Dividend stocks are powerful investments. They've outperformed nonpayers by more than two to one over the past 50 years. The strongest results come from companies that steadily increase their dividend payments. They've delivered a 10.2% average annualized return, according to Ned Davis Research and Hartford Funds.

One of the easiest ways to capitalize on this powerful total return potential is to invest in an exchange-traded fund (ETF) that focuses on dividend-paying stocks, such as the Schwab U.S. Dividend Equity ETF (SCHD 0.07%). Here's why I can't wait to buy more shares of this top dividend ETF this August.

Image source: Getty Images.

High-quality, high-yielding dividend stocks

The Schwab U.S. Dividend Equity ETF employs a straightforward strategy to invest in dividend-paying stocks. Its goal is to closely track the Dow Jones U.S. Dividend 100 Index. That index aims to measure the performance of 100 top high-quality, high-yielding U.S. dividend stocks. It tracks companies that have consistent records of growing their dividends and strong financial profiles.

The index screens for companies based on four dividend quality factors:

- Cash flow to total debt

- Return on equity

- Indicated dividend yield

- Five-year dividend growth rate

NYSEMKT: SCHD

Key Data Points

These characteristics allow these companies to pay stable, rising dividends. At its annual reconstitution last March, the index's 100 holdings had an average dividend yield of 3.8%, and had increased their payouts at an average annual rate of 8.4% over the past five years. This blend of yield and growth positions the Schwab U.S. Dividend Equity ETF to deliver attractive total returns in the future.

Cream of the dividend crop

The Schwab U.S. Dividend Equity ETF is a who's who list of top-tier dividend stocks. Chevron (CVX 0.27%) currently clocks in as its top holding at 4.4% of its net assets. The oil giant has a 4.5% dividend yield, several times higher than the S&P 500's (^GSPC 0.03%) 1.2% yield, and has increased its dividend for 38 consecutive years (and by a peer-leading pace over the past decade). That spans multiple commodity price cycles, demonstrating the durability of its dividend.

The oil company backs its high-yielding payout with the lowest production costs in the sector and one of its strongest balance sheets. Meanwhile, it has plenty of fuel to grow its dividend after closing its needle-moving Hess acquisition, which enhances and extends its growth outlook into the 2030s.

NASDAQ: PEP

Key Data Points

PepsiCo (PEP +0.03%) is another top holding, at 4.2% of the fund's assets. The beverage and snacking giant currently has a 4% dividend yield. It raised its payment by 5% earlier this year, extending its growth streak to 53 years in a row. That keeps it in the elite group of Dividend Kings. The growing demand for its iconic brands, combined with acquisitions such as its recent deal for healthier soda brand Poppi, should support continued dividend growth.

Strong returns

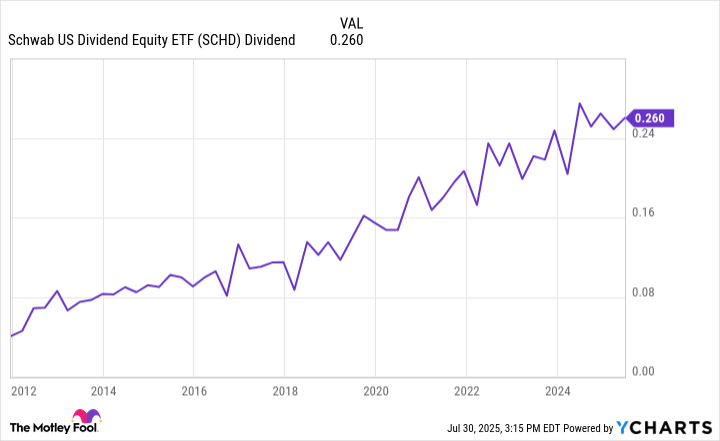

SCHD's portfolio of high-quality, high-yielding dividend stocks has delivered strong returns for investors. The fund has paid a steadily rising dividend as the companies it holds increase their payouts:

SCHD Dividend data by YCharts

The fund's high-yielding and steadily rising payout has really added to its returns over the years. The Schwab U.S. Dividend Equity ETF has delivered double-digit annualized total returns over the past five- and 10-year periods, producing an 11.5% annualized total return since its inception in late 2011.

The ETF currently offers investors a dividend yield of around 3.8% -- more than three times higher than the S&P 500. This should provide a strong and growing base return as its holdings increase their dividend payments. Meanwhile, growing earnings from the fund's companies should support continued growth in the fund's value.

A top-tier dividend ETF

The Schwab U.S. Dividend Equity ETF holds 100 of the best dividend-paying stocks in the country. These companies pay high-yielding and steadily rising dividends supported by high-quality financial profiles. These features put the fund in a strong position to continue delivering robust returns for investors. That's why I can't wait to buy more shares this month.