The stock market continues to float near all-time highs. With this rise, many growth stocks have reached new peaks of their own, and a decent portion of these are now sporting lofty valuations.

However, one of my favorite growth stocks has gone in the opposite direction. Despite its promising growth potential and rising margins, international sales helper Global-e Online (GLBE 7.25%) is down 50% from its highs as it battles short-term tariff headwinds.

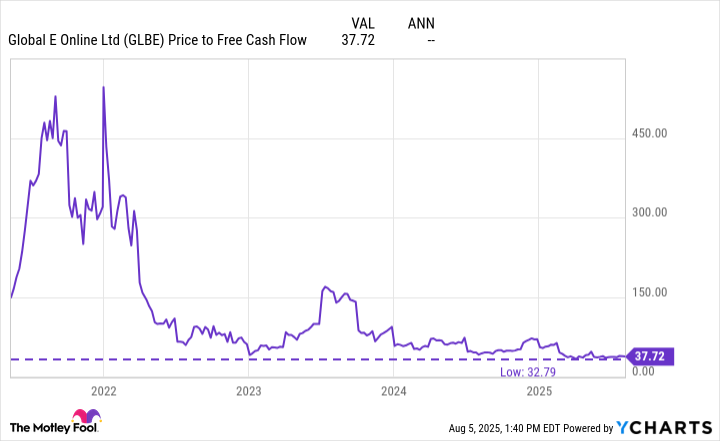

The company is currently trading near its lowest-ever valuation. Here's why it's time to buy this promising, founder-led growth stock.

Image source: Getty Images.

Growth options abound

Global-e Online aims to help merchants sell internationally as easily as they sell domestically. Typically, selling goods online in a foreign country is a highly complex task that's often not worth the battle for merchants to do in-house.

That's where Global-e's end-to-end platform comes in. Taking this complex sales process off of its merchants' hands, Global-e offers a full suite of global e-commerce enablement solutions, such as:

- Region-specific pricing in more than 100 currencies.

- More than 150 payment options, adjustable by location.

- Local messaging for customers and website layouts in more than 30 languages.

- Shipping options from more than 20 providers, with returns.

- Duty and tariff calculations in more than 170 markets.

- Zero-risk payment fraud.

- Local-market knowledge that lets merchants act locally.

Solving these issues in just one country is challenging, but doing this across 20, 50, or 100 countries can be a nightmare. Add in the fact that merchants who have switched to the company's offerings see a 40% conversion uptick, and the value proposition of Global-e Online's platform is clear.

Thanks to the value it provides to its merchants, the company has grown revenue sevenfold since 2020. Despite that incredible growth, Global-e still has less than a 1% market share of the $1.1 trillion cross-border e-commerce industry.

This small market share leaves a lengthy growth runway ahead for the company. Here are the four most crucial growth areas to watch.

1. Add new merchants

In 2020, Global-e added new merchants that did $287 million in gross merchandise volume (GMV). By 2024, this number had quadrupled. Now more than 1,400 merchants strong, the company regularly inks new deals with major retailers and brands such as Manchester United, FC Barcelona, Adidas, Victoria's Secret, and LVMH.

Management has stated that its payback period on new merchants is less than nine months across multiple geographies, meaning that customer growth doesn't take long to become profitable.

2. Grow alongside customers

Perhaps the most potent growth lever for Global-e is its ability to grow alongside its merchant customers. Since 2019, the company has grown its annual GMV per active merchant cohort by four times. This growth highlights the booming sales that new customers see as they expand into international markets with Global-e.

An example of this notion comes from Adidas, which expanded its partnership with the company from eight markets in 2021 to 27 today.

In total, Globel-e's merchants have grown their GMV four to five times faster than the overall e-commerce industry, making the growth stock a compelling investment idea.

3. Geographic and business-to-business expansion

Aside from adding more merchants and growing alongside existing ones, Global-e can also expand its economic footprint to grow. For instance, it's in the process of adding the Czech Republic, Hungary, and Indonesia to its supported countries.

Furthermore, the company has global sales expertise in the business-to-business (B2B) industry, which may be worth two or three times as much as traditional business-to-consumer (B2C). With the global B2B e-commerce market worth roughly $20 trillion in 2024 -- compared to $6.3 trillion for total online retail sales -- there's lots of potential for Global-e.

4. Managed markets with Shopify

Perhaps the best endorsement of Global-e's operations (and why I believe it has a wide moat) is its partnership with e-commerce juggernaut Shopify. The fact that an e-commerce darling as powerful as Shopify would rather partner with Global-e than try to sell internationally on its own speaks volumes.

Since combining to form Shopify Managed Markets, the companies have processed transactions for more than 10,000 merchants, filling orders in over 175 countries. Not only does this help grow Global-e's sales, but it acts as an incubator of sorts for potential customers for the company, as these smaller merchants grow their fledgling companies and brands.

Global-e's lowest-ever valuation

Despite all of these promising growth options and Global-e's widening moat, its stock is down 50% from its highs as the market seems to be worried about how tariffs will impact its business.

NASDAQ: GLBE

Key Data Points

However, co-founder and President Nir Debbi believes that while these tariffs create short-term uncertainty, they may create long-term opportunities for the company. Added tariffs make international sales more complex, whether it's B2B or B2C, and that's when Global-e can step in to help.

Regardless, due to these headwinds, the stock now trades near its lowest-ever valuation.

GLBE Price-to-Free-Cash-Flow data by YCharts.

Considering that Global-e expects to grow sales by 24% when it reports second-quarter earnings on Aug. 13, this valuation is reasonable. Furthermore, management believes the company's 22% free-cash-flow (FCF) margin could grow to 26% to 28% over the long haul, which would make its valuation even cheaper.

Though the road to success may be bumpy since Global-e Online's operations are tied to tariff volatility, the company's growth potential, wide moat, and rising margins make it a spectacular opportunity at today's valuation.