Lyft (LYFT +2.58%) is a ride-hailing platform that has had a complete margin makeover in recent years. And it feels like nobody even noticed.

CEO David Risher took over in April 2023, vowing to prioritize better cash flow. For perspective, the company had a net loss of $1.6 billion in 2022 and more than $350 million in negative free cash flow. Those numbers looked terrible.

However, Lyft has generated more than $900 million in free cash flow (FCF) over the last 12 months, showing a complete transformation in Risher's still-short tenure as CEO. Here's why this could be a big deal for shareholders.

Image source: Getty Images.

Is there an important history lesson?

Ride-hailing platforms and third-party delivery apps had dubious financial prospects in the past. Top players including Uber Technologies (UBER +1.00%), DoorDash (DASH +1.77%), and Lyft were all burning through substantial cash. But with better scale, better fiscal discipline, and by charging higher prices, many of the major players are now generating positive FCF.

NASDAQ: LYFT

Key Data Points

For example, Uber had negative FCF surpassing $700 million in 2021 before flipping the script in 2022 with positive FCF of $390 million. Investors immediately took notice. Consider that from its initial public offering (IPO) in 2019 through the end of 2021, returns were completely flat. But since the beginning of 2022, Uber stock has more than doubled in value. Investors evidently responded to the improved business economics.

For another example, DoorDash was generating FCF, but cash flow plunged by 95% in 2022 compared to 2021. Moreover, much of its FCF was enabled by liberal use of stock-based compensation -- a noncash charge that boosts cash flow but dilutes shareholders. Investors were consequently less enthused with DoorDash's cash flow in 2021 and were concerned as it plunged in 2022.

From its 2020 IPO through the end of 2022, DoorDash stock dropped by 74%. But it, too, flipped the script in 2023 with FCF of nearly $400 million. Since the start of 2023, DoorDash stock is up more than 400%.

Uber and DoorDash are two examples of stocks performing very well now that the business economics have improved. Could investors ride the same kind of upside with Lyft stock?

When will investors notice Lyft?

For its part, Lyft turned the corner with profitability in 2024. But since the start of 2024, the stock is down 5%, as of this writing. Whereas Uber stock and DoorDash stock started seeing immediate enthusiasm from investors, Lyft stock is still getting yawns on Wall Street.

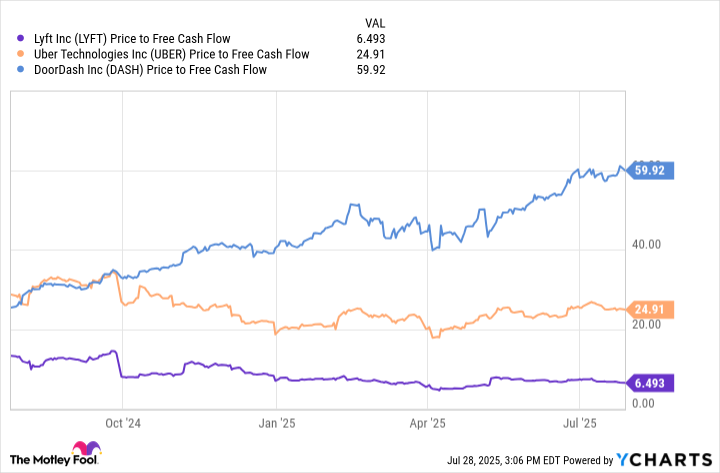

To underscore how little attention it's getting, consider that the stock trades at just 6.5 times its FCF. Generally speaking, even a mundane valuation would be closer to 15 or 20. Not to mention, Lyft is dirt cheap when compared to Uber and DoorDash, as the chart below shows.

LYFT Price to Free Cash Flow; data by YCharts.

Smart investors know that Lyft's long-term prospects are more important than the cash it has generated up until now and the valuation that the stock trades at. And I acknowledge that some investors doubt Lyft's future.

But from my perspective, the doubts are overblown. More people are taking rides on the platform than ever before, and the company has partnerships to prepare for potential changes in the space.

I believe that the business is solid and will continue to grow at a strong pace, which is why its cash flow and valuation are so attractive to me.

If Lyft continues to succeed with profitability, investors will eventually take notice, as they did with Uber and DoorDash. In my opinion, it's only a matter of when.

As a shareholder, I'm counterintuitively content -- not thrilled, but content -- with the stock's current underperformance. Management intends to buy back $500 million in shares before early 2026. With a current market cap of $6 billion, that's 8% of all shares in a single year. And at the current valuation, it's getting a great price.

Therefore, if Lyft stock keeps lagging, management should be able to boost long-term shareholder value by putting its excess cash to work.

In conclusion, the ride-hailing company is not the early version of itself -- it's had a complete margin makeover since 2023 and is now significantly profitable. Investors seem disinterested, letting shares sit in bargain territory. But eventually, I believe, they'll take notice, sending Lyft stock to market-beating gains.