Take-Two Interactive Software (TTWO +1.21%) stock has seen significant gains across 2025's trading despite some big changes for the company's video game release schedule. While the publisher was originally scheduled to release Grand Theft Auto VI this year, the crucial title has now been shifted to a May 2026 launch date.

Now, Take-Two is on the verge of releasing results for the first quarter of its 2026 fiscal year, which ended June 30. The company will publish its fiscal Q1 results and host a conference call after the market closes on Aug. 7, and the business update could spur significant moves for the stock.

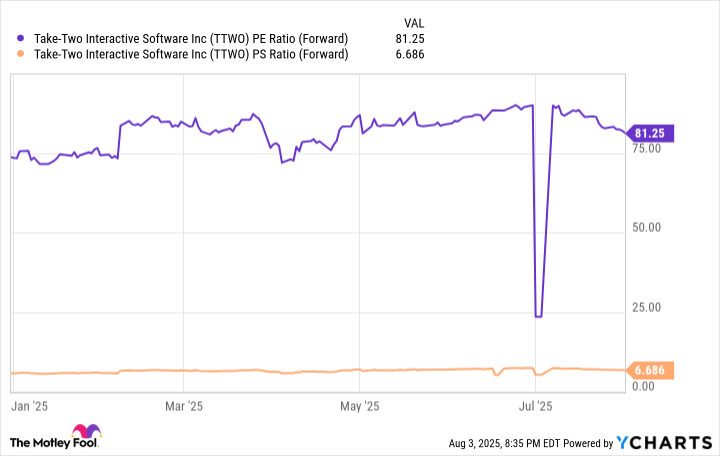

Investors may be wondering whether buying the stock ahead of the quarterly update would be a smart move. Check out the chart below for a look at how the company's valuation has fared after earnings reports, and read on for a deeper look at the gaming leader's key performance drivers and whether the stock might be a good long-term holding.

Image source: The Motley Fool.

Take-Two's business performance has supported big stock gains

Take-Two has seen valuation volatility in conjunction with its earnings reports in the recent past, and performance has been mixed when it comes to immediate near-term stock performance following the company's quarterly updates. On the other hand, taking a buy-and-hold approach to Take-Two stock ahead of a quarterly report from virtually any earnings release dating back to the summer of 2022 would have put shareholders in the green with their investment. That doesn't necessarily guarantee that Take-Two will perform well after its next quarterly report or over the long term, but solid business results and strong positioning in the gaming industry have generally helped support valuation gains for the publisher.

NASDAQ: TTWO

Key Data Points

What will be the biggest post-earnings drivers for Take-Two stock?

While the company's sales and earnings performance in fiscal Q1 can be expected to have some impact on where the stock goes after the earnings report, updates on the company's release pipeline could be even bigger catalysts. Most crucially, investors will be looking to see what Take-Two has to say about the release of GTA VI. The video game is by far the most important upcoming release in the company's lineup, and it's the centerpiece when it comes to valuing Take-Two stock right now.

TTWO PE Ratio (Forward) data by YCharts

Trading at roughly 81 times this year's expected earnings and 6.7 times expected sales, Take-Two Interactive could look highly overvalued for a company that saw revenue grow just 5% annually in its last fiscal year and as its net loss expand to $4.48 billion from $3.74 billion in the previous year. On the other hand, the company's business still has a high degree of cyclicality ,and there's a very good chance that nothing will be more important for the stock over the next five years than the performance of Grand Theft Auto VI.

It's difficult to overstate just how important GTA VI is for Take-Two stock. Some recent rumors have suggested that the game could see another delay that pushes it out past the May 26, 2026, release date the company has set for the title, and it's possible that the company's share price could see a significant pullback if another delay is announced for the game. On the other hand, the title is likely to be a huge hit when it finally releases, and patient investors could be rewarded for backing the company well in advance of the title hitting shelves.