The $3 trillion valuation club is fairly exclusive. Only three companies have ever achieved this valuation: Nvidia, Microsoft, and Apple. However, there's one company that I think is bound to join this group soon, and it's nearly unstoppable: Alphabet (GOOG 0.94%) (GOOGL 0.91%).

Alphabet is one of the top companies in the world, yet it isn't respected as much as many of its big tech peers because its core business is seen as vulnerable to disruption. However, it is proving each quarter that it will be just fine, making it inevitable that Alphabet will be a member of the $3 trillion club shortly.

Image source: Getty Images.

Google Search is still doing well despite investors' fears

Alphabet is the parent company of many brands, but its most notable is Google. The Google Search engine accounted for over half of Alphabet's revenue in Q2, so this platform must continue doing well. However, the market is uncertain of that outcome.

Many are worried that generative AI will replace Google Search, and there is already some anecdotal evidence that Google Search lost some users. Still, there is a massive chunk of the population that hasn't made the switch and is unlikely to, especially after Google integrated AI search overviews, which combine a generative AI summary with a traditional search experience. So far, this approach seems to be working, as Google Search's revenue rose 12% year over year in Q2. Growth like that normally doesn't occur in failing businesses, so the calls for Google's downfall were likely premature.

NASDAQ: GOOGL

Key Data Points

Alphabet's other properties are also seeing a lot of strength, most notably Google Cloud. Google Cloud is Alphabet's cloud computing wing, and it's seeing a ton of demand thanks to tailwinds in the AI realm. Its servers have become the top option for many in the AI world, including competitor OpenAI, the producer of ChatGPT. Google Cloud increased revenue by 32% in Q2 and posted an operating margin of 21% in the quarter. While it only makes up about 14% of Alphabet's total revenue, this is a key division to watch as its rapid growth will allow it to become a much larger part of Alphabet's revenue over the next five years.

Overall, Alphabet is posting solid results, with revenue rising 14% year over year and diluted earnings per share (EPS) rising 22%. There aren't many big tech companies that can match those results, yet Alphabet still trades at a discount due to fears of generative AI disrupting its business.

Alphabet's stock is cheap compared to its peers

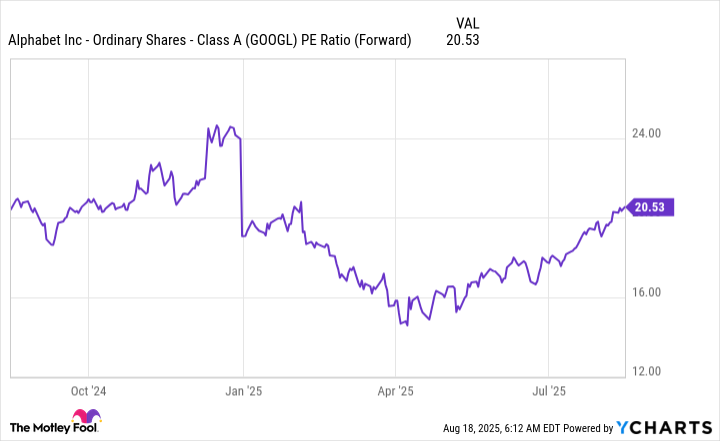

Alphabet's stock is rather cheap, trading for 20.5 times forward earnings compared to the S&P 500's 24.1.

GOOGL PE Ratio (Forward) data by YCharts

Unlike many of the other big tech stocks, Alphabet doesn't have a valuation risk, making it an intriguing buy today. Furthermore, if Alphabet's valuation were to rise to 24 times forward earnings, it would be worth $2.9 trillion, almost breaking the $3 trillion threshold.

After a few more successful quarters, this will easily allow Alphabet to cross over the $3 trillion threshold. If Alphabet were somehow to earn a premium in the market, it would allow for even more upside.

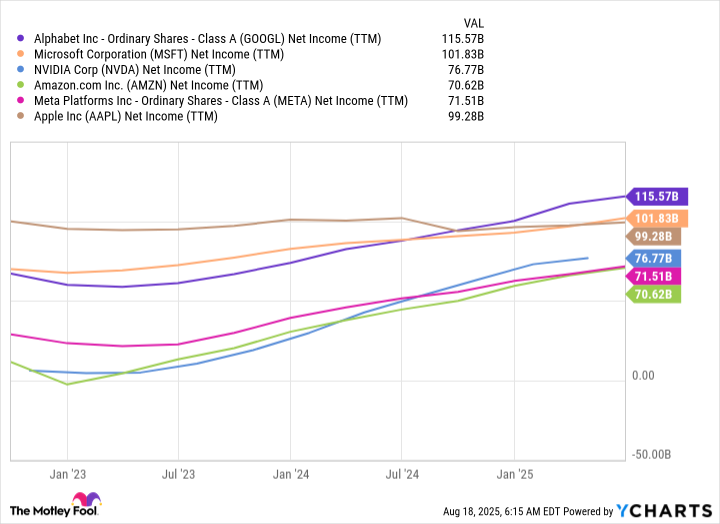

On another point, Alphabet generates the most profits of any big tech company.

GOOGL Net Income (TTM) data by YCharts

So, if all stocks had the same valuation, Alphabet would actually be the largest company in the world.

While I don't envision this scenario happening, it's critical to know that even with all of the challenges Alphabet faces, it's still the most profitable company in the world and produces a ton of free cash flow that can easily be reinvested in its product to ensure that it stays on top. Writing Alphabet off now is causing many investors to miss a no-brainer stock, and it could easily be worth $3 trillion by the end of the year, if not sooner.