Remember when special purpose acquisition companies (SPACs) dominated Wall Street headlines just a few years ago?

At the center of the frenzy was Chamath Palihapitiya -- better known on Wall Street as the "SPAC king". A former executive at AOL and Meta Platforms turned billionaire venture capitalist (VC), Palihapitiya made his name taking bold bets on disruptive companies.

For a while, SPACs seemed to fade quietly into the background of stock market activity. But just as investors began to write them off, Palihapitiya reignited the conversation with a new prospectus for his latest $250 million "blank check company": American Exceptionalism Acquisition Corp. While details are limited at the moment, Palihapitiya has hinted at the kinds of businesses he's targeting.

Let's break down what investors need to know about this SPAC, why Palihapitiya's recent move matters, and which company I think could be on his radar -- a potential candidate to become the next Palantir Technologies (PLTR +2.16%).

NASDAQ: PLTR

Key Data Points

What is American Exceptionalism Acquisition Corp.?

In the S-1 filing for American Exceptionalism Acquisition Corp., Palihapitiya outlines four core pillars he believes are essential to U.S. competitiveness -- artificial intelligence (AI), decentralized finance (DeFi), defense, and energy production.

At first glance, these may look like broad, boilerplate themes. But I see something deeper -- a unifying thesis that ties together some of the biggest secular growth opportunities underpinning the American economy.

Right now, the American economy is experiencing something akin to the Industrial Revolution thanks to the booming impacts of AI. But with any megatrend comes significant trade offs.

For AI, the most pressing challenges are not software development or infrastructure manufacturing -- it's the strain on the U.S. power grid. Hyperscalers such as Microsoft, Alphabet, Amazon, Meta, Oracle, and OpenAI are pouring hundreds of billions of dollars into data centers, each requiring massive amounts of electricity to operate at scale.

And it's not just the private sector. The U.S. government is moving aggressively with initiatives like Project Stargate, a $500 billion domestic infrastructure program designed to establish America's digital transformation.

Against this backdrop, I think Palihapitiya may be eyeing a start-up sitting at the intersection of his four pillars.

Image source: Getty Images.

What company could fit the bill for Chamath?

In my eyes, Houston-based Amperon could be a natural fit for the American Exceptionalism SPAC.

Amperon functions as an operating system for the power grid, offering AI-powered software that delivers real-time intelligence to utilities, energy traders, and large power buyers. Its platform enables decision-makers to forecast demand, renewable output, and wholesale prices with greater precision -- addressing some of the most pressing challenges in the energy economy.

In many respects, Amperon can be thought of as the Palantir of climate tech. Just as Palantir's Artificial Intelligence Platform (AIP) synthesizes massive volumes of unstructured data and turns them into actionable insights for government agencies and large private enterprises, Amperon applies the same methodology to the grid. It translates fragmented inputs -- from weather patterns or anomalies in demand surges -- into a unified model for energy stakeholders.

The company has also built strategic collaborations with Microsoft, National Grid, and Acario (part of Tokyo Gas). Much like Palantir's early contracts, these partnerships have the potential to deepen and expand over time -- embedding Amperon's tools more firmly into data workflows.

Both Amperon and Palantir demonstrate how AI-driven software layers can evolve into indispensable infrastructure. Where Palantir dominates defense and enterprise intelligence, Amperon is carving out a parallel role capturing energy, climate, and grid optimization.

And because energy touches every sector, Amperon's reach extends even further. Its intelligence platform could support crypto and DeFi protocols, where mining depends on reliable power sources, and strengthen defense applications, where resilient energy sources are critical to national security. This suggests that Amperon's total addressable market (TAM) is far broader than it might initially appear.

Ultimately, this vision aligns almost perfectly with the ethos of Palihapitiya's new SPAC: backing companies at the intersection of AI, defense, DeFi, and energy -- all rolled up and packaged into a compelling opportunity reshaping conscious capitalism.

Remember to be careful with SPACs

In the disclosure section of the prospectus, Palihapitiya reminds investors that they should only consider this SPAC if they can "embody the adage from President Trump that there can be 'no crying in the casino.'" Harsh as it sounds, the warning is well placed.

History hasn't been kind to SPACs. A University of Florida study found that SPACs across nearly every major industry have consistently underperformed the broader market over the past decade.

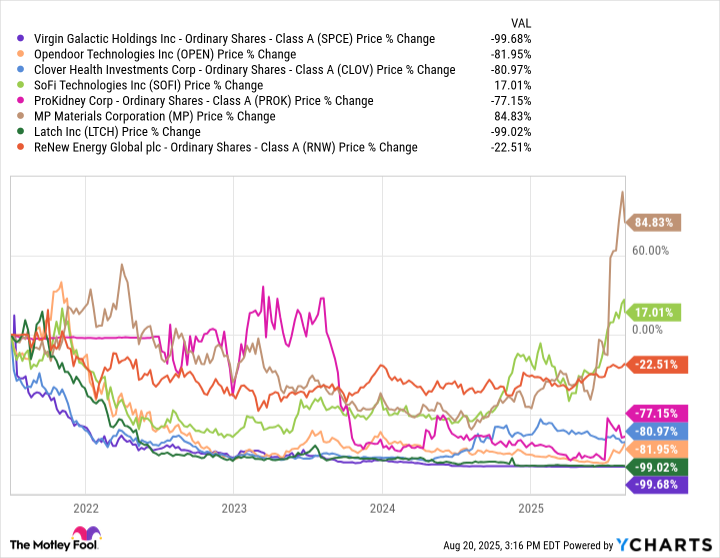

Palihapitiya's own track record underscores this risk. Aside from MP Materials and SoFi Technologies, most of his SPACs have been financial catastrophes. As an investor, he has also backed other high-profile deals that flamed out -- including Desktop Metal and Berkshire Grey (both delisted) and Proterra and Sunlight Financial (both bankrupt).

My take is to approach the new SPAC with measured optimism, while keeping Palihapitiya's history of stewarding outside capital at the forefront of your thesis.

American Exceptionalism's converging focus on emerging themes across AI, defense, crypto, and energy might position it as a unique opportunity potentially poised for explosive growth. But smart investors understand that promise and hope are never true substitutes for prudent, disciplined investing.