Apple is the world's third-largest company by a wide margin, with a $1 trillion gap between it and fourth-place Alphabet . However, I think several companies are slated to pass Apple in market share over the next five years, including fifth-place Amazon (AMZN -0.00%), which is valued at around $2.4 trillion compared to Apple's $3.5 trillion.

That's a wide gap to make up in five years, but looking at Amazon's growth tailwinds versus Apple's makes it fairly clear that Amazon is the much better stock pick.

Image source: Getty Images.

Amazon has two business units driving profit growth

Apple's business is fairly straightforward; it's the leading consumer tech brand and generates significant revenue selling iPhones and other products in the Apple ecosystem. Amazon is a bit more complex, as it has the online store that most investors are familiar with, but that's not the best reason to invest in it.

Although its online stores division posted the best quarter in a long time (revenue rose 11% year over year), the real stars of the show are Amazon Web Services (AWS) and its advertising services division.

AWS is Amazon's cloud computing platform, and it is seeing strong demand fueled by the migration of traditional workloads to the cloud, as well as by new artificial intelligence (AI) workloads. AWS grew revenue by 17% year over year in Q2, which is strong growth considering it generated nearly $31 billion in revenue during the quarter. However, AWS's primary competitors (Microsoft's Azure and Google Cloud) posted stronger growth rates in their corresponding quarters, so investors are worried about AWS's long-term ability to perform in this sector despite its being the market-share leader.

AWS will likely continue to underperform its peers due to its size, but 17% growth is nothing to sneer at. AWS is also a large part of Amazon's profit picture. In Q2, it accounted for 53% of Amazon's operating profits despite accounting for only 18% of revenue. Analysts still expect cloud computing to grow rapidly over the next few years, and if Amazon surpasses Apple in market cap, this will be a primary reason why.

Advertising services is Amazon's fastest-growing segment, with revenue rising 23% year over year, an acceleration over previous quarters' growth rate. Amazon has one of the most lucrative places to advertise on the internet, as consumers are already coming to their platform to make purchases. Paying to place a product at the top of an Amazon search almost guarantees increased sales. This is worth a lot to its advertising clients and will be a key part of Amazon's investment thesis over the next few years.

Amazon's margins are rising

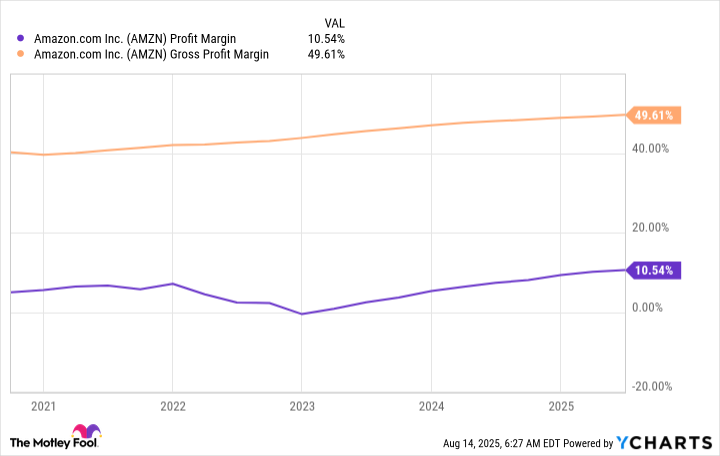

Amazon isn't a revenue growth story; it's a profit growth story. The rise of high-margin businesses like AWS and advertising services has helped Amazon boost its profit margins over the past few years.

AMZN Profit Margin data by YCharts

With its two high-margin business segments growing faster than other parts of its business, Amazon will naturally have elevated profit growth rates. In Q2, Amazon's operating income rose 31% year over year.

Contrast that with Apple, whose Q3 FY 2025 (ending June 28) operating income increased by 11%. Amazon's profit growth rate is much faster. Over five years, a 30% growth rate will increase its operating income by 271% while an 11% growth rate increases operating income by only 69%.

That would be enough to drive Amazon's profits higher than Apple's, propelling it to surpass it in size along the way. Amazon is an excellent stock pick for the next five years and a no-brainer buy at today's prices.