Dividend-paying stocks don't get the credit they deserve. Over the past 50 years, the average dividend-paying stock in the S&P 500 has outperformed non-payers by more than 2-to-1. Data from Ned Davis Research and Hartford Funds shows that dividend payers returned 9.2% annually, while non-payers returned 4.3%. Dividend stocks have also been much less volatile than non-payers.

The Schwab U.S. Dividend Equity ETF (SCHD 0.45%) makes it easy to invest in leading dividend-paying stocks. Here are some reasons this fund might be a good fit for your portfolio.

Image source: Getty Images.

The top 100 dividend stocks in one fund

The Schwab U.S. Dividend Equity ETF is a passively managed fund that follows the Dow Jones U.S. Dividend 100 Index. To build the index, its managers begin by identifying U.S. companies that have made dividend payments for at least 10 years. They then rank these companies based on the strength of their financial metrics compared with others in their industry, using four key measures:

- Cash flow to total debt.

- Return on equity.

- Indicated dividend yield.

- Five-year dividend growth rate.

By using these measures, the fund leaves out companies that don't meet its quality standards. This way, only dividend stocks with solid financials and the potential for steady, growing payouts make it into the fund.

NYSEMKT: SCHD

Key Data Points

Each March, the fund updates its 100 holdings. At its last update, these stocks offered an average dividend yield of 3.8%, which is over three times higher than the S&P 500's 1.2%. Over the past five years, these companies have also raised their payouts by an average of 8.4% a year, outpacing the S&P 500's 5% annual growth. This means the fund offers both income and growth.

The fund's top holdings include some of the most consistent dividend stocks in the country. Its top holding is beverage and snacking giant PepsiCo (PEP 0.17%). This iconic company has raised its dividend payment for 53 straight years, earning a spot among the Dividend Kings -- companies with 50 or more years of annual dividend increases. PepsiCo's dividend has grown at a 7.5% compound rate since 2010 and currently yields 3.7%. With a long-term goal of high-single-digit annual earnings-per-share growth, more dividend increases seem likely.

Growing income and total returns

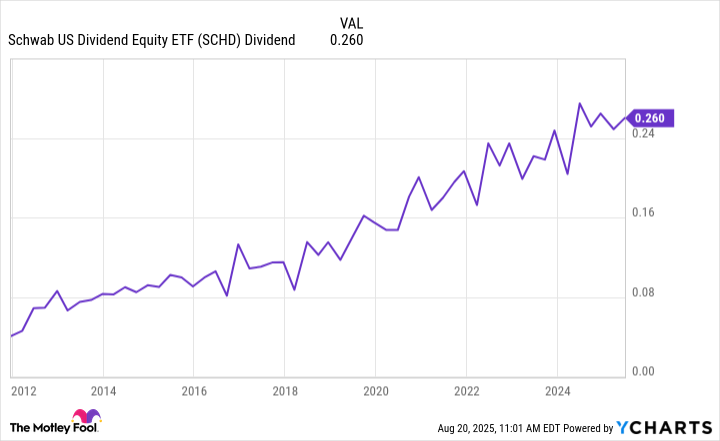

The Schwab U.S. Dividend Equity ETF focuses on companies that grow their dividends. That focus has enabled the fund to steadily pay higher cash distributions to investors:

SCHD Dividend data by YCharts

Currently, the fund pays a 3.9% annualized dividend yield. As the companies in the fund continue to increase their dividends, this payout will grow, giving investors a steady and rising base cash return even when markets are down.

Focusing on dividend growth stocks is an important distinction. While dividend stocks have outperformed non-payers over the decades, the best returns during the past half-century came from companies that grew their dividends:

|

Dividend policy |

Returns |

|---|---|

|

Dividend growers and initiators |

10.2% |

|

No change in dividend policy |

6.8% |

|

Dividend cutters and eliminators |

(0.9%) |

Data sources: Ned Davis Research and Hartford Funds.

The Schwab U.S. Dividend Equity ETF invests in high-quality companies that grow their dividends. That has helped it deliver robust returns for investors over the years. Since it started, the fund has produced an average annual return of 11.5%, including reinvested dividends. These results come from investments that tend to be less risky and less volatile, making the fund an even more attractive long-term holding.

An ideal foundational holding for any portfolio

If you want a simple way to build wealth and earn more income over time, the Schwab U.S. Dividend Equity ETF could be a smart addition to your portfolio. Its strong history, solid approach, and focus on steady, growing payouts make it an ideal choice for investors who value stability and long-term growth.