When the tide comes in, a lot of boats float -- even some that probably shouldn't. In that vein, the crypto sector's tide just rolled to a new high-water mark, with the entire market's value cresting at more than $4.2 trillion.

Put simply, money is showing up. The important question for long-term investors is whether the forces pushing prices higher are likely to stick around, fueling a continuation of the rally. If they are, there's still plenty of time to buy and get a decent return, but if they're not, waiting for a correction or a bear market would provide better opportunities, so let's take a look at what's happening now.

Image source: Getty Images.

What's actually inside that $4 trillion

Let's start with the obvious fact that many investors still don't appreciate.

Bitcoin (BTC +1.85%) is still the center of gravity of the entire crypto sector, accounting for more than half of its value, with a market cap of about $2.4 trillion. That means one giant asset is responsible for the majority of the move.

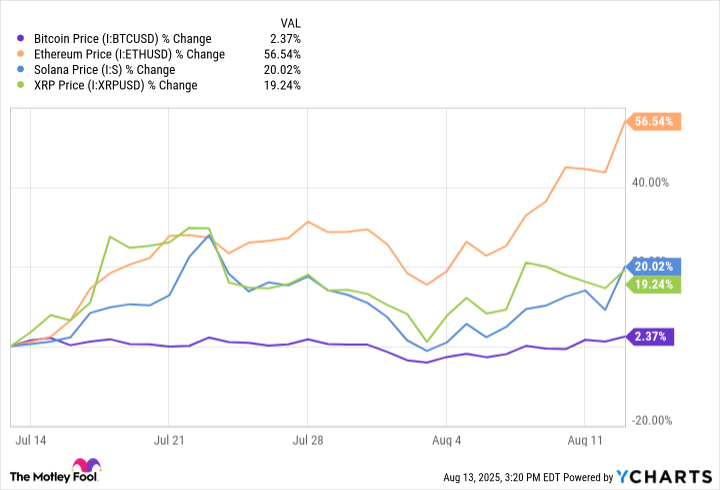

Behind Bitcoin, three familiar names do much of the remainder of the heavy lifting. Ethereum (ETH +2.07%) represents roughly the next 13% of the market, reflecting its role as the default smart contract platform that institutions can access via spot exchange-traded funds (ETFs). Solana (SOL +4.82%) has matured into a top-tier asset with a market cap near $100 billion, a nontrivial slice of the pie even if it's small relative to Bitcoin and Ethereum. Likewise, XRP (XRP +0.31%) was recently near a $193 billion market cap, helped by international payments adoption, institutional investor adoption narratives, and renewed investor interest.

Bitcoin Price data by YCharts

In other words, Bitcoin is the engine, with its own uptrend driven by its halving-mediated supply dynamics and by enormous institutional purchasing. But Ethereum, Solana, and XRP are also experiencing key catalysts of their own amid a very favorable macro backdrop, potentially causing the rest of the market to catch a tailwind too.

CRYPTO: BTC

Key Data Points

Can it keep going?

There are a few reasons to think that the crypto sector is going to continue to gain in value during the coming months. At the highest level, cryptocurrencies absolutely thrive on liquidity, and global liquidity has been increasing significantly.

Several major central banks are easing their monetary policies by reducing interest rates or tilting dovish after an aggressive tightening cycle. There's currently a lot of talk and expectations surrounding the U.S. Federal Reserve cutting rates at its next meeting in September. The European Central Bank (ECB) has been cutting its interest rate repeatedly since mid-2024 and then pausing in July, and the Bank of England trimmed its rate to 4% in early August.

Easier money doesn't guarantee higher crypto prices, but historically it has helped riskier assets.

Furthermore, regulatory clarity has improved in the U.S., removing some structural frictions and encouraging financial institutions to embrace crypto. The Securities and Exchange Commission (SEC) has approved and expanded the toolkit for crypto exchange-traded products (ETPs), including allowing in-kind creations and redemptions for certain crypto ETPs, a detail that reduces costs for large investors. When paired with the Trump administration's pro-crypto stance, it's no surprise that prices are trending higher.

CRYPTO: ETH

Key Data Points

Separately, corporate treasuries are another new buyer cohort. There have been numerous companies popping up with the sole ambition of buying and holding Bitcoin, Solana, Ethereum, and XRP, among other coins. For investors, having fewer coins sloshing around on the open market tends to support price.

Put together, all of those tailwinds, plus others like major ETF inflows, suggest that the rally can and probably will continue in the near term. However, investors should be wary about investing more than they're willing to hold for a few years because there's no such thing as a free lunch in crypto, and despite everything, a downturn could still occur.

CRYPTO: SOL

Key Data Points

Liquidity can reverse, politics can shift policy, and ETF inflows can swing and become outflows if performance cools. And crypto is still very volatile, no matter how you look at it.

But assuming that central banks do not suddenly tighten their monetary policies and that U.S. regulatory restraint continues rather than reverses, it's likely the uptrend persists.