Sailing higher throughout the week, shares of tanker stock Torm (TRMD 1.42%) are extending their upward trend today. The company reported second-quarter 2025 financial results today as well as updated 2025 guidance, and investors are eager to click the buy button as a result.

As of 10:41 a.m. ET, shares of Torm are up 7.7%.

Image source: Getty Images.

Management sees calm seas through the rest of 2025

Reporting revenue of $315.2 million, Torm beat analysts' profit estimates. Whereas the consensus was that the company would report earnings per share (EPS) of $0.57, Torm posted $0.60 EPS for Q2 2025.

NASDAQ: TRMD

Key Data Points

But investors are likely more focused on what management had to say about the remainder of the year than its report on the recent quarter. For 2025, management projects time charter equivalent (TCE) earnings -- an industry metric that measures the vessels' profitability -- of $800 million to $950 million, an upward revision from the earlier 2025 TCE guidance of $700 million to $900 million. In addition, the company projects earnings before interest, taxes, depreciation, and amortization (EBITDA) of $475 million to $625 million, instead of the previous guidance of $400 million to $600 million.

Is now a good time to dock Torm stock in your portfolio?

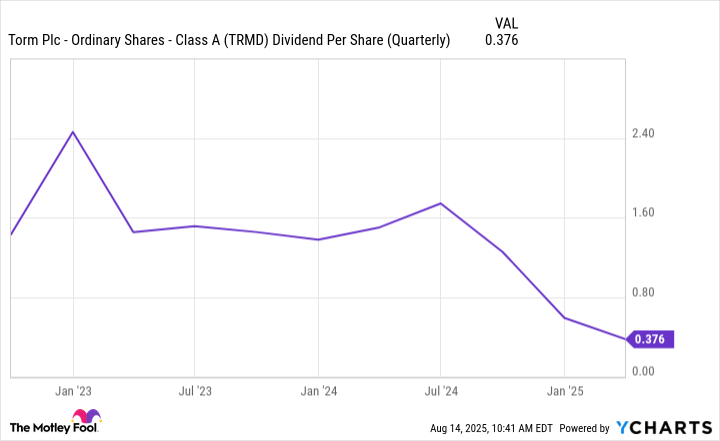

For those who have Torm stock on their radars, the likelihood is that it's there due to the company's generous dividend. Currently, the distribution represents an ultra-high forward yield of 8.4%. But before investors rush to pick up shares of Torm, it's important to note that the quarterly dividend varies considerably, and over the past three years, it has steadily declined.

TRMD Dividend Per Share (Quarterly) data by YCharts.

For those seeking a reliable passive income stream, Torm stock doesn't fit the bill, but for those with a higher risk tolerance and who are comfortable with the lack of certainty in the quarterly payout -- though it has the potential to be generous -- Torm stock may warrant a closer look.