Even though it has a monopoly on critical technology and the artificial intelligence revolution in full swing, ASML Holdings (ASML 4.07%) has lagged both the Nasdaq 100 index and the iShares Semiconductor ETF (SOXX 4.42%) year to date, as well as over the past one, three, and five years.

This is kind of an amazing statistic, given ASML's monopoly on extreme ultraviolent lithography (EUV), which is needed to produce semiconductors below the 7 nanometer (nm) node. 7nm chips began to be produced in 2019, and the industry has progressed to 2nm chips, which will arrive by the end of this year. Furthermore, all the leading DRAM memory producers are just now adopting EUV, and DRAM demand is exploding because of the memory needs of AI systems.

Of course, ASML has been known to have this monopoly for a while and entered the past five years at a higher valuation than peers. Yet the stock's underperformance has changed that, and shares now look like somewhat of a bargain, at least by growth stock standards.

NASDAQ: ASML

Key Data Points

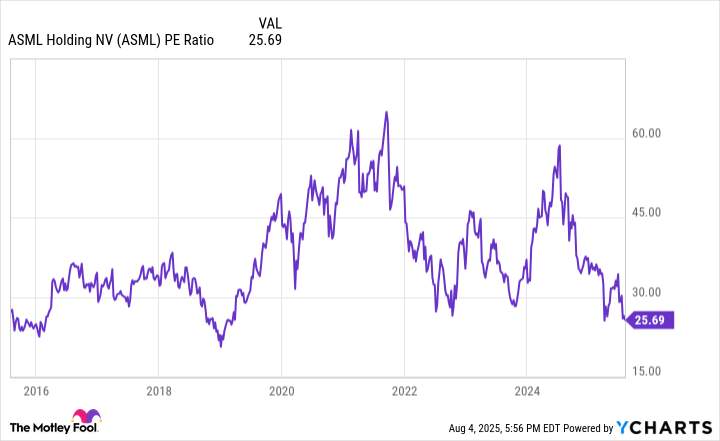

ASML is at a decade-long discount

After its recent post-earnings selloff, ASML now trades at roughly 25 times earnings. That valuation doesn't scream "cheap" on the surface. But again, ASML is an extraordinary company, and that valuation is the cheapest it has been over the past 10 years, with a few exceptions.

ASML PE Ratio data by YCharts

Much of the recent selloff has to do with near-term concerns over the 2026 growth outlook. On ASML's recent earnings release, management said that while the company is still preparing for a growth year next year, it wasn't guaranteeing it. That was a change from last quarter, when ASML said it was expecting a growth year in 2026, after a strong midteens growth expectation this year.

Management spoke of the overhang of tariffs, which could have both direct and indirect impacts. Tariffs may directly slow the several of ASML's end markets, as those end products are still mostly assembled in East Asia. There is also the question of Section 232 tariffs on semiconductors, which have not yet been announced. Should semiconductors get tariffed specifcally, many important chips could be directly affected, given the importance of Taiwan Semiconductor Manufacturing (TSM 2.98%) in the electronics supply chain.

There are also indirect impacts on the wider economy, which could also depress overall demand. Although chips tend to have la strong long-term growth outlook, it's still a very cyclical business at times. Last Friday, we perhaps saw the first signs of tariffs' impacts on the economy, as job creation for July came in well below target, while the stronger readings from May and June were also revised down.

Image source: Getty Images.

The big innovation in chips today doesn't have to do with lithography

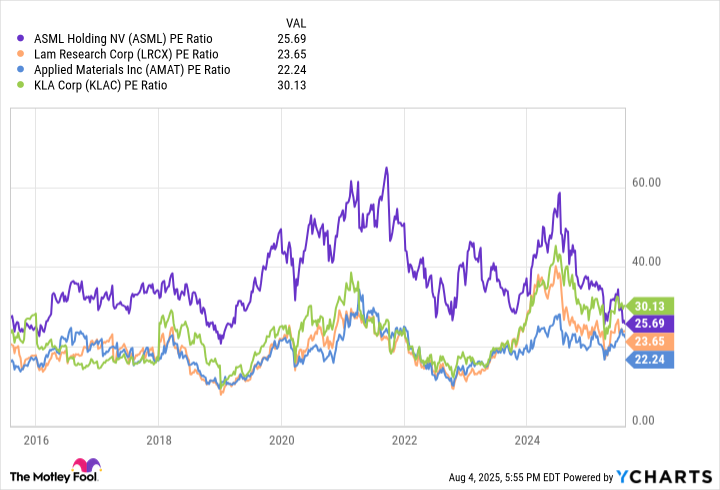

Another part of ASML's valuation compression may have to do with the technology of chipmaking itself.

Major chipmakers are now switching from finFET transistors, with the gate surrounding three sides of the transistor source, to gate-all-around transistors, in which the gate encircles the source on all four sides. This architecture also allows transistor sources to be stacked on top of each other in vertical fashion.

In addition, another innovation going on right now is backside power, in which the power controls of the chip are being built on the back side of the silicon and connected through the silicon surface to the front. This frees up more space on the front of the chip, allowing greater transistor counts and performance.

Lithography, which is what ASML does, has to do with shrinking transistors down to smaller and smaller sizes so that more can fit on a given piece of silicon. However, the enabling technologies of GAA and backside power have more to do with other areas of manufacturing technology, such as etch and deposition, novel packaging and wafer thinning, and increased metrology.

This could be why other major semicap equipment stocks in etch, deposition, and metrology have seen their valuations go up, as ASML's valuation has come back down toward them:

ASML PE Ratio data by YCharts

But near-termism has created an opportunity

While the picture for 2026 and maybe the next couple of years are a bit murky for ASML, the long-term growth opportunity appears intact, as does ASML's competitive advantage in lithography.

Countering the worries about a near-term slowdown in lithography intensity, ASML CEO Christophe Fouquet noted:

So I think that after the 1.4 nanometer node, we will see again some litho intensity increase some more EUV layers. If you look at the long term also there, the Logic customers are extremely bullish about the need for more EUV layers. So yes, there is one node as it happened before with FinFET, where there's a bit of a pause. But I always explain the only reason for that pause is to enable more shrink moving forward. So for every node where you pause basically to change your transistor architecture, usually, you will see 3, 4, 5 nodes where you continue basically to shrink and there drive more litho intensity.

Basically, the 2nm node may not see an increase in litho intensity as chipmakers focus on getting the new transistor and backside power right, but lithography intensity and shrink should still continue beyond that point into the future. On that note, ASML kept its 2030 revenue range outlook between 44 billion to 60 billion euros intact. That's relative to the 32.2 billion euros ASML has made over the past 12 months.

In that scenario, ASML should be making between 14 billion and 23 billion euros in net profit by 2030, relative to its 230 billion Euro market cap today.

Given ASML's technology moat and the strong long-term picture for advanced semiconductors and memory, that a seems like a very solid value for investors looking beyond the next year.