Although it may not bring the same excitement as picking individual companies, one of the most efficient ways to invest is through exchange-traded funds (ETFs). They simplify investing by eliminating the need to research individual companies, and in many cases, they produce returns that are just as good, if not better.

If you're looking to add a few ETFs to your portfolio, the following three from Vanguard are good options. One covers a large part of the U.S. market, one is dividend-focused, and one gives you exposure to international companies. A $1,000 investment can cover a lot of ground with just three investments.

Image source: Getty Images.

1. Vanguard S&P 500 ETF

If I had to choose a single investment to lead my portfolio, it'd be the Vanguard S&P 500 ETF (VOO 0.08%). It's currently, and will likely always be, my largest holding. The reason is the trifecta: diversification, blue chip companies, and low cost.

With large tech companies surging in valuation, the S&P 500 (which this Vanguard ETF tracks) is admittedly less diversified than it has historically been; however, it still offers broad exposure to the U.S. market, containing market leaders from all 11 major sectors.

NYSEMKT: VOO

Key Data Points

These are some of the most influential companies in the world, and they have a significant impact on the U.S. economy, which is why many consider an investment in the S&P 500 akin to betting on the growth of the U.S. economy. Historically speaking, that has been a great bet, with the S&P 500 averaging around 10% annual returns over the long term.

Below are the five most represented sectors in the Vanguard S&P 500 ETF and a few notable companies in those sectors:

- Information technology (33.1% of the ETF): Apple, Microsoft, Nvidia

- Financials (13.9%): Berkshire Hathaway, JPMorgan Chase, Visa

- Consumer discretionary (10.4%): Amazon, Home Depot, Tesla

- Health care (9.3%): Eli Lilly, UnitedHealth Group, Johnson & Johnson

- Industrials (8.6%): UPS, Caterpillar, Honeywell

The icing on the cake is this Vanguard ETF's low 0.03% expense ratio. It's one of the lowest in the stock market and ensures you can keep more of your gains in your pocket.

NYSEMKT: VIG

Key Data Points

2. Vanguard Dividend Appreciation ETF

While the Vanguard S&P 500 ETF offers a dividend, the Vanguard Dividend Appreciation ETF (VIG +0.22%) is a more pure dividend ETF that can provide reliable above-average income for investors. As the name suggests, the Vanguard dividend ETF gives special consideration to companies that have consistently increased their annual dividend payments, which can reward long-term investors.

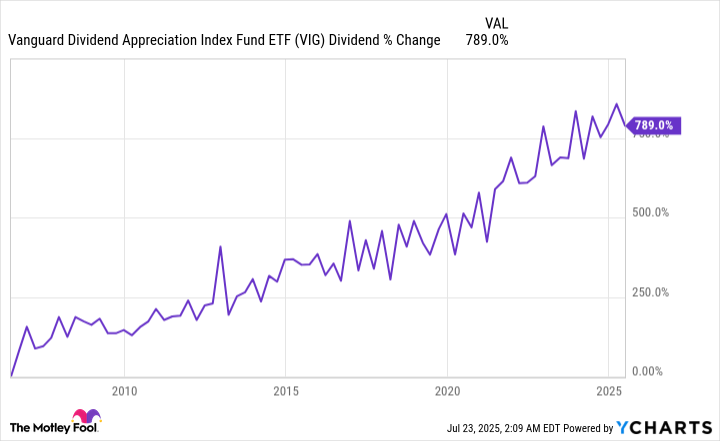

The Vanguard Dividend Appreciation ETF's actual dividend payout fluctuates because companies pay dividends at different times, but it has grown from around $0.098 in June 2006 to just over $0.871 in its latest July payment.

VIG Dividend data by YCharts

This Vanguard ETF is a good option because it provides income regardless of its stock price performance. Obviously, it's good to have both stock price appreciation and a solid dividend, but the former is never guaranteed, while the latter is. To further maximize this fund's benefits, consider reinvesting dividends to acquire more shares instead of receiving cash payouts.

The Vanguard Dividend Appreciation ETF's holdings are also in the Vanguard S&P 500 ETF, so be mindful of the overlap if you're investing in both to avoid overconcentration.

3. Vanguard Total International Stock ETF

A well-rounded stock portfolio should include companies from abroad, which is where the Vanguard Total International Stock ETF (VXUS +0.05%) comes into play. It's a broad ETF that contains companies from both developed and emerging markets.

The difference between investing in companies in developed markets versus emerging markets can be compared to investing in established companies versus younger growth stocks.

NASDAQ: VXUS

Key Data Points

Developed markets offer more stability, which typically means less risk; emerging markets offer more growth potential, which typically comes with more volatility. There are exceptions to this, but that's the general trade-off between the two. Below is how the Vanguard Total International Stock ETF is divided by regions:

- Europe: 39.8%

- Emerging markets: 26.7%

- Pacific: 25.3%

- North America: 7.6%

- Middle East: 0.6%

The Vanguard Total International Stock ETF is a good way to hedge against overconcentration in the U.S. market. It's very broad (over 8,500 stocks) and spans a diverse mix of economies, reducing reliance on any single country's performance.

I would still lean heavily on the U.S. economy and U.S. companies, but having around 10% of your portfolio in international stocks can add meaningful diversification.