Warren Buffett's never been a big fan of technology stocks. He says they're too difficult to understand and often vulnerable to change. He'd rather own more predictable picks, which means he prefers investing in already-profitable companies with simple business models. This preference disqualifies many artificial intelligence (AI) stocks from becoming a Berkshire Hathaway holding.

Not every technology stock, however, is the clichéd dot-com type of investment that Buffett has sought to avoid. A handful of AI stocks are arguably justifiable additions to Berkshire's portfolio based on their predictability, profitability, and of course, their potential upside.

Here's a closer look at three such AI prospects that Buffett might actually approve of if given a closer look. They may be a good way of adding some AI exposure to your portfolio as well.

Image source: Motley Fool.

Arm Holdings

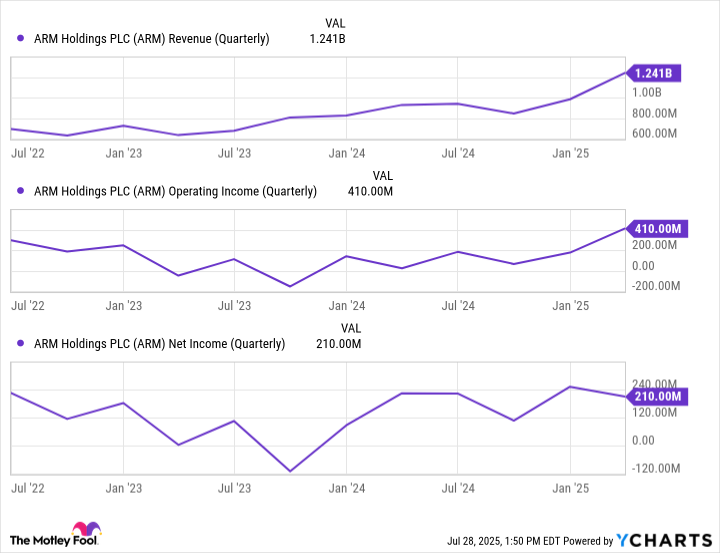

OK, Arm Holdings' (ARM 2.16%) revenue and earnings may not be perfectly predictable from one quarter to the next. The company's top and bottom lines do reliably grow though, and it is reliably (and increasingly) profitable.

ARM Revenue (Quarterly) data by YCharts.

But what is it? This company is frequently categorized as a semiconductor stock, which isn't an inaccurate description. It's not a manufacturer in the same vein as Intel (INTC +0.90%) or Qualcomm, though. Rather, Arm only designs microchip architecture and then licenses this intellectual property to chipmakers that often outsource the production of these chips to a third-party manufacturer. For instance, Apple's (AAPL 0.13%) latest iPhone processors are based on Arm's chip architecture, but this particular silicon is actually made (per Apple and Arm's specs) by a company called Taiwan Semiconductor Manufacturing (TSM 1.68%), also known as TSMC.

Arm only collects a relatively small amount of revenue for every iPhone sold with its tech built into it. But since Arm incurs no production or distribution costs, this is high-margin revenue. Last fiscal year Arm Holdings turned $4 billion worth of sales into nearly $800 million worth of net income.

Given the technological prowess of outfits like Intel, Apple, and Qualcomm, it seems strange that they should rely on -- and pay -- a company like Arm for something as relatively common as chip design. But it actually makes a lot of sense for a couple of reasons.

First, all of Arm's know-how is patented, so using it would be illegal even if it is a logical and intuitive solution. And second, Arm's solutions are actually superior, particularly when it comes to power efficiency. Its cloud-computing data center processors require up to 60% less electricity than comparable processors from rivals, for example, answering one of data center operators' biggest frustrations.

That's why Arm believes it could control as much as half of the data center processor market by the end of this year, up from only about 15% as of 2024.

Taiwan Semiconductor

Taiwan Semiconductor Manufacturing doesn't just make Apple's newest Arm-based iPhone processors. It manufactures high-performance chips for most of the major semiconductor names including Nvidia, Qualcomm, Advanced Micro Devices, and Broadcom -- just to name a few. Indeed, analysts' estimates put TSMC's market share of global production of high-performance processors anywhere from 80% to as high as 90%.

What gives? As it turns out, manufacturing computer processors is complicated and expensive. It's often easier and cheaper to punt this work to an organization with the experience, expertise, and capacity to make these chips than it is to try and do it yourself. Over the course of the past couple of decades, TSMC has emerged as the industry's premier contract manufacturer

This satisfies a couple of Buffett's most important rules for buying stocks. As he advises, look for proven, high-quality companies with a wide competitive moat. TSMC offers both.

A handful of chipmakers are attempting to wean themselves from reliance on silicon made in the Pacific region particularly by TSMC. Back in 2022, for instance, Intel committed billions of dollars to establishing its own chipmaking foundries in Europe and the U.S.

The fact that much of this work has been delayed due to complications and recently scaled back, however, underscores the difficulty of getting into or expanding the chipmaking business when players like TSMC are already so well established and so far ahead, technology-wise. Apple's strategy is more aligned with reality. It's partnering with TSMC to establish a manufacturing presence within the U.S. that it can enjoy some control of and that won't simultaneously require it to fend off competition while these factories are being built.

More important to Buffett-minded investors, while the business may ebb and flow from time to time, the world's never not going to need new and better computer chips.

DigitalOcean

Finally, add DigitalOcean (DOCN 2.49%) to your list of undervalued and profitable AI stocks that Warren Buffett could appreciate.

It's probably the least-known name of the three AI prospects in focus. In fact, there's a good chance you've never even heard of it. Its market cap of less than $3 billion just doesn't turn many heads, and it's seemingly not nearly as critical to the AI industry as Arm or TSMC.

Don't be dissuaded by its relatively small size or lack of recognition. It's arguably the most Buffett-like of all three AI stocks highlighted here.

NYSE: DOCN

Key Data Points

DigitalOcean provides a range of cloud-based services to clients that simply want to outsource their data center needs. These include blockchain solutions, simple web hosting, video streaming technologies, online video games platforms, and yes, a whole bunch of AI solutions like AI training, virtual customer service agents, and automated coding. Although DigitalOcean doesn't strictly serve the AI industry, AI is an increasingly bigger profit center.

But that's not what makes this outfit such a Buffett-esque pick. Rather, Warren Buffett would very likely fall in love with this stock due to the nature of its business model and the fact that it's reliably profitable. DigitalOcean's clients pay for access to its technological solutions on a predictable, monthly basis. As of Q1 of this year, its annualized recurring revenue run rate stands at $843 million (up 14% from the year-earlier comparison) versus 2024's total top line of $781 million, of which $84 million was turned into net income.

As long as the world needs the cloud -- and needs cloud-based AI solutions in particular -- this company's revenue and earnings are apt to grow in step with both industries.