Nvidia (NVDA +0.04%) recently became the first company in the entire world to cross $4 trillion in market capitalization. Most of that value was created on the back of booming sales of its graphics processing units (GPUs) for the data center, which are the best chips on the market for developing artificial intelligence (AI).

The latest crop of AI models are capable of "reasoning," which means they spend time thinking before rendering responses. They require a lot more computing capacity than traditional large language models (LLMs), which is why Nvidia CEO Jensen Huang believes data center spending will top $1 trillion per year by 2028.

The world's largest data center operators will have to continue increasing their spending significantly for Huang's prediction to come true. Fortunately, a recent update from Alphabet (GOOG +1.09%)(GOOGL +1.04%) CEO Sundar Pichai suggests things are moving in the right direction.

Image source: Nvidia.

Nvidia is on track for a record year of GPU sales

Last year, Nvidia launched a new lineup of GPUs based on its Blackwell architecture, which provided up to 30 times more performance in certain configurations compared to GPUs built on the older Hopper architecture. Nvidia then revealed another lineup of GPUs based on the improved Blackwell Ultra architecture this year, which offer 50 times more performance than Hopper GPUs.

Both Blackwell architectures were specifically designed to handle the increased workloads demanded by reasoning models like OpenAI's GPT-o series, Anthropic's Claude Sonnet 4, Meta Platforms' Llama 4, and Alphabet's Gemini 2.5. But these latest GPUs still might not be enough, because Huang says some reasoning models require up to 1,000 times more computing capacity than traditional LLMs.

Nevertheless, Blackwell chips are still the best money can buy, and demand is significantly exceeding supply. According to Wall Street's consensus estimate (provided by Yahoo! Finance), Nvidia could generate a record $200 billion in revenue during its current fiscal year 2026 (which ends on Jan. 31, 2026), which would represent a whopping 53% increase from its fiscal 2025 result. If recent history is any guide, the data center segment is likely to make up around 90% of that total.

NASDAQ: NVDA

Key Data Points

Sundar Pichai's recent update should be music to Nvidia investors' ears

On July 23, Alphabet reported its operating results for the second quarter of 2025 (ended June 30). Its Google Cloud segment delivered revenue growth of 32% compared to the year-ago period, which was an acceleration from the 28% growth it generated in the first quarter, and AI was the primary catalyst.

Google Cloud operates state-of-the-art data centers that are fitted with thousands of chips from suppliers like Nvidia, and it rents the computing capacity to developers who use it to create AI software. In fact, Alphabet says almost every AI unicorn (start-ups worth $1 billion or more) is using Google Cloud's infrastructure.

Moreover, Alphabet says over 85,000 enterprises are now building their AI software on top of its flagship Gemini models, which are accessible through Google Cloud. The company said Gemini usage exploded by 35 times during the second quarter (relative to the year-ago period), which is a precursor for data center demand. In other words, businesses that use advanced Gemini models need significant amounts of computing capacity to serve their AI software to customers, which is great news for Google Cloud.

Alphabet CFO Anat Ashkenazi actually told investors that Google Cloud's order backlog for data center capacity surged by 38% during the second quarter, to an eye-popping $106 billion. Alphabet will have to build more infrastructure to fill that demand, which is a big tailwind for chip suppliers like Nvidia.

In fact, Alphabet CEO Sundar Pichai just increased the company's capital expenditures (capex) forecast for 2025 to $85 billion, from $75 billion previously.

NASDAQ: GOOGL

Key Data Points

Nvidia stock is soaring, but more upside might be on the way

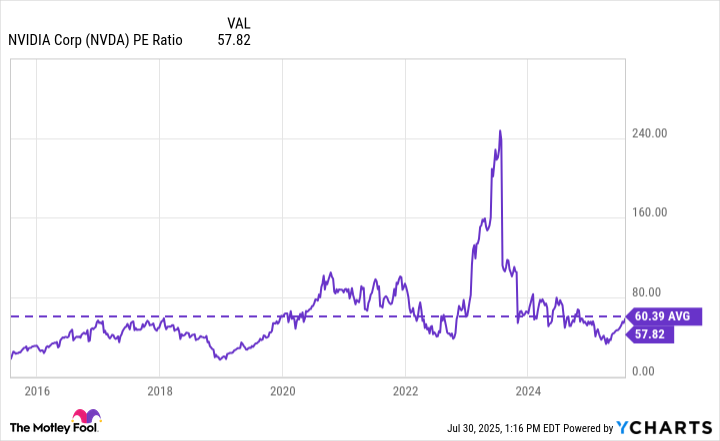

Nvidia stock has soared by an eye-popping 1,100% since the start of 2023, which is when the AI revolution really started gathering steam. But the stock is trading at a price-to-earnings (P/E) ratio of 57.7, which is actually a small discount to its 10-year average of 60.4, so it might still be undervalued despite those blistering gains:

NVDA PE Ratio data by YCharts

Nvidia's business could grow even faster than Wall Street expects this year if the company's other top customers follow Alphabet's lead and raise their capex forecasts, which could fuel additional upside in its stock in the short term.

However, investors who focus on the longer term might reap the greatest rewards, especially if annual data center spending tops $1 trillion by 2028 as Huang predicts. Nvidia could capture the lion's share of that spending because it's the market leader, meaning its annual revenue and earnings might be orders of magnitude higher a few years from now. If that's the case, Nvidia stock could be a bargain at the current price.