Home Depot (HD 1.33%) has one of the most successful stocks in history. The stock launched its initial public offering (IPO) in 1981, just two years after its founding. Today, it operates over 2,300 stores in the U.S., Canada, and Mexico.

However, after expansion outside of North America failed, it has opened fewer than one new location per month. With its current markets close to saturation, it's worth predicting where Home Depot stock will be over the next five years.

Image source: Home Depot.

The state of Home Depot

Home Depot is the No. 1 home improvement retailer. The average location serves do-it-yourselfers working on projects around the home, stocking around 35,000 products.

Since Home Depot was far larger than the average hardware store, it made itself a one-stop shop for home improvement, changing the way Americans shopped for such items. Of its peers, only Lowe's, the other major home improvement retailer in the U.S., comes close to fully competing, though chains like Floor & Decor or Tractor Supply compete in specific areas.

Nonetheless, Home Depot's most concerning threat may be its success. Approximately 90% of the U.S. population lives within 10 miles of one of its locations. Amid its failed expansion efforts outside of North America, Home Depot appears to have few options for outsized growth.

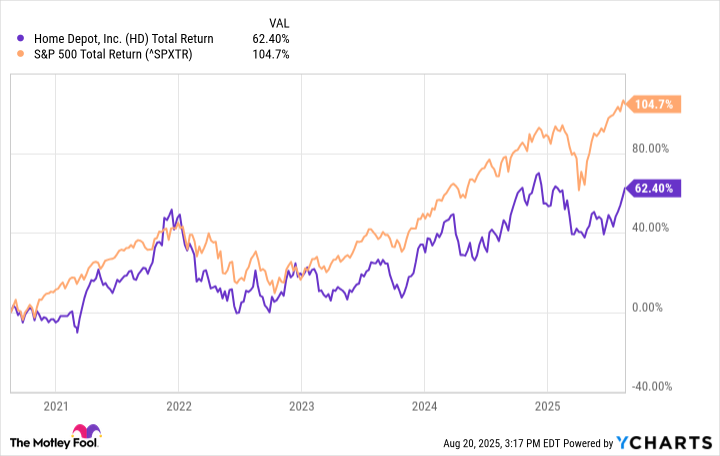

Unless it can find a way to succeed in new markets, that dynamic is unlikely to change. Thus, it will probably come as little surprise that Home Depot has underperformed the S&P 500 over the previous five years, even when accounting for dividends.

HD Total Return Level data by YCharts.

Home Depot's financials

Like the state of the enterprise, the financials reflect a mature business. In the first half of 2025, revenue of $85 billion grew 7% compared to the same period in 2024.

Unfortunately, both its costs of sales and operating expenses rose faster than revenue during that time frame. Consequently, operating income grew by only 0.6% for the period. Also, falling interest income and rising interest expenses helped take its net income for the first two quarters of 2025 to $8 billion, a 2.2% reduction versus year-ago levels.

Additionally, third-quarter projections call for sales growth of 2.8%. Still, even if Home Depot beats that estimate, a sequential growth slowdown appears likely.

Instead, dividends have arguably become the best reason to own Home Depot stock. Its first dividend was in 1987, and it amounted to a split-adjusted annual payout of approximately one-sixth of one cent per share. Since that time, numerous increases have taken its current payout to $9.20 per share yearly. That amounts to a dividend yield of 2.25%, well above the 1.2% average for the S&P 500.

The payout also rises most years, making it more appealing to income investors. Moreover, that track record gives longtime shareholders good reason to stay with the stock since dividend yields will rise relative to their original investment.

NYSE: HD

Key Data Points

Where the challenge may come is with the company's price-to-earnings (P/E) ratio. That earnings multiple of just over 27 is below the S&P 500's average of 30. Nonetheless, considering the company's slow growth, investors may perceive that valuation as pricey, possibly prompting new investors to seek stock and dividend returns elsewhere.

Home Depot in five years

Over the next five years, investors should expect rising dividends and higher returns, but not enough to beat the S&P 500.

Given its role in the home improvement space, the company and stock will likely benefit from slow, steady returns. This should gradually take the stock and its dividend higher over time.

Unfortunately, Home Depot is not offering its investors meaningful growth prospects beyond inflation and the increase in population. Such conditions make it difficult to beat the market, giving investors few reasons to pay 27 times earnings for a stock that delivers lower returns than the S&P 500.

Ultimately, the rising dividend should continue to offer increased benefits to shareholders in the retail stock, leaving them with little reason to sell. However, a likely underperformance means investors should probably put new capital to work elsewhere.