Dividend Champions are an elite group of stocks that have increased their dividend payments for more than 25 consecutive years.

Blue chip dividend growth stocks with these lengthy track records are typically some of the best compounders on the market. This compounding ability may not be surprising, given that dividend growth stocks in the S&P 500 index have delivered annualized total returns 2.6 percentage points higher than the index as a whole since 1973.

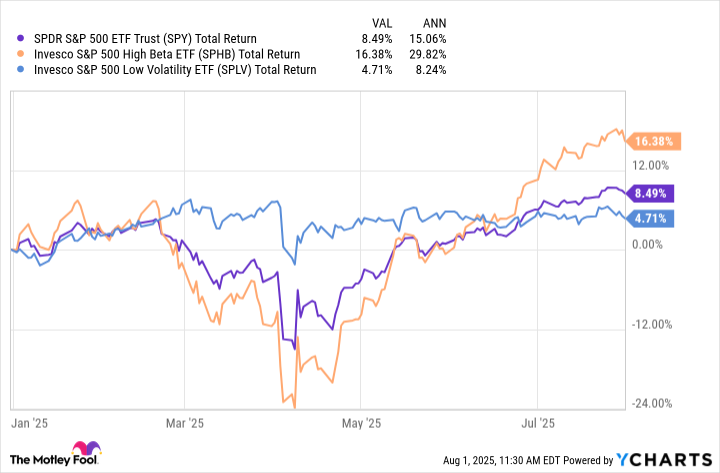

However, so far in 2025, these steady-Eddie, low-volatility compounders haven't been favored by the market. Many investors have shifted their attention to high-beta (more volatile) growth stocks as they look to profit from a market setting new all-time highs.

SPY, SPHB, and SPLV Total Return Level data by YCharts

Despite this apparent shift in investing attitude, one iconic American brand (and Dividend Champion) has managed to buck this trend and beat the S&P 500 so far this year.

Coca-Cola: Up 11% in 2025

The Coca-Cola Company (KO +0.34%) is home to 30 billion-dollar brands, including its namesake brands as well as Sprite, Fanta, Vitaminwater, Minute Maid, Smartwater, and more.

Of these 30 brands, Coke created 15 of the brands organically, while it acquired the other 15, showing the company's roots as both an innovator and a shrewd mergers and acquisitions (M&A) behemoth.

Image source: Coca-Cola.

Interestingly, from these 15 acquired brands, 12 of them became billion-dollar brands after Coke purchased them. While it is great that the company can lean on M&A to grow, this track record of successfully integrating and growing these brands post-acquisition is far more promising.

While Coca-Cola is best known for its sparkling soft drinks (pop, where I'm from), it is actually a well-diversified leader in the commercial beverage industry. Not only is it No. 1 in global market share for sparkling soft drinks, but it also holds the top spot for water (Dasani, Smartwater, and more), sports drinks (Powerade, Bodyarmor, and others), and juice (Minute Maid, Simply, and Maaza).

Despite this leadership position, Coke's growth story should be far from over, as it still only holds a 14% market share in beverages overall in developed markets and a 7% share in emerging markets.

Image source: Coca-Cola's Investor Presentation.

Furthermore, 68% of emerging markets' drinks are non-commercial, whereas that figure sits at only 30% in developed markets. Over the long haul (multiple decades, likely), this 68% figure will likely trickle lower and benefit Coca-Cola over time, provided it remains the market share leader in global beverages.

Considering the company recently announced second-quarter earnings that saw it grow its value share (similar to market share) for the 17th consecutive quarter, it's no wonder the stock is beating the market so far this year.

Is Coca-Cola a passive income machine?

Powered along by this leadership position, Coca-Cola has grown its dividend payments for a stunning 62 years in a row. The stock currently pays a 2.9% dividend yield, which is more than double that of the S&P 500 index.

Despite this hefty dividend yield, the company only utilizes 69% of its net income to make its dividend payments. This reasonable payout ratio leaves plenty of wiggle room for future increases, especially considering Coca-Cola's leadership position and stable operations.

However, Coke's dividend growth rate has slowed to 5% annually over the last decade. In my eyes, this makes it more valuable to investors seeking a high yield up front, rather than buyers hoping for a return to double-digit dividend growth.

Regardless, Coca-Cola remains one of my daughter's core holdings, as she gets to invest in a product she enjoys and collect reasonable returns doing so.

Is Coca-Cola a market beater?

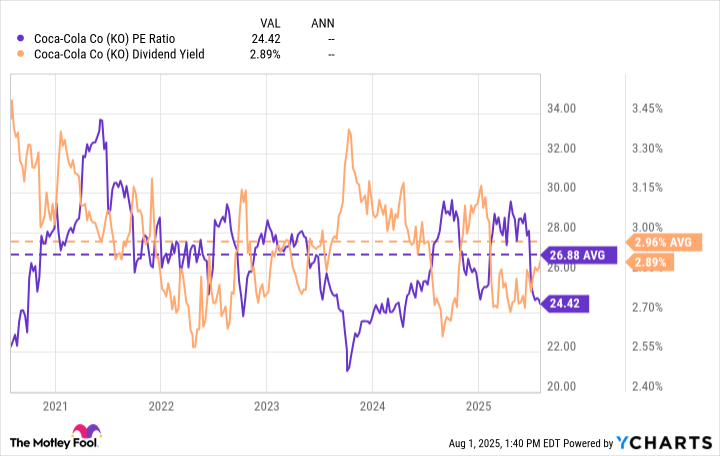

Following Coke's 11% total return so far this year, the stock now holds a price-to-earnings (P/E) ratio of 24 and trades at 23 times next year's earnings.

KO PE Ratio and Dividend Yield data by YCharts

This P/E ratio of 24 is slightly below its five-year average of 27 and is on par with the S&P 500's average P/E of 25. Coca-Cola's dividend yield of 2.9% is also roughly in line with its five-year averages.

These figures lead me to believe that the company is fairly valued right now.

Considering this valuation and management's ambitions to grow earnings per share by 8% over the long term, I believe Coca-Cola could provide market-similar returns. Though it won't be a multibagger anytime soon, its stability should make it an outstanding pick for income-seeking investors.

However, if investors are looking to try to beat the market handily, they may want to look elsewhere for faster growth options.