Finding stocks that can double in a reasonable time frame is a smart investing strategy. I'm not talking about finding stocks that can double in under a year, as there is more luck than anything in that approach. Instead, I'm looking for stocks that can double in under five years.

The rule of thumb is that the market doubles about once every seven years, so if a stock can double in five, it's a market outperformer. I think there are a handful of stocks that meet this threshold, and each looks like an excellent buy now.

Image source: Getty Images.

Alphabet

Alphabet (GOOG 1.11%) (GOOGL 1.07%) is the parent company of Google, YouTube, Waymo, and the Android operating system. However, the most important part of its business by far is Google Search. This division brings in over half of Alphabet's total revenue and has allowed Alphabet to fund various investments.

NASDAQ: GOOG

Key Data Points

But Google Search is under attack. Investors are worried that Google Search will become a victim of generative AI and lose significant market share. While there is some anecdotal evidence that users are defecting from Google to generative AI, the vast majority of the population still uses Google Search.

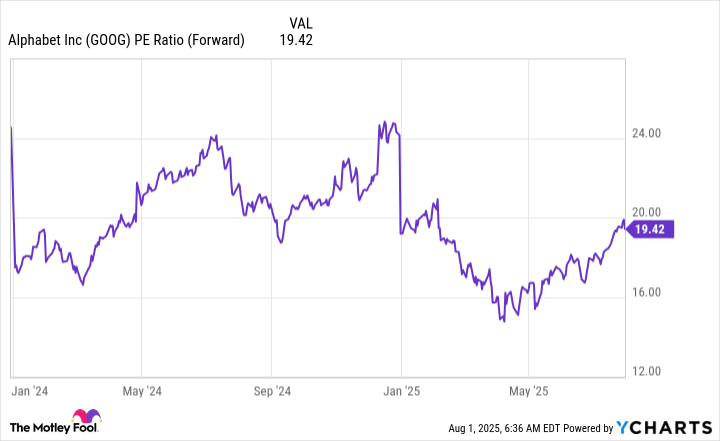

However, investors' fear of Google Search losing market share has caused the stock to fall to a cheap valuation. At less than 20 times forward earnings, Alphabet's stock is cheaper than the S&P 500, which trades for 24 times forward earnings.

GOOG PE Ratio (Forward) data by YCharts

Alphabet's business is still growing, with Google Search's revenue rising 12% year over year in Q2 and companywide diluted earnings per share increasing 22%. Combined with Alphabet's cheap stock price, this makes the stock an easy candidate to double in under five years.

Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing (TSM +4.44%) is a massive beneficiary of the AI arms race. TSMC is a chip foundry, which means it fabricates chips for companies that are unable to do so themselves. Considering there's only a handful of chip foundries globally, this makes TSMC a top competitor in an industry where there are few other options.

NYSE: TSM

Key Data Points

This cements TSMC at the top of a very important industry, making it a smart investment. It also has massive growth potential, as management projects revenue will increase at a nearly 20% compound annual growth rate (CAGR) over the next five years. A 20% CAGR over a five-year period results in a revenue gain of almost 150%, so this far exceeds the threshold needed to double in under five years.

TSMC isn't as cheap as Alphabet, trading at 24.7 times forward earnings. However, that's nearly in line with the broader market, which reduces the overall risk of buying this stock today.

Amazon

At first glance, Amazon (AMZN +0.54%) may not seem like a great candidate to double in five years, as its commerce platform is already dominant. However, that's not the Amazon story investors should be focused on.

NASDAQ: AMZN

Key Data Points

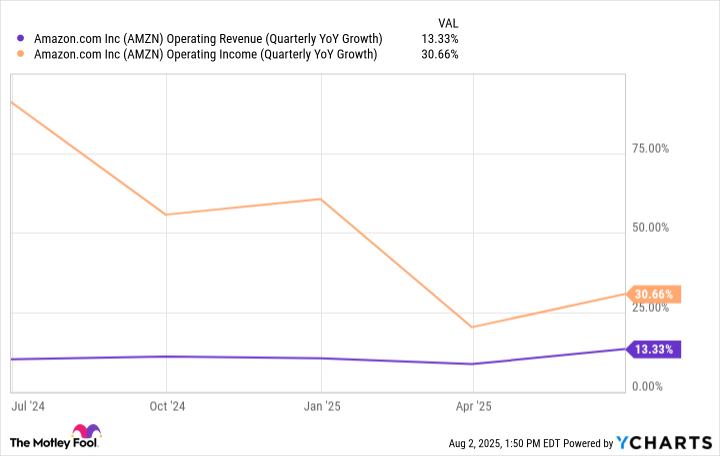

Amazon isn't a revenue growth story; it's a profit growth story. This is because Amazon's higher-margin divisions, such as Amazon Web Services (AWS) and advertising, are growing much faster than the company as a whole. In Q2, Amazon's overall revenue rose 13% year over year.

However, AWS saw sales rise 17% and advertising delivered an excellent 23% growth rate. With these two businesses growing much faster than the overall company, it means Amazon's profits will grow much faster, which is exactly what has happened over the past few quarters.

AMZN Operating Revenue (Quarterly YoY Growth) data by YCharts

Amazon's profit growth will drive it to double in under five years, and with the market's negative reaction to its Q2 earnings, it makes for an excellent stock to buy right now.