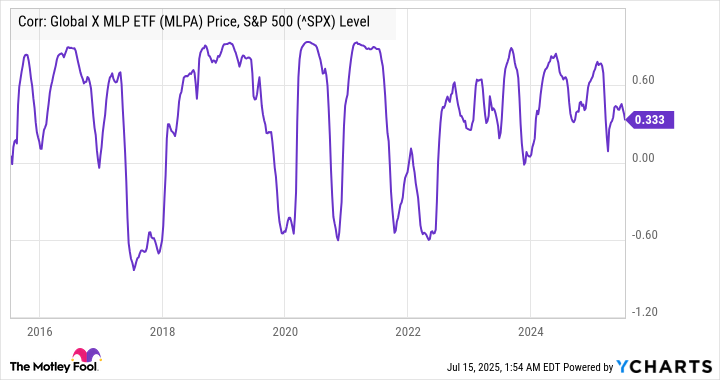

Moreover, as the chart below demonstrates, its performance tends to have little correlation with the S&P 500 index.

Fundamental Chart data by YCharts.

While that's not always a good thing, it does offer investors a way to invest without increasing their overall exposure to the S&P 500. In a nutshell, the ETF's performance is driven by sentiment regarding the long-term role of natural gas in the economy. That's sometimes been negative, not least due to the rise of renewable energy, causing concern over the long-term structural role of gas.

That said, there has been a growing realization in recent years that natural gas is likely to play a crucial role in future energy provision, as its reliability and cost offset the intermittency of renewable energy sources. Moreover, it's an energy source abundantly available in the U.S. -- one that will help ensure domestic energy sufficiency.

Low management fees and a high yield are only two reasons to love the Schwab U.S. Dividend Equity ETF

Scott Levine (Schwab U.S. Dividend Equity ETF): One of the usual suspects when it comes to reliable ETFs that provide strong dividends, the Schwab U.S. Dividend Equity ETF is a great choice for investors looking to fortify their portfolios with a rock-solid source of passive income. In addition to its distribution that has a 30-day Securities and Exchange Commission (SEC) yield of 3.8%, the ETF has an extremely low total expense ratio of just 0.06%.

With net assets of over $71 billion, the Schwab U.S. Dividend Equity ETF is an attractive option for risk-averse income investors for a variety of reasons. For one, companies that have market capitalizations over $70 billion represent about 62% of the fund's holdings -- an attractive feature since large-cap stocks usually demonstrate less volatility and more reliable dividends than smaller-cap stocks.

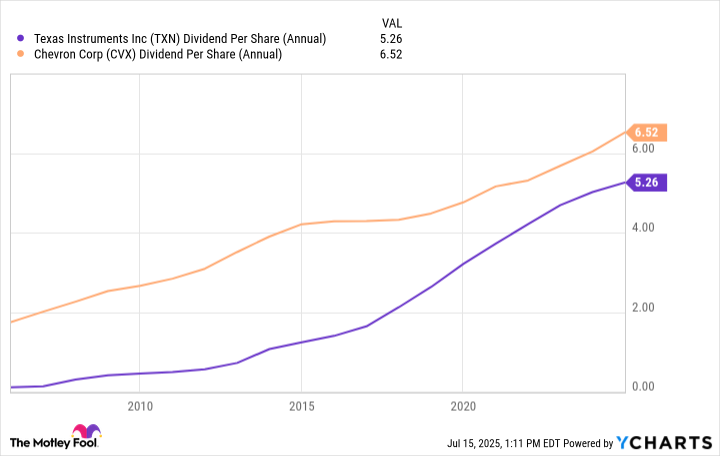

Tech stalwart Texas Instruments and oil supermajor Chevron, for example, are the top-two positions among the ETF's 103 holdings. Both companies have market caps in excess of $195 billion, and they've demonstrated multiyear commitments to increasingly rewarding shareholders with dividends.

TXN Dividend Per Share (Annual) data by YCharts.

Chevron's heavy weighting in the fund is unsurprising. Not only is Chevron one of the largest energy stocks by market cap, the energy sector comprises the largest share of positions in the Schwab U.S. Dividend Equity ETF. In fact, large energy stocks often return capital to shareholders via dividends.

The S&P 500 may nudge lower this month, but if it does, generating steady passive income from the Schwab U.S. Dividend Equity ETF will take the sting out of it.

This ETF's high yield is the real deal

Daniel Foelber (JP Morgan Nasdaq Equity Premium Income ETF): The ETF was launched in May 2022. That year ended up being the worst calendar year for the Nasdaq-100 since 2008, and the new ETF offered a way to use the volatility of the underlying holdings in that index to earn income from options, dividends, and other means.

The primary way the ETF earns income is by selling covered call options. Call options take away the potential upside of a stock in exchange for a guaranteed return.

For example, the price of Nvidia (NVDA 0.65%) -- the largest holding in the Nasdaq-100 and the JP Morgan Nasdaq Equity Premium Income ETF -- is $170.78 per share at the time of this writing. An Aug. 15, 2025 call with a $175 share price at the time of this writing has a midpoint between the bid and ask price of $4.10.

Someone selling that call option would collect $4.10 per share, but they would also have to sell Nvidia for $175 a share if the buyer of the option decides to execute it, which could happen if Nvidia is over $175 a share. The move will backfire if Nvidia soars, but because there's a guaranteed gain from the option income, the strategy can be effective for investors who are willing to sacrifice the upside potential of a stock in exchange for dividend income. And that's exactly the kind of investment objective the JP Morgan Nasdaq Equity Premium Income ETF aims to achieve.

It's also worth understanding that stocks with higher volatility tend to command higher options premiums. So the premiums on the call options for stocks in the Nasdaq-100 will generally be higher than S&P 500 stocks. Or put another way, the buyer of a call option on a red-hot growth stock is going to be willing to pay more than they would for a call option on a stodgier company like Coca-Cola. The high options premiums are why the fund sports a whopping 11.2% 30-day SEC yield (as of June 30, 2025).

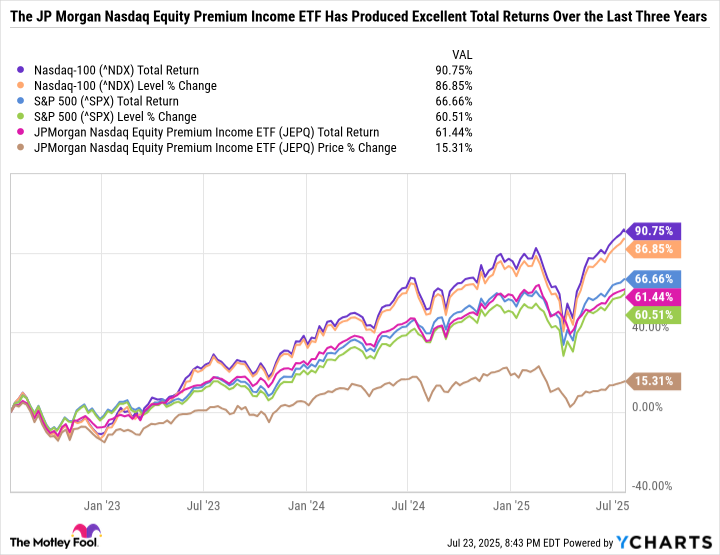

Over the last three years, the JP Morgan Nasdaq Equity Premium Income ETF has only gained a modest 15.3% despite its holdings being similar to those of the growth-stock-powered Nasdaq-100. But factor in its dividend income, and the fund is up 61.4% -- which is close to the S&P 500.

As you can see in the chart, investors would have produced an even larger return if they had just invested in the Nasdaq-100 without an income-oriented strategy. But the last three years have featured explosive gains for top growth stocks. If these stocks cool off or trade sideways for a while, the JP Morgan Nasdaq Equity Premium Income ETF will likely outperform the Nasdaq-100.

The ETF features a 0.35% expense ratio, which is much higher than a low-cost index fund or sector ETF. However, the fund offers a service that would be extremely difficult to replicate without an ETF, so the fees could be worthwhile if the fund aligns with your investment objectives.

The fund stands out as an excellent way to generate monthly passive income from growth stocks. However, it's worth understanding that the call premiums generated don't offer much downside protection, so the fund can feature similar volatility to the Nasdaq-100 during rapid and steep sell-offs.