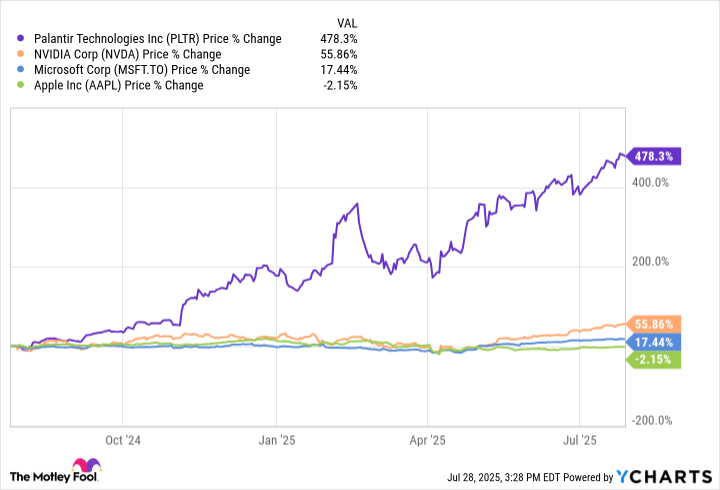

There are probably few investors out there who are more satisfied than those who bought Palantir Technologies (PLTR 0.17%) stock early in its run. The artificial intelligence (AI) company is blowing other stocks out of the water these days, with its stock up 478% in the last year and more than doubling in 2025. Palantir is now one of the world's top 25 most valuable companies, ahead of such blue chip names as Procter & Gamble and Bank of America.

Palantir's run is fueled by the adaptation of its Artificial Intelligence Platform (AIP) by government and commercial clients, fueling dramatic growth in both revenue and earnings. And with Palantir set to report second-quarter earnings on Aug. 4, there are plenty of reasons to believe that this run is far from over.

NASDAQ: PLTR

Key Data Points

How Palantir is making money

Palantir already had two AI-powered platforms. Its Gotham platform is prized by governments and defense agencies to gather information from multiple sources, identify targets, and make real-time assessments to provide insights about battlefield situations. Palantir is recognized for helping the U.S. military track down 9/11 mastermind Osama bin Laden in 2011. Then you have the Foundry platform used by Palantir's commercial clients. Foundry helps clients manage supply chains and inventory, automate workflows, and optimize operations.

The AIP platform made both of these powerful tools better and easier to use because AIP allows users to make detailed queries, and then it generates responses using generative AI. And the results are evident in the massive gains the company is seeing: Since rolling out AIP in April 2023, Palantir's revenues have gone through the roof.

| Year | Revenue | Profit (Loss) | Earnings per Share |

|---|---|---|---|

| 2021 | $1.54 billion | ($520.3 million) | ($0.27) |

| 2022 | $1.90 billion | ($161.2 million) | ($0.18) |

| 2023 | $2.22 billion | $217.3 million | $0.10 |

| 2024 | $2.86 billion | $467.9 million | $0.21 |

| 2025 (projected) | $3.90 billion |

Image source: Palantir Technologies.

In the first quarter of 2025, the company reported revenue of $884 million, up 39% from a year ago. U.S. commercial revenue jumped 71% from a year ago to $255 million, and U.S. government revenue was up 45% from a year ago to $373 million.

The stock is by far outperforming the biggest companies on the planet, as well as the S&P 500 and the Nasdaq Composite.

What can we expect from Palantir next?

The second quarter is expected to be another blowout quarter. The company is continuing to reel in work, including contracts with the Navy to improve ship production and fleet readiness and a partnership with Accenture (ACN 0.15%) to develop AI solutions for federal agencies. On the commercial side, Palantir signed a deal with The Nuclear Company to develop and modernize nuclear power plants, as well as an agreement with The Joint Commission to use AI to manage accreditation and certification standards at hospitals and healthcare organizations.

Palantir issued guidance for second-quarter revenue of $934 million to $938 million -- the midpoint of that would be a 38% increase from Q2 2024. Its full-year guidance is now in a range from $3.89 billion to $3.902 billion.

Image source: Getty Images.

The main argument for investing in Palantir today, of course, is the valuation. With a trailing price-to-earnings ratio (P/E) of 682 and a forward P/E of 269, Palantir is ungodly expensive. But that's not a deal-breaker for me. I keep remembering that Amazon had a P/E of more than 1,000 back in 2013 before people realized how important cloud computing and its Amazon Web Services platform would be.

I think Palantir is like Amazon -- people are just starting to appreciate that Palantir is a transformative company that is changing the world and how businesses and governments operate. And when it reports earnings on Aug. 4, I think you're going to continue to see the stock soar.

How to invest in Palantir

I would never recommend that someone overinvest in a stock or put their entire nest egg into Palantir. But I do think it's a company that should be part of a portfolio. If you are worried about the inherent volatility that comes with a stock that's growing as quickly as Palantir (and has such a crazy valuation), I recommend using a dollar-cost averaging strategy to establish your position over time. Just be sure never to be overextended on any one stock -- even one as compelling as Palantir.