If you have watched any sports event in the past couple of years, you will likely be aware of the explosion in sports betting. Everything including football, esports, table tennis, and mixed martial arts is now eligible to be bet on in many parts of the U.S. (for better or worse, but that's a different story).

Since the U.S. Supreme Court gave states the authority to decide how to regulate sports betting in May 2018, they have been progressively legalizing it and welcoming in mobile and retail sports books. And when you look at the tax revenue they have made as a result, it's easy to see why many states have welcomed it.

One of the main beneficiaries of this new market has been DraftKings (DKNG +2.04%). It was one of the first online sports books and continues to be a leader in the space. If you have $1,000 available to invest (and an emergency fund saved up and high-interest debt paid down), DraftKings is a great growth stock to consider.

Image source: Getty Images.

DraftKings' financials continue to make impressive strides

The company recently reported its second-quarter earnings, and they didn't disappoint. Revenue grew 37% year over year (YOY) to $1.5 billion, and its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) -- which excludes one-time expenses and costs like stock-based compensation -- grew 135% YOY to $301 million.

Both of those were company quarterly records, and the adjusted EBITDA was double DraftKings' previous record, showing the company's improving profitability. Revenue is fairly straightforward, but adjusted EBITDA is a key metric here because it shows how its core business is performing.

NASDAQ: DKNG

Key Data Points

For a while, management put profitability on the back burner to focus on capturing market share, which is typical for younger companies in high-growth mode, but it has seemingly reached the point where profitability is the norm and expectation. It even reached the point where DraftKings was able to invest in growth initiatives while repurchasing 6.5 million of its shares.

Going beyond just sports betting

The sports betting industry is progressively becoming crowded, with competitors including newcomers like Flutter Entertainment's FanDuel, Disney's ESPN Bet, Fanatics sportsbook, and legacy betting companies like Caesars Sportsbook and Entain, a 50% owner of BetMGM.

However, DraftKings has been diligent about expanding its business beyond sports betting. Its iGaming revenue increased 23% YOY, and gaming revenue from jackpots doubled since the second quarter of 2024. When DraftKings purchased Jackpocket -- the leading digital lottery app in the U.S. -- for $750 million last year, this is what it had in mind, and it seems to be paying off.

Aside from the performance of its non-sports betting ventures, being able to attract customers to its lottery and casino offerings allows it to cross-sell between its products, increasing how much it makes off customers in the long term and overall monetization.

Monthly unique payers (MUPs) went from 3.1 million in the second quarter of 2024 to 3.3 million in this past quarter, but more importantly, the average revenue per MUP increased from $117 to $151.

The stock seems like a value at current prices

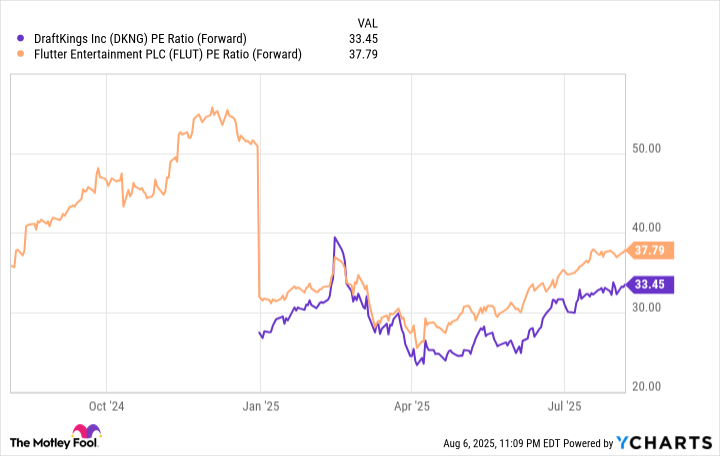

Although DraftKings' stock is up nearly 25% year to date through Aug. 6 and about 45% in the past 12 months, it could still be fairly valued, especially for long-term investors. It currently trades at 33 times its projected earnings for the next 12 months, which isn't cheap, but it's still lower than its main competitor, Flutter Entertainment (FanDuel).

DKNG PE Ratio (Forward) data by YCharts; PE = price to earnings.

In the U.S. online sports betting space, DraftKings and FanDuel essentially have a duopoly. But if I had to choose between the two, I'd go with DraftKings because it's more of a pure-play bet on the rapidly growing U.S. sports betting market and is expanding beyond sports betting more aggressively.