Programmatic advertising specialist The Trade Desk (TTD 0.95%) is having a terrible 2025 so far. The year went from bad to worse for investors after the company released its second quarter results on Aug. 7.

The Trade Desk stock was hammered as the company's guidance indicated a slowdown in its growth. Though The Trade Desk has been integrating artificial intelligence (AI) tools into its programmatic advertising platform, it seems like the stiff competition from bigger players in the advertising industry is hampering its ability to sustain healthy growth levels.

Let's look at the reasons why The Trade Desk has dropped an alarming 55% year to date, and determine whether that drop represents an opportunity to buy the stock in anticipation of a potential turnaround.

Image source: Getty Images

Execution issues and competitive pressures are weighing on The Trade Desk

The Trade Desk started 2025 on a negative note. The stock was clobbered after releasing its full-year 2024 results in February when sales execution issues led the company to miss its revenue target. The company's May quarterly report helped it win back investor confidence as Q1 revenue was up by 25% year over year and well ahead of consensus expectations.

NASDAQ: TTD

Key Data Points

However, inconsistency reared its ugly head once again in Q2. Revenue growth slowed to 19%, and earnings increased just a few cents to $0.39 per share. In the same quarter last year, The Trade Desk had reported much stronger revenue growth of 26%.

The guidance, however, is what really spooked the market. Management expects revenue growth in the current quarter to further decelerate to 14% for a total of $717 million. The adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) forecast of $277 million would be an improvement of just 8% year over year.

It is easy to see why this slowdown has investors worried. The Trade Desk's competitors in the digital advertising market have been reporting solid growth. Amazon, primarily known for its e-commerce and cloud computing offerings, reported a healthy 23% year-over-year increase in its advertising business last quarter to $15.7 billion.

The tech giant struck a deal with streaming provider Roku to expand its footprint in the connected TV advertising space in the U.S., gaining access to 80 million households. Connected TV is one of the key areas that's driving growth for The Trade Desk, so Amazon's big move in this market is definitely a cause for concern.

On the other hand, social media giant Meta Platforms' focus on deploying AI tools is helping it win a bigger share of advertisers' wallets. Meta's tools are driving strong returns for advertisers, and the company has also been able to boost user engagement through AI-recommended content.

As a result, Meta's revenue increased 22% last quarter. It is worth noting that both Meta and Amazon are significantly larger companies than The Trade Desk, and they are achieving healthy growth levels while The Trade Desk is witnessing a slowdown. This doesn't bode well for the company, especially given its valuation.

Why investors could be in for more pain

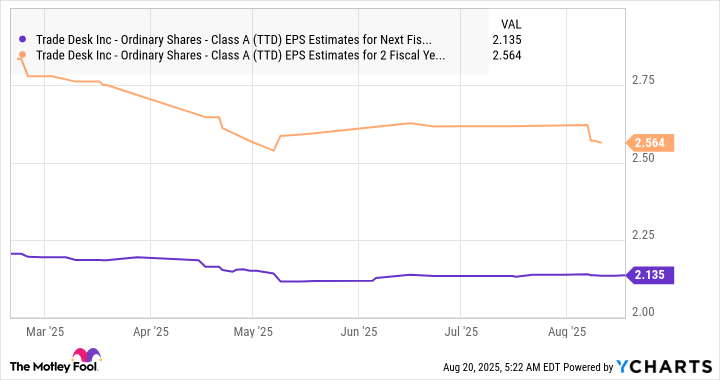

Analysts are forecasting an improvement of just 8% in The Trade Desk's earnings this year to $1.79 per share. The company is expected to return to double-digit growth in 2026.

Data by YCharts.

However, The Trade Desk is trading at 66 times trailing earnings, which is double the average price-to-earnings ratio of the Nasdaq-100 index. Buying The Trade Desk stock at this expensive multiple doesn't look like a smart thing to do right now. The slowing revenue growth is going to negatively impact the bottom line as well, so it remains to be seen if the company is capable of matching Wall Street's earnings expectations going forward.

That's why investors would do well to focus on other tech stocks that are clocking faster growth rates while trading at more reasonable valuations, as The Trade Desk is likely to remain under pressure going forward.