Shares of Advance Auto Parts (AAP +3.79%) slid 4% last week on news that the auto parts retailer is issuing $1.5 billion in senior unsecured notes to refinance its debt. In layman's terms, it's buying new money to pay off older debt.

Advance Auto Parts has been struggling mightily amid fierce competition from AutoZone and O'Reilly Auto Parts. With the stock down down 67% over the past three years -- and its turnaround efforts showing some positive signs -- is this a good opportunity to go bargain hunting?

Image source: Getty Images.

Q1 results topped expectations

Advance Auto Parts stock catapulted 57% higher on May 22, when the company reported better-than-expected first-quarter 2025 results. While Advance Auto Parts' Q1 net sales fell 7% to $2.6 billion, they exceeded the company's own guidance by roughly $80 million. Investors also cheered the company's adjusted diluted earnings per share (EPS), which came in at a loss of $0.22, topping the consensus estimate by $0.47.

CEO Shane O'Kelly gave investors more grist for the optimism mill when he said the company is on target to deliver positive operating margins by the second quarter. On July 24, Advance Auto Parts guided for Q2 adjusted operating income margin between 2.8% and 3%. The company will report its Q2 results on Aug. 14.

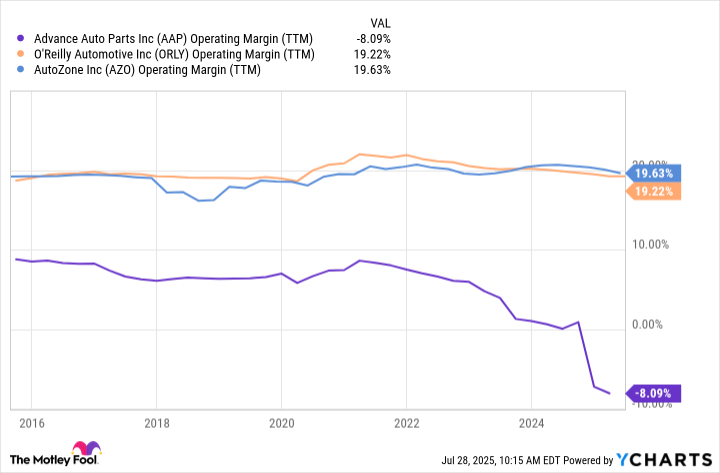

The chart below should help illustrate why a return to positive operating margins would be such a big deal for the company, and could lift the stock higher:

AAP Operating Margin (TTM) data by YCharts

Operating margin measures the percentage of revenue a company retains as operating profit. Hampered by operational and supply chain inefficiencies, Advance Auto Parts' margins have lagged industry heavyweights AutoZone and O'Reilly Auto Parts over the past decade. As the chart above shows, AutoZone and O'Reilly have maintained relatively steady operating margins, while Advance Auto Parts' margins have been trending in the wrong direction since 2021.

A key reason Advance Auto Parts has struggled in this area is its merchandising margin, or cost of goods sold. Simply put, the company isn't making as much profit per part as its competitors. To address this gap, Advance Auto Parts has been conducting line reviews with its parts suppliers to eliminate underperforming units, boost availability of high-demand items, and negotiate better pricing.

In May, O'Kelly said the company expects to cut its product costs by more than 0.5% annually, starting in the second half of 2025. If Advance Auto Parts can swing to positive operating margins this year, it would be a clear sign that at least once facet of the company's turnaround plan is working.

NYSE: AAP

Key Data Points

It's all about the parts

Making sure the right parts are in stock when customers call (or click) is where the rubber meets the road for auto parts retailers. It's an area where Advance Auto Parts has struggled in relation to its larger rivals.

Advance Auto Parts' turnaround plan focuses on improving parts availability and order-fulfillment speeds. A big component of the plan is creating a leaner and meaner distribution footprint. To that end, the company is consolidating its disparate network of 38 distribution centers, with the goal of having 12 large facilities -- averaging 500,000 square feet -- that are optimized for efficiency and unified under the same management software system.

Advance Auto Parts has shuttered more than 500 corporate stores and exited more than 200 Carquest locations, based on its previously announced plans. At the same time, the company is building out its network of "market hubs," which are larger stores that serve as mini distribution centers. With three times the number of SKUs (stock-keeping units) as a regular store, market hubs expand same-day parts delivery to as many as 90 stores in their area. Advance Auto Parts aims to have 60 market hubs by the middle of 2027.

On the Q1 earnings call, O'Kelly estimated that the company had seen a 1% uptick in comparable-store sales in areas where market hubs are already up and running. While those are early results, it bodes well for Advance Auto Parts' "multi-echelon supply network," as O'Kelly called it. In May, O'Kelly said the company has trimmed roughly 10 minutes off its average delivery time compared to last year.

Is this a good time to buy Advance Auto Parts stock?

Prior to last week's pullback, Advance Auto Parts stock had been rolling. From the closing bell on May 21 -- the day before its first-quarter results were published -- through July 21, the share price had doubled. If you're thinking about starting a position now, it's natural to wonder if you're late to the party.

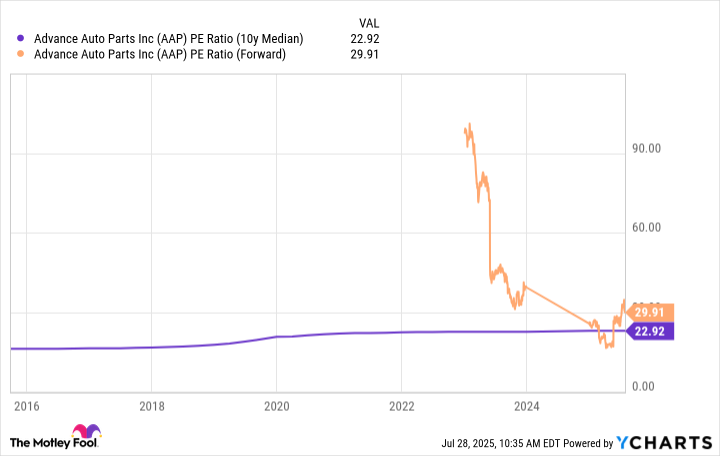

Based on its forward price-to-earnings (P/E) ratio of 30, which is based on earnings estimates, Advance Auto Parts stock is trading at a premium to its median P/E multiple over the past decade.

AAP PE Ratio (10y Median) data by YCharts

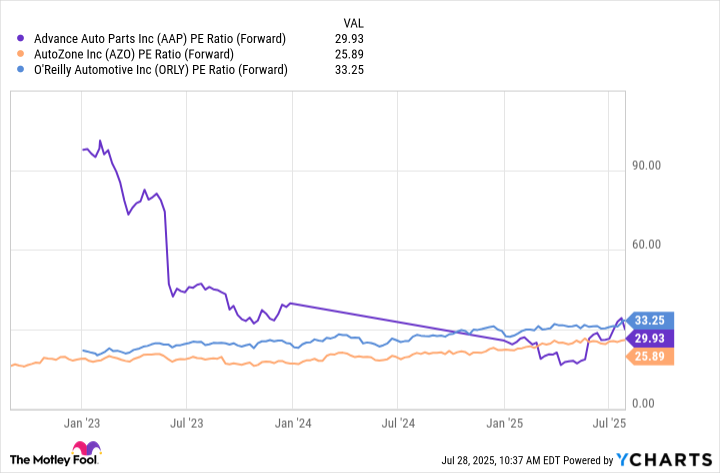

However, its forward P/E multiple is roughly at the midpoint of rivals AutoZone and O'Reilly.

AAP PE Ratio (Forward) data by YCharts

When Advance Auto Parts reports its second-quarter results on Aug. 14, investors will want to see more signs of progress on the restructuring plan. If it can continue to shore up its bottom line -- and provide more details on its plan to capture market share from competitors -- I think this turnaround story could have some legs. Investors looking to buy should wait until after the report so they have more information on which to base a decision.