Apple (AAPL +0.05%) and Microsoft (MSFT 1.66%) are the second- and third-largest companies on the market right now, with valuations of $3.9 trillion and $3.4 trillion, respectively. That means a company would need to be worth $7.3 trillion by 2030 to be worth more than the combined value of these two companies right now.

There are only a handful of potential companies that could do that, with the chief suspect being Nvidia (NVDA +0.42%), currently the world's largest company. I think that a $7.3 trillion market cap is achievable for Nvidia by 2030. Here's how it will achieve it.

Image source: Getty Images.

The AI hyperscalers are increasing their guidance for 2026 expenses

Nvidia is thriving in the world of artificial intelligence (AI). Its graphics processing units (GPUs) have become the computing hardware of choice for many AI hyperscalers due to their strong ecosystem and fantastic computing power. GPUs can process multiple calculations in parallel, making them suited for any workload that needs a lot of processing power. Historically, GPUs were used for gaming graphics, engineering simulations, and cryptocurrency mining, but their biggest use case by far is AI.

NASDAQ: NVDA

Key Data Points

As a bullish sign for Nvidia, the AI hyperscalers aren't slowing down their spending. During its Q2 conference call, Alphabet told investors it is raising its 2025 capital expenditure projection from $75 billion to $85 billion, and also commented that 2026 will see a further increase in capital expenditures. Meta Platforms commented that it will see "significant capital expenditures dollar growth in 2026" for building out its computing capacity to meet demand.

Nvidia will be a huge beneficiary from these hyperscalers' increasing demand, but Nvidia doesn't expect it to stop in 2026.

A third-party projection cited by Nvidia during its 2025 GTC event stated that global data center capital expenditures in 2024 were around $400 billion. That number is expected to increase to $1 trillion by 2028. That's huge growth, but will it be enough to propel Nvidia past the $7.3 trillion mark by 2030?

Nvidia will rapidly grow over the next few years

If global data center capital expenditures increase at that rate, it would have a compounded annual growth rate (CAGR) of about 26%. Because Nvidia's business is heavily tied to the data center industry, we'll use that as its base growth rate figure.

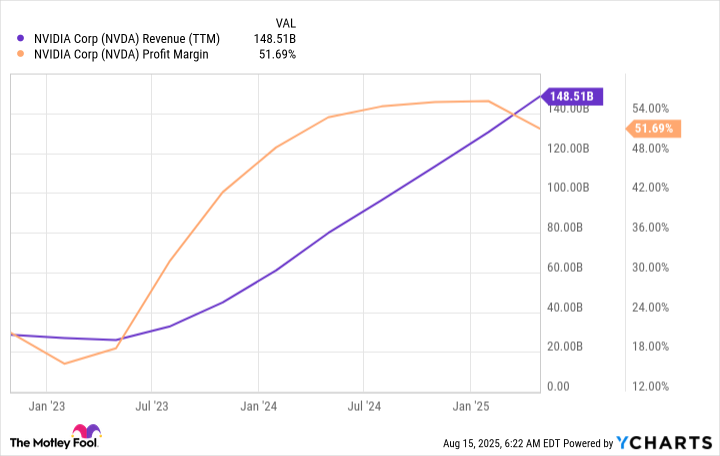

Over the past 12 months, Nvidia has generated $149 billion in revenue, with a mid-50% profit margin (it dipped a bit during its last quarter due to an inventory write-down it had to take on H20 chips that were meant for China but could no longer be sold at that time due to export restrictions).

NVDA Revenue (TTM) data by YCharts

Should Nvidia achieve that CAGR over the next three and a half years, Nvidia's revenue and profits would be $335 billion and $184 billion, respectively. If we give it a forward price-to-earnings (P/E) multiple of 40 (it's currently 42), that would give Nvidia a market cap of $7.36 trillion by 2028.

The original projection was for Nvidia to reach a market cap of $7.3 trillion by 2030, and this projection exceeded that level by 2028. That leaves plenty of room for Nvidia to underperform this guidance and still achieve this lofty goal.

Nvidia is expected to remain dominant for some time, and with all the massive data center capital expenditures ongoing, Nvidia's stock will be a must-own for investors.