Warren Buffett has a strong case for being the most well-known name in the investing world. He has spent six decades leading Berkshire Hathaway to become one of the world's premier companies and has made many investors rich along the way.

Buffett and Berkshire's success is largely why investors tend to lean on his investing wisdom and follow many of Berkshire's investing moves. A trillion-dollar corporation and your average investor don't have much in common, but Berkshire's portfolio has become a go-to for inspiration.

If you have $1,000 to invest, one Buffett and Berkshire stock to consider buying and holding on to for the long haul is Visa (V 0.74%). Visa isn't a large holding in Berkshire's stock portfolio (about 1%), but it's one of the most successful businesses in it.

NYSE: V

Key Data Points

Visa has a business model built for long-term profitability

Visa has a solid business model where it takes a percentage of every transaction over its network. This lets Visa make money without taking on the risks that come with issuing credit directly or lending money to consumers.

If someone doesn't pay their credit card bill, the credit card issuer -- usually a bank -- loses money, not Visa. Visa is simply the intermediary. And few intermediaries are in as lucrative a position. In its fiscal third quarter (ended June 30), Visa processed more than 83 billion transactions (up 10% year over year), contributing to the $10.2 billion in revenue it made -- a 14% increases year over year.

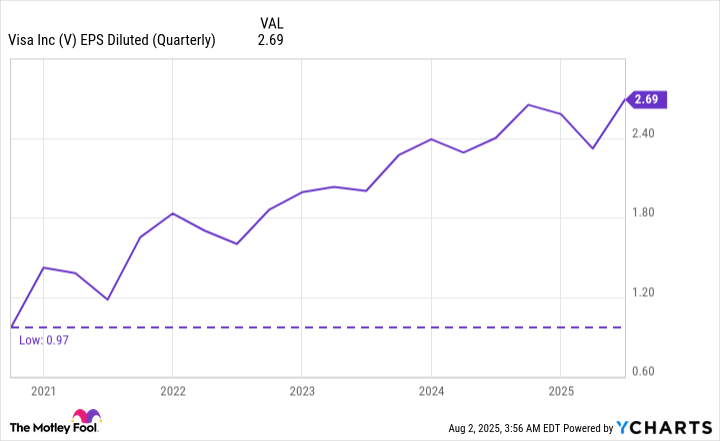

Visa's earnings per share (EPS) beat analysts' expectations, coming in at $2.69. That was 12% higher than the same quarter last year and up 177% in the past five years.

V EPS Diluted (Quarterly) data by YCharts

EPS can often be a more meaningful metric for investors than revenue because it reflects profitability and shows how much value is created for each share it has.

Visa will be a huge beneficiary of the growth of digital payments

The world is slowly but surely embracing digital payments and shying away from cash transactions. Digital payments are common in places like the U.S., U.K., and Japan. However, many developing countries remain dependent on cash. This leaves a lot of room for Visa to expand its digital presence and increase its transaction volume.

According to Grand View Research, the global digital payment market is expected to have a compound annual growth rate (CAGR) of 21% from 2025 to 2030. Visa won't be the only beneficiary of this growth, but it will undoubtedly be one of the biggest.

One thing working in Visa's favor is the network effect. Potential merchants are motivated to accept Visa because it's the most widely held card in the world, and potential cardholders are incentivized to get a Visa card because it's the most widely accepted card in the world. It's a virtuous cycle that drives growth.

Image source: Visa.

Dividends and stock buybacks are an added bonus for investors

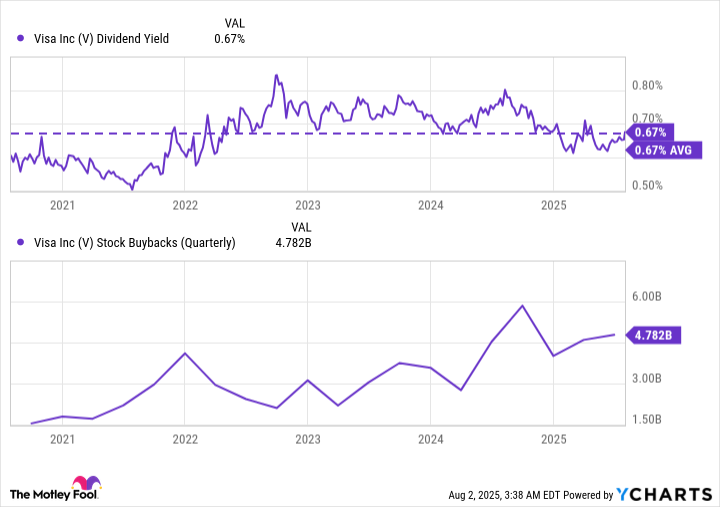

Visa doesn't get talked about as a dividend stock, but it does, in fact, pay one out. Its current yield is a modest 0.7% ($6.70 per $1,000 invested), which is on par with its average during the past five years. It's not enough to consider going yacht shopping, but it's worth noting that it has increased its annual dividend for 17 consecutive years. And given the company's strong financial position, I don't expect this to change.

Aside from its dividend, Visa has been returning shareholder value by repurchasing shares. In Q3, it purchased 14 million shares for close to $4.8 billion, bringing the total spent on repurchases in 2025 to more than $13.2 billion. Visa has $29.8 billion more authorized to spend on share repurchases, which I trust management to use wisely as long-term value creator.

V Dividend Yield data by YCharts

If you're in on Visa for the long haul (which you should be), the dividend and share buybacks are an added bonus to a stock that has shown it can routinely outperform the market.

As digital payments become more common, Visa's importance in the financial ecosystem will only increase. It's a stock I personally plan to keep in my portfolio for decades to come.