Arista Networks (ANET 0.48%) is a key player in the cloud computing industry, as its networking components and software offerings enable fast data transmission in data centers. The company is now benefiting from the heavy investments in artificial intelligence (AI) infrastructure.

This explains why Arista's latest results for the second quarter turned out to be better than Wall Street's expectations. Arista stock shot up more than 17% following the release of its quarterly results on Aug. 5. Arista didn't just beat expectations -- it also raised its full-year revenue guidance substantially.

Arista's latest pop brings the stock's gains over the past three years to a whopping 360% as of this writing. However, will the company be able to sustain this impressive momentum over the next three years as well? Let's find out.

Image source: Getty Images.

Arista Networks' growth rate is likely to improve further

Arista's Q2 revenue shot up 30% year over year to $2.2 billion, while its non-GAAP earnings jumped nearly 38% from the year-ago period to $0.73 per share. The company points out that the strong demand for its networking components, such as switches and routers, from AI hyperscalers and cloud computing providers was the catalyst behind its robust growth.

Even better, Arista is now expecting its 2025 revenue to increase by 25%, as compared to the earlier estimate of 17%. Looking ahead, the possibility of Arista further increasing its guidance cannot be ruled out. After all, the company points out that the high-speed networking delivered by its switches and routers can reduce the operating costs of AI data centers.

NYSE: ANET

Key Data Points

Arista claims that 30% to 50% of the processing time in data centers is wasted in transferring data in AI clusters powered by graphics processing units (GPUs). The company's offerings allow data center operators to improve their network utilization rates, thereby leading to lower costs. Not surprisingly, the company expects its AI-related networking revenue to exceed its $1.5 billion estimate in 2025.

The company is confident of maintaining healthy growth in the AI business in the long run as well, and that's not surprising. Grand View Research is projecting a 4x jump in the data center networking market's revenue between 2025 and 2033 to almost $155 billion at the end of the forecast period. Arista itself sees its total addressable market (TAM) jumping to $70 billion by 2028 from $41 billion last year.

This increase in the company's TAM over the next three years should ensure healthy growth for the company, especially considering its improving market share. Arista points out that it controlled a third of the high-speed data center switching market at the end of 2024, up by 3.5 percentage points from the previous year.

Importantly, Arista has been gradually taking share away from Cisco Systems in this space over the past several years, with its market share growing from just 3.5% in 2012 to more than 30% last year. So, a combination of market share gains and the overall growth of the data center networking market could help this AI stock deliver more upside. However, investors may be concerned about one thing right now.

The stock is expensive right now

Though Arista Networks has been growing at a nice clip, the stock seems to have run ahead of itself if we take a closer look at its valuation. Its price-to-earnings ratio of 54 is on the expensive side, which means that it will have to continue outperforming analysts' expectations consistently to sustain its stock market rally.

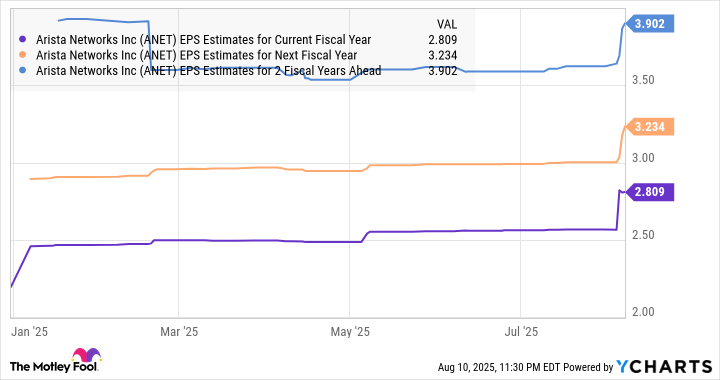

But the good part is that Arista's growth estimates have been hiked for the next three years following its latest quarterly report.

ANET EPS Estimates for Current Fiscal Year data by YCharts.

We have already seen that Arista's potential revenue opportunity is on track to jump significantly. Additionally, its market share has been improving. So, Arista seems capable of outperforming Wall Street's estimates over the next three years. In fact, the company expects to achieve its $10 billion annual revenue target in 2026, two years ahead of its original expectation.

As such, there is a strong possibility of Arista's growth turning out to be better than estimates, which should allow it to justify its premium valuation and deliver more gains to investors over the next three years.