Investing in dividend stocks can be a great way to generate passive income that can be used in retirement, to cover a portion of living expenses, or to reinvest in the stock market.

Regardless of the use case, some investors may be seeking to generate a specific amount of passive income, such as $1,000 per year.

Investing $10,000 into each of the following stocks -- Lockheed Martin (LMT 1.22%), International Paper Company (IP +3.37%), and Chevron (CVX +2.30%) -- should achieve that goal by producing around $1,100 in annual dividend income based on the forward dividend yields of these stocks. Here's why all three stocks stand out as top buys now.

Image source: Getty Images.

This defense giant has value and income written all over it

Daniel Foelber (Lockheed Martin): Lockheed Martin made a new 52-week low after reporting second-quarter 2025 results.

NYSE: LMT

Key Data Points

The defense contractor's earnings came in much lower than expected due to pre-tax losses on programs of $1.6 billion and other charges of $169 million.

In fourth-quarter 2024, Lockheed announced $1.72 billion in program losses from classified programs. Investors hate uncertainty, and the company's latest quarter marks the second major disappointment in less than a year. However, the stock appears to be a compelling buy for long-term investors.

Lockheed exited the latest quarter with a total backlog of $166.53 billion across its four segments -- which is a little over two full years' worth of revenue. The backlog provides a consistent revenue stream that can be used to manage cash flow and invest in future projects. However, some projects in the backlog are better than others. That is why Lockheed has been reviewing projects and addressing challenges to try to improve its processes or restructure programs when necessary.

The losses appear unfavorable on paper, but if they result in a higher-quality order book, they may be worth it in the long run.

The program losses are accounting changes that impact net income and earnings per share (EPS), but not cash flow. Lockheed lowered its full-year diluted EPS and operating profit guidance, but its revenue, capital expenditures, and free cash flow (FCF) guidance remain the same. This means that Lockheed's long-term investments and capital return programs aren't impacted.

The company plans to generate $6.7 billion in FCF at the midpoint of guidance, returning around $3 billion to shareholders through buybacks and $3.1 billion through dividends. So, despite the lower EPS figure, Lockheed is still supporting its entire capital return program with FCF.

Lockheed has a solid track record of growing its dividend, with 22 consecutive years of boosting its payout. At 3.1%, Lockheed has the highest dividend yield among the major defense contractors (RTX, Northrop Grumman, L3Harris Technologies, General Dynamics, and Honeywell International all yield under 2%).

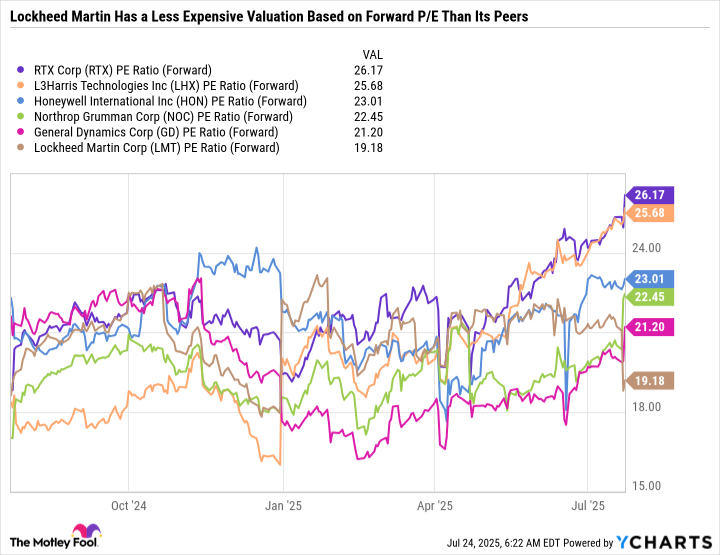

RTX PE Ratio (Forward) data by YCharts

It also has the lowest forward price-to-earnings ratio of the major defense contractors -- signaling the stock is a good value and could look like a bargain in hindsight if it can return to meaningful earnings growth.

All told, Lockheed is a good choice for investors who believe the company can regain its footing and become a good value in the long run. In the meantime, the stock's dividend yield is a worthwhile incentive to get paid to wait for the fundamentals to improve.

A solid stock for passive income-seeking investors

Lee Samaha (International Paper): Trading on a near 4% dividend yield, International Paper offers investors a relatively safe, if unexciting, way to generate income. That will suit investors who like investments in so-called "boring" stocks. The company generates slightly over half of its sales from the processed food & beverage (34%) and fresh food (20%) end markets, with a further 18% coming from the higher-growth e-commerce & logistics market and the rest from non-durables and durables.

Food and e-commerce are attractive markets to be in as they ensure revenue stability. Additionally, International Paper has an earnings growth opportunity through its acquisition of the U.K. packaging company DS Smith, which was completed in January of this year. Consolidating an already mature industry and generating cost and revenue synergies (to offset a lack of top-line growth) is usually a good strategy, and International Paper's management believes it will generate $600 million to $700 million in synergies by the fourth year of the deal.

Management also anticipates achieving a free cash flow (FCF) of $2 billion to $2.5 billion in 2027 and plans to distribute 40% to 50% of its FCF as dividends. Taking the midpoint of both figures implies $1.01 billion in cash dividends in 2027, a significant improvement from the $643 million paid in 2024.

While the current trading environment isn't ideal, International Paper is a solid company with some underlying earnings growth prospects and offers a sustainable dividend for investors seeking passive income.

Chevron projects strong cash flow growth despite lower energy prices.

Scott Levine (Chevron): In most cases, those seeking reliable dividend stocks are prioritizing reliability over yield. But to have both -- a company with a proven track record of consistently rewarding shareholders and an attractive yield? That's a winning combination. For these investors, therefore, oil supermajor Chevron should shine brightly on income investors' radars right now thanks to its almost four-decade history of annual dividend hikes and its 4.5% forward-yielding dividend.

Besides Chevron's history of increasing its payout and its high-yield dividend, the allure of Chevron stock lies in the company's operations throughout the entire energy value chain. This diversity in Chevron's operations helps to insulate it from the volatility associated with downturns in energy prices.

With the price of global oil benchmark Brent crude dropping about 16% over the past year, some energy companies have lowered their immediate growth expectations. Chevron, however, forecasts production and free cash flow to rise higher over the next couple of years, even if Brent averages $70 per barrel. Thanks to production growth in the Gulf of America and in the Permian, Chevron projects daily production will rise from 3.34 million barrels of oil equivalent in 2024 to 3.4 million to 3.47 million barrels of oil equivalent for 2025. If Brent crude remains at an average of $70 per barrel, Chevron sees production rising another 3% to 6% from 2025 to 2026.

Also, Chevron expects free cash flow to grow over the next couple of years due to increased activity in the Permian and TCO project in Kazakhstan. In total, the company projects an additional $9 billion in free cash flow by 2026 with Brent crude averaging $60 per barrel.

For income-focused investors, Chevron stock is a great option for fueling their passive income streams.