One of the biggest misconceptions in investing is how "hard" or "time-consuming" it is. In some cases, combing through financial statements and tuning into earnings calls can be beneficial, but for the average investor, simple, broad exchange-traded funds (ETFs) can get the job done.

ETFs allow you to invest in many stocks with a single investment and remove much of the need to do a deep dive into individual companies. It makes investing simple, and it doesn't have to come at the expense of attractive returns.

These two ETFs below are great options for long-term investors. Each has proven results and can play a key role in making a diversified portfolio. A $1,000 investment today could go a long way.

Image source: Getty Images.

1. Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF (VOO +0.33%), which mirrors the S&P 500, is my largest holding and one I always recommend to investors of all types. The S&P 500 tracks 500 of the largest American companies on the stock market and has been one of the most consistent investments for decades.

NYSEMKT: VOO

Key Data Points

The appeal of VOO to me is its diversification, proven results, and low cost. It's a trifecta that makes for a great long-term investment. With VOO giving more weight to larger companies (by market cap), it has become tech-heavy, but you can still count on it holding blue chip stocks from virtually every major sector.

These are the sectors represented in VOO:

- Information technology: 33.1%

- Financials: 13.9%

- Consumer discretionary: 10.4%

- Communication services: 9.8%

- Healthcare: 9.3%

- Industrials: 8.6%

- Consumer staples: 5.5%

- Utilities: 2.4%

- Real estate: 2.1%

- Energy: 3%

- Materials: 1.9%

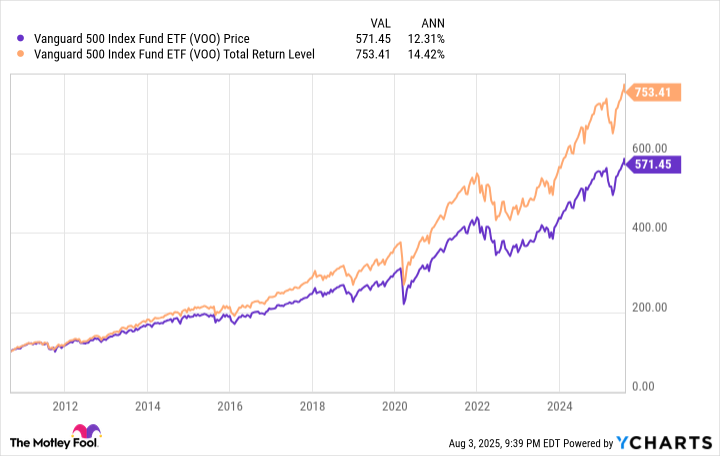

In these sectors, you have time-tested, well-established companies like Coca-Cola, JPMorgan Chase, Berkshire Hathaway, Johnson & Johnson, Visa, and plenty of others. This is a large reason for VOO's (and the S&P 500 in general) impressive long-term returns. The S&P 500 has averaged around 10% annual returns over the long term, but they have been higher since VOO's inception.

Even if VOO regresses to the S&P 500's historical average, its returns have been high enough to make investors meaningful money. And with its low 0.03% expense ratio, you can ensure most of these gains stay in your pocket, not Vanguard's.

2. Vanguard Dividend Appreciation ETF

Having a dividend-focused ETF can work wonders for your portfolio, especially if you're holding on to it for the long haul and letting compound earnings work its magic. That's why the Vanguard Dividend Appreciation ETF (VIG +0.52%) is a good go-to.

NYSEMKT: VIG

Key Data Points

It's one thing for an ETF to have dividend stocks; it's another (more lucrative) thing when those dividend stocks are intentional about increasing their annual payouts. VIG focuses on the latter. To make the cut for the ETF, companies must have increased their annual dividend for 10 consecutive years.

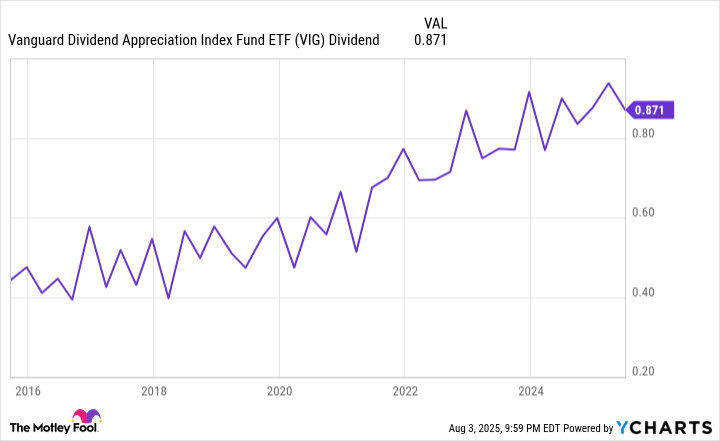

VIG has averaged a modest 1.88% dividend yield over the past decade, but its dividend payout has nearly doubled in that time. The amount of the payouts will vary because the different companies in the ETF have different pay schedules, but the overall trend has remained upward.

VIG Dividend data by YCharts

The tech sector is still the most represented in VIG, but financials (22.7% of the ETF), healthcare (15.1%), industrials (11.2%), and consumer staples (10.4%) round out the top five.

VIG's total returns have lagged behind the S&P 500's over the past decade -- 209% versus 254% -- but it's well-suited for investors looking for reliable income and less volatility (at least historically).

At the current pace of its dividend increases, I wouldn't be surprised if VIG's dividend payouts double over the next decade, as they have in the past decade.