Artificial intelligence (AI) software company Palantir (PLTR 5.23%) has a strong case as the most talked-about stock this year. The success of its AI tools amid the current AI boom has made it one of the more high-profile stocks on the market, and its stock price has followed the hype. Its stock is up 143% year to date through Aug. 14, but the surge started way before now.

Image source: Getty Images.

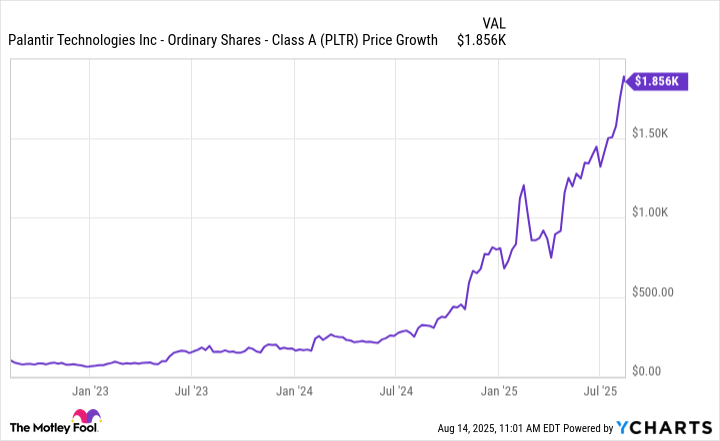

Had you invested $100 into the stock three years ago (with Aug. 14, 2022, as the starting point), your investment would be worth over $1,850. Calling those returns impressive would undoubtedly be an understatement.

What has changed with Palantir's business?

Palantir's core business hasn't changed over the past three years, but the surrounding perception seemingly has. For a while, many people viewed Palantir as a niche government contractor, but it is now seen as a company whose software can be used for commercial businesses as well.

In the second quarter, Palantir achieved its first $1 billion quarter (up 48% year over year), with its U.S. government and U.S. commercial benefits increasing revenue 53% and 93% year over year, respectively.

NASDAQ: PLTR

Key Data Points

After such an impressive run over the past three years, the one red flag with Palantir's stock is just how expensive it has become. At the time of this writing, the stock is trading at nearly 135 times its sales, which is, to put it lightly, absurd by even the most lax of standards.

Palantir has proven it's a great company and leader in its industry, but if you're investing expecting similar returns over the next three years, you could be in for some disappointment. If you're interested in investing in the company, make sure you approach it with a long-term mindset, and mentally prep yourself for the inevitable volatility.