Warren Buffett is perhaps the greatest investor of all time. It's not surprising, then, that every move he makes and the portfolio he manages as the CEO of Berkshire Hathaway are carefully scrutinized. Buffett's conglomerate owns plenty of excellent stocks. One of the best to buy might be Visa (V 1.64%), a well-established financial services company. Here is why Visa is a great stock to buy.

Visa's terrific business model

Millions of credit and debit cards in circulation are branded with Visa's logo. That might lead some to think that the company issues these cards itself. But that's not the case. Visa owns a payment network that facilitates card transactions. It serves as an intermediary between merchants, their banks, and the financial institutions that do issue credit cards to consumers, also known as issuing banks.

When people swipe (or tap) their cards at a point-of-sale system, their information is routed through Visa's network and approved or rejected based on various details. Visa gets a fee as a percentage of the transaction amount for its role in all this. So, the more transactions, the more money the company makes.

Image source: Getty Images.

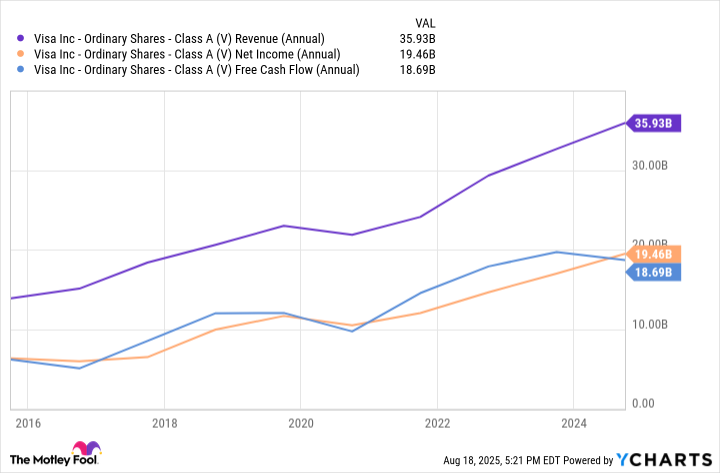

As a non-issuing bank, Visa does not extend credit to consumers. While that means it loses out on interest payments, it also insulates the company from credit risk. Visa's role in payments means it is deeply embedded in the day-to-day lives of the average consumer in many parts of the world, even if most aren't consciously aware of the role the company plays. Visa is kind of like the sky: It's always there, but many barely notice it. That's not a bad place to be as a business. It's hard to argue with results. Visa has consistently posted strong financial results over the past decade.

V Revenue (Annual) data by YCharts.

Furthermore, the company boasts a wide moat that should enable it to maintain its strong position for an extended period. Visa's ecosystem has a network effect. The more debit and credit cards in circulation are branded with its logo, the more attractive it is for merchants to accept it as a payment method. That, combined with Visa's brand name, makes it challenging to compete with the company. That's why it has few direct competitors.

There is still plenty of growth left

Visa became a publicly traded company in 2008. The stock has significantly outperformed the market since. However, there should be ample room for growth. Visa has played a role in helping swap cash and check transactions with digital ones. The latter are safer. If someone steals cash, it's hard to stop them from using it. Nowadays, we can prevent someone from using a credit card with a few taps of a button. Additionally, cards are much easier and safer to carry, offering added convenience.

Digital payments have been on the rise partly due to those dynamics. However, Visa still sees a massive trillion-dollar opportunity to capitalize on the substantial remaining volume of cash and check transactions. Another factor that should grant Visa a significant long-term tailwind is the growth of e-commerce. Cash isn't an option on major online marketplaces, forcing people to use digital payment methods. E-commerce still has plenty of room to grow, though. It accounted for just 16.2% of total retail sales in the U.S. as of the first quarter. When will it peak?

It's worth noting that while the U.S. ranks among the top 10 most penetrated e-commerce markets, it trails the leaders by a significant margin. E-commerce penetration stands at 47% in China and 30.6% in the United Kingdom. Visa generates more revenue in the U.S. than in any other single country. As online commerce continues to grow in the U.S. and reaches the level of penetration it has in other countries, or even approaches it, that will generate a significant increase in transactions and associated fees within its ecosystem.

Lastly, investors should also consider Visa due to its excellent dividend program. Although its forward yield appears rather disappointing at 0.7%, Visa has increased its dividends by 321.4% over the past decade and still maintains a conservative payout ratio of 22.4%. Visa is a terrific option for both growth- and income-oriented investors willing to hold on to its shares for a long time. Investors can grab two shares of the company with $1,000.