The average American household faces more than a 30% projected shortfall between what Social Security and its personal savings will provide in retirement and its anticipated spending. As a result, future retirees will need to find ways to bridge that gap.

One solution is to invest in high-quality, high-yielding stocks that can provide a steady income during retirement. Black Hills (BKH +0.05%), MPLX (MPLX +0.04%), and Brookfield Renewable (BEPC 0.74%) (BEP 0.13%) stand out to a few Fool.com contributing analysts as awesome options. Here's why they think you should get to know these top-notch high-yield dividend stocks.

Image source: Getty Images.

Don't overlook Black Hills because it's small

Reuben Gregg Brewer (Black Hills): Utility giant NextEra Energy has a market cap of $155 billion. Black Hills' market cap is a fraction of that at just $4.4 billion or so. Black Hills isn't a small company, per se, but it is tiny for a utility. Yet it is one of the few utilities that has achieved Dividend King status, with a streak of 55 annual dividend increases behind it. For reference, industry giant NextEra is only up to 31 years.

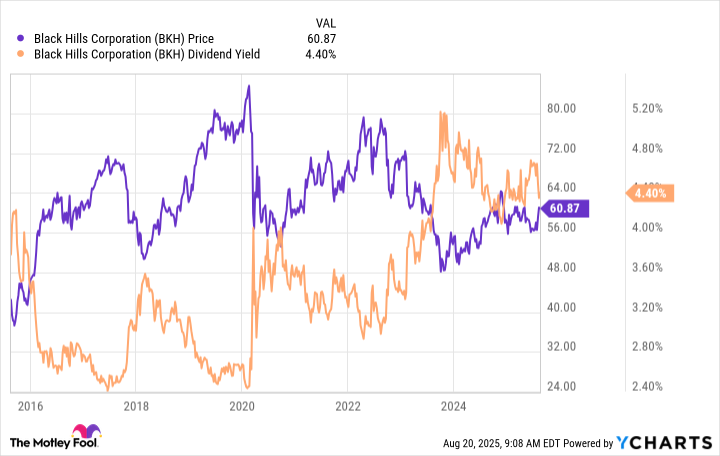

The dividend history, however, is just one reason to like Black Hills. It also offers a lofty 4.3% dividend yield. NextEra yields 3% and the average utility an even lower 2.7%. Black Hills' yield, meanwhile, is near the highest levels of the past decade, so the yield is attractive relative to its own history as well.

But what, exactly, are you buying here? A fairly plain-vanilla regulated natural gas and electric utility. Black Hills is just a reliable high-yield stock with a long history of rewarding dividend investors well for owning it -- only something exciting did just take place. Black Hills has agreed to merge with Northwestern Energy. Billed as a merger of equals, it is Black Hills that's doing the buying. The combined entity will be nearly twice as large and is expected to have a faster growth trajectory.

Black Hills is, thus, getting more attractive in some important ways. The one caveat is that management isn't disclosing the post-merger dividend policy. That suggests there could be a reset, but the yield will probably remain attractive on an absolute basis and the dividend is likely to remain geared toward growth.

NYSE: BKH

Key Data Points

A high-octane income investment

Matt DiLallo (MPLX): MPLX has quietly put together an exceptional record of distributing cash to investors. The master limited partnership (MLP) has increased its payout every year since its formation in 2012. It has grown its distribution at a 10.7% compound annual rate since 2021, an impressive pace for a company that currently yields over 7.5%.

The midstream company can easily cover its high-yielding payout. It has generated over $2.9 billion in distributable cash flow through the first six months of this year, covering its payout by a comfortable 1.5 times. That performance enabled it to generate nearly $1 billion in surplus free cash flow. MPLX returned an additional $200 million to investors through unit repurchases and retained the remainder to fund its expansion.

NYSE: MPLX

Key Data Points

MPLX's robust excess free cash flow helps support its strong balance sheet. The company ended the first half of this year with a low 3.1 times leverage ratio, comfortably under the 4.0 times range its stable cash flows can support. That has given it the flexibility to make several acquisitions this year, including its recently announced $2.4 billion deal for Northwind Midstream.

The MLP has also been utilizing its financial strength to invest in organic growth initiatives. It currently has a broad array of expansion projects under construction that should enter commercial service through 2029. These growth projects will provide MPLX with incremental sources of stable cash flow as they come online.

MPLX offers an exceptional combination of yield and growth, backed by a rock-solid financial foundation. Those features make it a great option for those seeking to generate retirement income and are comfortable receiving the Schedule K-1 Federal Tax Form that the MLP sends its investors each year.

A big yield with solid dividend growth potential

Neha Chamaria (Brookfield Renewable): Brookfield Renewable has increased its dividend every year since 2001, growing it by a compound annual rate (CAGR) of 6%. Importantly, the company's funds from operations (FFO) per unit grew by a CAGR of 11% over the period, reflecting how well covered Brookfield Renewable's dividends have always been. Dividends, when backed by cash-flow growth, are often safe and highly bankable.

NYSE: BEPC

Key Data Points

So just how bankable are Brookfield Renewable's dividends? All you need to do is look at the company's growth plans to know the answer. Brookfield Renewable is one of the largest and most diversified renewable energy companies in the world. Renewable energy has massive growth potential. Brookfield Renewable already has an advanced-stage pipeline of over 70 gigawatts and expects to spend $8 billion to $9 billion over the next five years to expand further. Moreover, Brookfield Renewable sells electricity under long-term contracts, which means nearly 90% of its FFO is contracted and, therefore, stable and predictable.

Brookfield Renewable expects to grow its annual FFO per unit by over 10% through the next decade and annual dividend per share by 5% to 9%. The corporate shares (BEPC) also yield a solid 4.5%. So that dividend growth potential, when combined with the yield, could hugely help fund your retirement. Although Brookfield Renewable has partnership units (BEP) as well as corporate shares listed on the New York Stock Exchange, an investors in the U.S. can avoid receiving a K-1 tax form and foreign tax withholding with the corporate shares.