Following the end of each quarter, investment firms that manage over $100 million are required to file a form 13F with the Securities and Exchange Commission (SEC). These filings document the stocks that investment funds bought and sold during the most recent quarter -- providing investors with an idea of where "smart money" is looking for value and growth.

In recent years, billionaire money manager Stanley Druckenmiller of the Duquesne Family Office came into the spotlight after the investor admitted he exited semiconductor powerhouse Nvidia far too early -- calling his decision a "big mistake."

Image source: Getty Images.

Since then, Druckenmiller has reentered the chip landscape -- this time plowing into a key beneficiary of the artificial intelligence (AI) infrastructure boom beyond the usual suspects like Nvidia, Advanced Micro Devices, or Broadcom.

Over the past year, Duquesne has built a solid position in foundry specialist Taiwan Semiconductor Manufacturing (TSM +1.81%). During Q2, Druckenmiller increased his firm's stake in Taiwan Semi by 28% -- bringing its total exposure to roughly 765,000 shares.

Let's unpack what makes TSMC such a compelling AI chip stock, and assess if now is a good opportunity for you to follow Druckenmiller's lead.

NYSE: TSM

Key Data Points

Taiwan Semi is rolling on all cylinders, and...

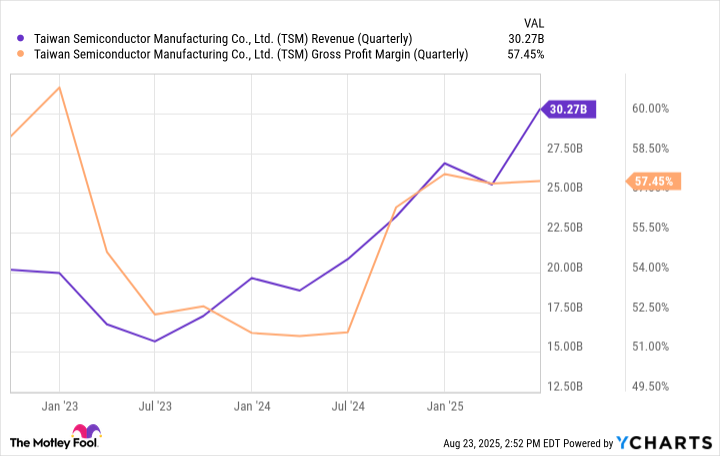

The chart below highlights revenue and gross profit margin trends throughout the AI revolution for TSMC. With an estimated 68% share of the global foundry market, Taiwan Semi is operating on a level far above rivals like Samsung or Intel -- giving the company the ability to exercise substantial pricing power for its services.

TSM Revenue (Quarterly) data by YCharts

...its momentum isn't slowing down

At first glance, investors might worry that TSMC's steep revenue growth and expanding profit margins are nearing a peak. But the data suggests otherwise.

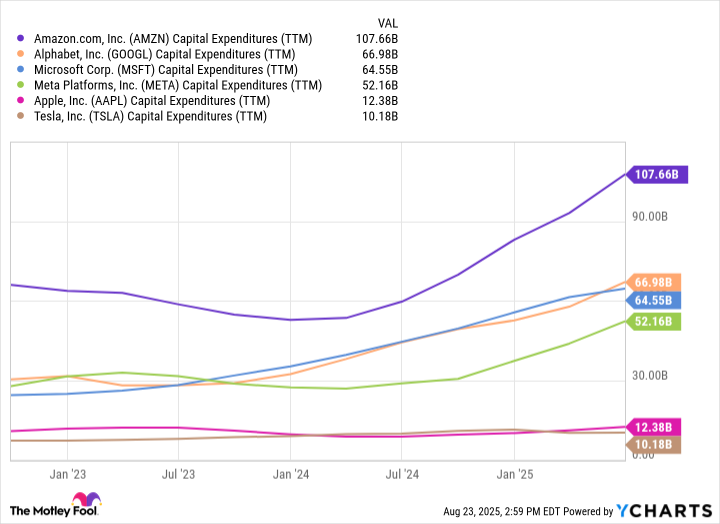

Enterprise spending on AI infrastructure is accelerating, led by cloud hyperscalers Amazon, Alphabet, and Microsoft, which are in the midst of a historic capital expenditure (capex) spree to acquire GPUs and networking equipment for next-generation data centers. And it's not just the cloud giants. Meta Platforms, Apple, and Tesla are also investing heavily to advance ambitions in robotics, autonomous driving, and consumer electronics.

AMZN Capital Expenditures (TTM) data by YCharts

Collectively, this spending acts as a proxy for GPU demand. Behind the scenes, this is an enormous tailwind for Taiwan Semi -- the foundry responsible for manufacturing these advanced chipsets for Nvidia, AMD, and many others.

While Nvidia and AMD capture most of the headline news, TSMC may actually offer the most durable growth prospects in the chip realm. In many ways, the company represents a long-term call option for the global buildout of AI infrastructure.

Is TSMC stock a buy?

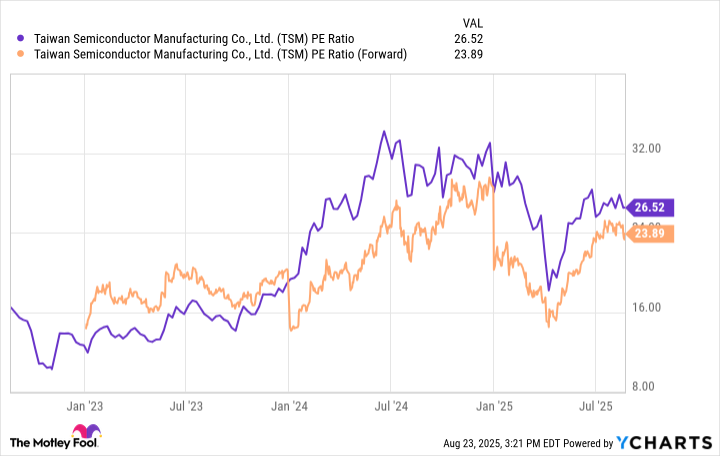

Valuing TSMC stock is a bit tricky. Like many of peers in the semiconductor landscape, the company has witnessed considerable valuation expansion in recent years. On a simple price-to-earnings (P/E) or forward P/E basis, the stock certainly doesn't look like a bargain.

TSM PE Ratio data by YCharts

But dig deeper, and a different story emerges. Taiwan Semiconductor trades at a PEG ratio well-below 1 -- suggesting the company may actually be undervalued relative to its future growth potential. That's the kind of setup investors like Druckenmiller might be trying to capitalize on -- a rare opportunity at the intersection of growth and value.

For long-term investors, I see TSMC as a no-brainer chip stock to buy and hold over the next several years. It may not command the spotlight, but it's playing a supporting role in the infrastructure revolution that underpins the AI chip era.