There are about 55 companies that qualify as Dividend Kings -- meaning they have boosted their payouts for at least 50 consecutive years. The list will likely grow as existing Dividend Kings retain their status and new companies gain the distinction.

Here's why Sherwin-Williams (SHW +0.92%), Pentair (PNR 10.30%), and McDonald's (MCD +0.40%) are all on track to become Dividend Kings within the next five years and are worth buying now.

Image source: Getty Images.

Sherwin-Williams has excelled at growing shareholder value -- and should continue to do so in the future

Scott Levine (Sherwin-Williams): Professional painters and DIYers will certainly recognize the name Sherwin-Williams, but income investors will likely know the name for its extended commitment to rewarding shareholders. Over the past 46 years, Sherwin-Williams, whose stock currently offers a forward yield of 0.93, has provided investors with increasing dividend payouts. If the streak continues for another four years, the company will be coronated as a Dividend King.

NYSE: SHW

Key Data Points

With origins going back to 1866, Sherwin-Williams has a long history that extends beyond its time as a dividend superstar. From its simple beginning until today, Sherwin-Williams has evolved into an industry stalwart, specializing in paints and coatings for automotive and marine applications, industrial wood coatings, and a variety of others. In addition to more than 5,400 stores and branches, Sherwin-Williams operates over 140 manufacturing and distribution facilities.

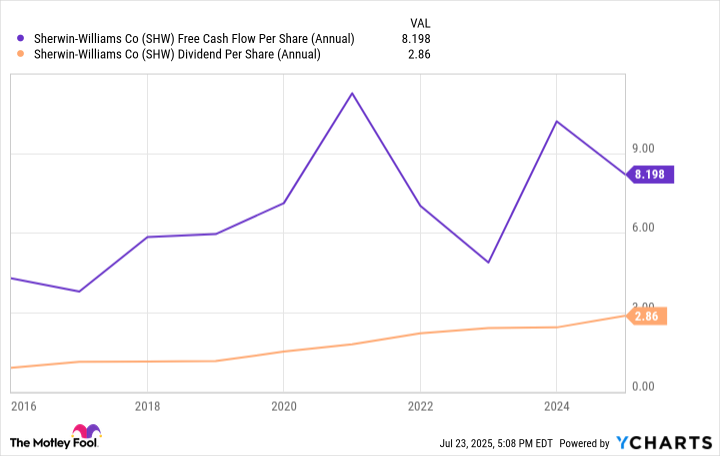

Although the stock's 0.93% forward yield is modest, the allure of Sherwin-Williams stock as a passive income play is in the sustainability of its payout. Over the past decade, Sherwin-Williams has maintained an extremely conservative 26.6% payout ratio. Plus, the company generates ample free cash flow to cover the distributions.

SHW Free Cash Flow Per Share (Annual) data by YCharts.

While some companies boast of impressive streaks of dividend raises -- all the while notching nominal boosts to their payout -- Sherwin-Williams has done the opposite. From 2014 through 2024, the company has raised its dividend at a 14.6% compound annual growth rate.

For conservative investors looking for rock-solid income investments, Sherwin-Williams demands consideration. The stock is sensitive to activity in the housing market and industrial demand. However, investors who are comfortable riding out the temporary volatility will benefit over the long term.

Solid end markets and ongoing margin expansion make Pentair an attractive stock to buy

Lee Samaha (Pentair): This water products company has increased its dividend for 49 consecutive years, and is therefore on the cusp of becoming a Dividend King. As always with Dividend Kings, it's not just the dividend itself or the yield that's important; it's the reason why the company has been able to raise its dividend for so many consecutive years.

In Pentair's case, it's the solidity of its end markets, which include fluid treatment and pump products and systems (Flow segment), commercial and residential water treatment solutions (Water Solutions), and energy-efficient pool solutions (Pool).

NYSE: PNR

Key Data Points

There are two reasons to buy the stock. First, its end markets, as outlined above, depend on the need to maintain and improve water infrastructure, the growth of commercial and residential developments, as well as urbanization, and ongoing demand for pool products from an ever-growing installed base of pools in the U.S.

The second reason stems from management's transformational initiatives, which continue to drive profit margins higher through more targeted pricing, reduced sourcing complexity, the implementation of lean manufacturing techniques, and a focus on developing and selling key products to key customers that account for the majority of its business, using the 80/20 rule.

These initiatives have driven operating margin from 18.6% in 2022 to an estimated 25% in 2025 and then 26% in 2026, helping Pentair stock rise 45% since the start of 2022.

McDonald's business model supports a growing dividend

Daniel Foelber (McDonald's): In September 2024, McDonald's raised its dividend to $1.77 per share per quarter, marking its 48th consecutive year of boosting the payout. That puts McDonald's on track to reach 50 years of dividend increases by next year.

McDonald's has the ideal business model for consistently returning cash to shareholders through dividends. Franchisees own and operate 95% of McDonald's restaurants -- paying McDonald's fees like rent and royalties. McDonald's offers franchises different options, depending on how much skin they want in the game.

Half of McDonald's stores operate using a conventional license where McDonald's pays for the building and real estate, the franchisee pays for the equipment, and the franchisee collects operating profit from the store and pays McDonald's rent and royalties.

NYSE: MCD

Key Data Points

Another option is a developmental license (20% of McDonald's restaurants), where the franchisee pays for the building, real estate, and equipment, thereby avoiding rent payments to McDonald's and pocketing a higher percentage of cash flow (although still paying McDonald's royalties).

For foreign-affiliated franchisees (which are 25% of McDonald's restaurants), franchisees pay for equipment, the building, and real estate, and McDonald's receives royalties and equity-based earnings depending on its ownership stake.

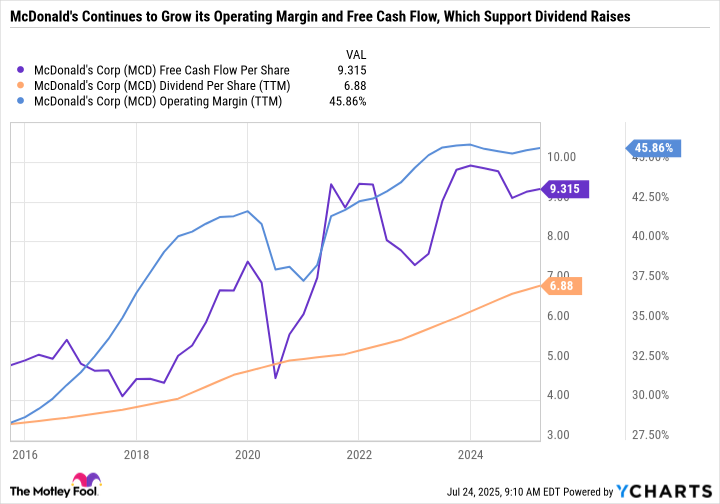

These fees give McDonald's steady free cash flow (FCF), making its results fairly predictable and its capital return program forecast highly accurate. McDonald's also has a very high operating margin because the franchise model is capital-light. That means McDonald's doesn't have to spend a lot of money to make money, and converts a high amount of sales to operating income.

MCD Free Cash Flow Per Share data by YCharts.

As you can see in the chart, McDonald's can afford to boost its dividend because of its high-margin FCF growth.

Add it all up, and McDonald's stands out as an ultra-high-quality dividend stock that can serve as a foundational holding in a passive income portfolio.