Opendoor Technologies (OPEN 4.30%) operates an interesting housing-related business. There are reasons to like the stock if you are an aggressive investor. But there are also some very big reasons to be cautious. Before you buy Opendoor Technologies thinking it will make you a millionaire, you'll want to dig a bit deeper into the company's story.

What does Opendoor Technologies do?

From a simple perspective, Opendoor is a house flipper. It steps in to quickly buy homes in whatever condition they are in, easing the process for home sellers. Then Opendoor fixes up the houses it buys and sells them, hopefully at a higher price than what it paid. It uses a proprietary computer algorithm to help it select which houses to buy, and where, in 50 or so markets.

Image source: Getty Images.

House flipping is not new. It has been done by small investors for years, often with the investors having the skills to fix up the homes they buy.

Opendoor is basically trying to take this business and scale it up. Given the unique nature of every home, that's a large and complex task. The company has achieved a great deal of success from an operational perspective, building out a platform for buying and selling homes and a network of professionals to manage and upgrade the homes it buys.

What it has not achieved yet are sustainable profits. There are some inherent headwinds to that, given that property markets tend to be seasonal. Homebuying tends to take place most often in the spring and summer, which leaves the fall and winter with less transaction volume.

Even if Opendoor manages to become profitable, investors need to be prepared for big profit swings throughout the year. And that means that a lot will ride on the success of the selling season every single year.

What about the stock's massive price spike

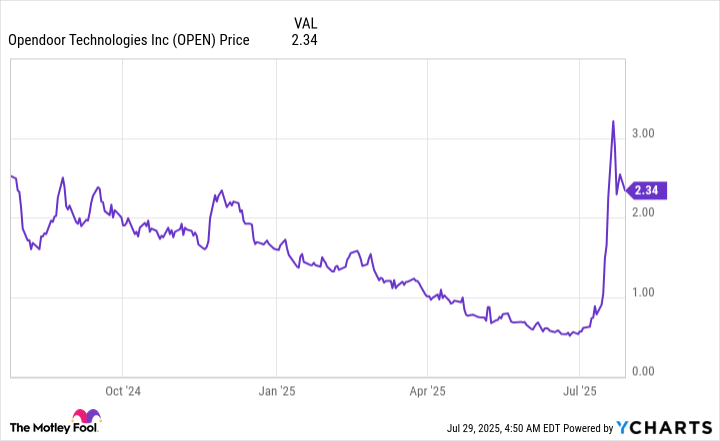

So the huge price spike that just occurred in Opendoor's stock must indicate something positive about the business, right? Not really.

It seems like there has been a return of the meme stock hysteria that occurred a few years ago. In fact, the company had recently received a warning that its stock might be de-listed because it had fallen to such a low price level.

Management had even gone so far as to schedule a special meeting to seek shareholder approval for a reverse stock split. That changes nothing about the business, but it raises the price of the shares because it reduces the number of shares outstanding. Often, however, a company's stock price will keep falling after a reverse split because the business remains the same. And in Opendoor's situation, the business is still unprofitable.

NASDAQ: OPEN

Key Data Points

The company has put the reverse stock split on pause for now, given the steep price advance. But investors looking at this situation need to tread with particular caution.

Right now it looks more like investors are gambling with Opendoor stock than investing in the business. The stock could absolutely go higher from here, but it could also fall dramatically and quickly if meme stock investors move on to a new investment.

At the end of the day, it remains an upstart business in a seasonal industry trying, and so far struggling, to become sustainably profitable. That's not a compelling story for a long-term investor.

Opendoor is probably not your ticket to millionaire status

There are likely to be people who make a lot of money gambling on Opendoor's stock. That's not the same thing as investing, however. And the risk of playing the meme stock game is that you end up being the last one in the door, which means you probably lose money.

For investors who want to buy and hold stocks to build wealth over time, Opendoor is best avoided right now. In fact, until the business manages to become sustainably profitable, it probably only deserves to be on your watch list.