The market can oftentimes focus too much on companies' short-term results. Whether a company meets, beats, or misses expectations for a given quarter, the results can be a notable spike or slide in its share price. The problem is that paying too much attention to such fluctuations can drive both investors and management toward short-term thinking.

If you're an investor who can keep your focus on the long term, though, you don't have to worry as much about how a company in your portfolio does during any single quarter, and can be guided instead by the bigger picture.

Based on its long-term prospects, one stock I see as particularly intriguing now is Advanced Micro Devices (AMD +0.04%), also known as just AMD. It recently reported earnings numbers that didn't beat the analysts' consensus across all key metrics -- its adjusted per-share profit missed expectations by one cent, which led to a (brief) decline in its share price. While a large-scale sell-off isn't underway, the stock could still be a terrific buy right now.

And there was one particular statistic in that report that points to the sheer potential that AMD possesses in the long run -- a stat that some investors who were focusing on the top and bottom lines may have overlooked.

Image source: Getty Images.

7 of the top 10 companies focused on AI and building models are using AMD's new chips

The big question for AMD has been whether its newest AI accelerators will be able to compete with (and take some market share from) those of its massive rival, Nvidia (NVDA 4.42%). If they can, then AMD, which is a fraction of the size of Nvidia, would surely be a no-brainer buy. AMD's new Instinct MI400 chips will be available next year, and previously, OpenAI CEO Sam Altman said his company would use them and was enthusiastic about what they could do.

It appears OpenAI is far from the only tech leader interested in AMD's chips. On the second-quarter earnings call, AMD CEO Lisa Su said that "seven of the top 10 model builders and AI companies use Instinct." She was referring to the company's current chip, the MI350. The more advanced one coming to market next year may be even more popular, as AMD looks to narrow the gap between itself and Nvidia.

This is an impressive stat because it may indicate that companies are seeing AMD's chips as potential alternatives to Nvidia's. AMD may have been slower out of the gate when the AI revolution was first heating up, but now, as it's ramping up its AI chip development, it could take some meaningful market share away from Nvidia. The proof, as it usually is, will be in the numbers.

AMD's growth rate has been moving in the right direction

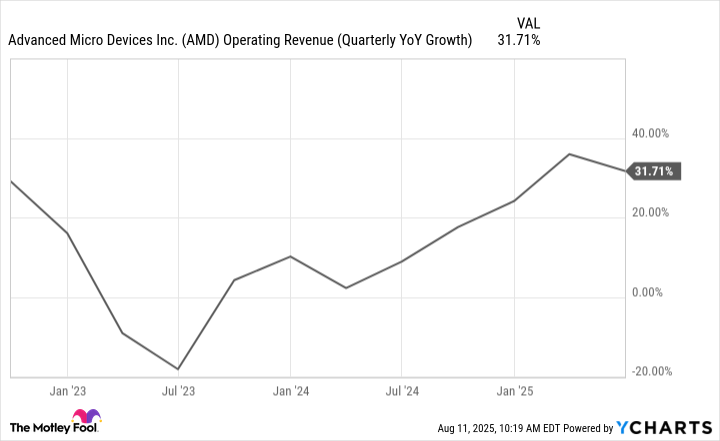

Another encouraging sign for AMD investors is that the company's sales growth has been firmly above 20% for multiple quarters. The trend has been a positive one over the past year.

AMD Operating Revenue (Quarterly YoY Growth) data by YCharts.

If the company can sustain this type of growth rate, it will inevitably capture the attention of more growth investors along the way.

NASDAQ: AMD

Key Data Points

The stock is a strong buy for the long term

Shares of AMD have rallied by more than 40% this year, and they may seem expensive, trading at over 100 times trailing earnings. But with the company arguably on the cusp of much more growth, especially as its new chips gain market share, there could be considerably greater upside ahead for the business and the stock. Its forward earnings multiple (which is based on analysts' consensus expectations) is 44. While that's still a bit high, it does reflect the significant growth expected from the business in the near future.

For long-term investors, now is as good a time as any to load up on shares of AMD. The business looks to be on the right track, and as its new chips reach more customers, it could be a hot stock to own for years to come.